Xponential Fitness, Inc., owner of the Club Pilates, CycleBar, StretchLab, YogaSix, Pure Barre, Rumble, BFT, and Lindora fitness and wellness brands, reported total revenue for the fourth quarter of 2024 decreased 7 percent to $83.2 million, down from $89.3 million in the prior-year Q4 period. The company said increases in franchise and marketing fund revenues were offset by decreases in other service, merchandise and equipment revenues.

- North America system-wide sales increased 21 percent to $464.7 million.

- North America same-store sales growth was 5 percent, compared to 14 percent in Q4 2023.

- Reported North America quarterly run-rate average unit volume (AUV) of $668,000 in Q4, compared to $612,000 in Q4 2023.

Net loss totaled $62.5 million, or $1.36 per basic share, in Q4, compared to a net loss of $12.3 million, or earnings per basic share of 3 cents, in the prior-year Q4 period.

The change in net loss was said to be the result of the following:

- $4.7 million of higher overall profitability,

- $7.1 million decrease in financial transaction fees,

- $2.2 million decrease in restructuring and related charges, offset by a $41.1 million increase in impairment of goodwill and other assets,

- $17.1 million increase in litigation expenses,

- $3.0 million increase in acquisition and transaction expenses, which includes non-cash contingent consideration primarily related to the Rumble acquisition,

- $1.3 million increase in transformation initiative costs,

- $1.2 million increase in contract settlement costs, and

- $0.5 million increase in loss on brand divestiture.

Adjusted net loss for the fourth quarter, which excludes $1.9 million in acquisition and transaction expenses, $0.1 million expense related to the re-measurement of the company’s tax receivable agreement, $46.0 million related to the impairment of goodwill and other assets, $0.5 million loss on brand divestitures, and $6.9 million of restructuring and related charges, was $7.1 million, or an adjusted net loss of 19 cents per basic share, based on a share count of 32.9 million shares of Class A Common Stock.

Adjusted EBITDA, defined as net income (loss) before interest, taxes, depreciation and amortization, adjusted for equity-based compensation and related employer payroll taxes, acquisition and transaction expenses, litigation expenses (outside of the ordinary course of business), financial transaction fees and related expenses, tax receivable agreement re-measurement, impairment of goodwill and other assets, loss on brand divestitures and wind down, executive transition costs, non-recurring rebranding expenses, transformation initiative costs, contract settlement costs, and restructuring and related charges of $30.8 million for the quarter, up 13 percent from $27.2 million in the prior-year Q4 period.

“We have made significant progress over the course of my first two full quarters as CEO, and I have gained a deeper understanding of both the opportunities and challenges at Xponential,” said Mark King, CEO of Xponential Fitness, Inc. “It is clear from some of the issues we have found and are addressing that there is a lot to do. That said, I have full confidence in the team we’ve assembled; they all have experience executing on exactly what Xponential must execute to sustainably grow.”

Full-Year Summary

- Revenues grew 1 percent to $320.3 million.

- Increased North America system-wide sales of 23 percent to $1.71 billion.

- Reported North America same-store sales growth of 7 percent, compared to growth of 16 percent.

- Posted net loss of $98.7 million, or a loss of $2.27 per basic share, in 2024, based on a share count of 32.0 million shares of Class A Common Stock, compared to a 2023 net loss of $6.4 million, or earnings of $1.08 per basic share, based on a share count of 31.7 million shares of Class A Common Stock.

- Posted Adjusted net income of $1.8 million, or a loss of 13 cents per basic share, compared to Adjusted net income of $10.7 million, or earnings of 7 cents per basic share.

- Reported Adjusted EBITDA of $116.2 million in 2024, compared to $100.3 million in 2023.

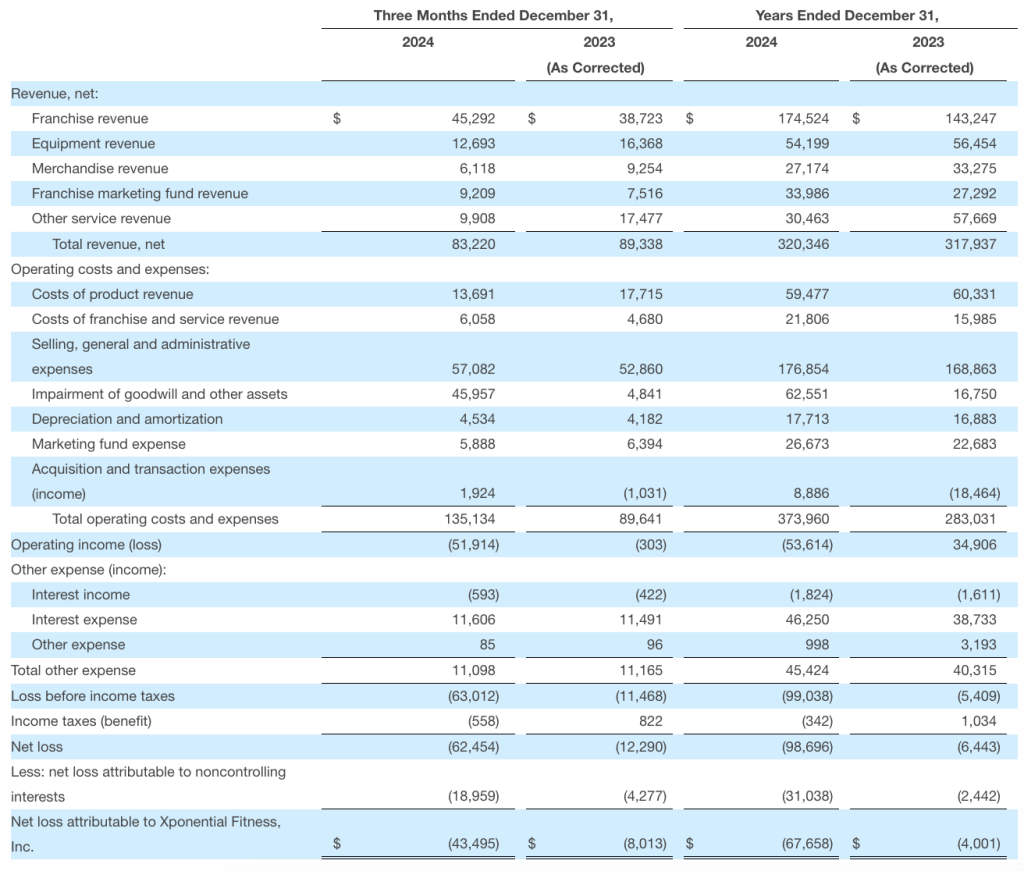

Income Statement Fourth Quarter and Full Year 2024 vs. Restated 2023

(in $ thousands)

Liquidity and Capital Resources

As of December 31, 2024, the company had approximately $32.7 million in cash, cash equivalents and restricted cash, and $352.4 million in total long-term debt.

Net cash provided by operating activities was $11.7 million for the full year ended December 31, 2024.

Financial Restatement

Xponential Fitness, Inc. has announced a restatement of 2023 financial statements. The 2023 restatement corrects accounting errors primarily related to accrued inventory, 401(k) compliance, purchase accounting, and vendor rebates. The net impact of the 2023 corrections increased net loss from $1.7 million to $6.4 million and decreased Adjusted EBITDA from $105.3 million to $100.3 million. The restatement is not a result of any substantive change to the company’s operations or business performance for the corrected periods and had no impact on the company’s overall cash position or net cash flows.

2025 Outlook

The company initiated full year 2025 outlook, which compares to 2024 results as follows:

- Net new studio openings in the range of 200 to 220, or a decrease of 12 percent at the midpoint;

- North America system-wide sales in the range of $1.935 billion to $1.955 billion, or an increase of 13 percent at the midpoint;

- Revenue in the range of $315.0 million to $325.0 million, representing no change at the midpoint;

- Adjusted EBITDA in the range of $120.0 million to $125.0 million, or an increase of 5 percent at the midpoint;

Additional key assumptions for the full year 2025 include:

- Tax rate in the mid-to high-single-digits;

- Share count of 34.0 million of Class A Common Stock for the GAAP EPS and Adjusted EPS calculations, and

- $1.9 million in quarterly dividends paid related to the company’s Convertible Preferred Stock, or $2.2 million if paid-in-kind.

Xponential’s portfolio of brands includes Club Pilates, the largest Pilates brand in the U.S.; CycleBar, the largest indoor cycling brand by the number of studios in the U.S.; StretchLab, the largest assisted stretching brand in the U.S., offering one-on-one and group stretching services; YogaSix, the largest franchised yoga brand in the U.S.; Pure Barre, a total body workout that uses the ballet barre to perform small isometric movements, and the largest Barre brand in the U.S.; Rumble, a boxing-inspired full-body workout; BFT, a functional training and strength-based program; and Lindora, a leading provider of medically guided wellness and metabolic health solutions.

Image courtesy Xponential Fitness, Inc.