Wolverine World Wide raised its full-year earnings outlook for the third time this year after posting better-than-expected third-quarter profits and burly double-digit backlog growth. The Outdoor Group, Heritage Brands Group and Wolverine Footwear Group all delivered strong double-digit increases in operating profit in the quarter.

But management also cited strong demand across its brand portfolio.

“The sell-through experience for our retail partners has also been exceptionally strong and our own consumer direct business, which includes both our brick-and-mortar stores and e-commerce operations, continues to outperform,” said Blake Krueger, company chairman, CEO and president, on a conference call with analysts. He also intimated that, “American brands, especially those with a boot tradition or a close affinity to the outdoors, are benefiting from these global consumer preferences.”

On the downside, gross margins in the fourth quarter are expected to be lower due to higher product costs and continued higher freight costs. Management also indicated that results in the third quarter were hurt by factory delays for a few brands in the portfolio and its past-due backlog at quarter end was higher than the prior year. Said CFO Don Grimes, “Fortunately, most of these orders will slide into and benefit the fourth quarter.”

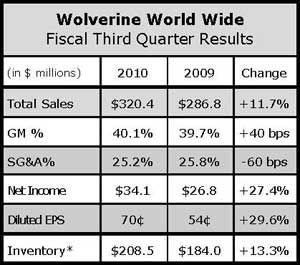

Excluding restructuring charges that pulled down year-ago earnings, earnings in the third quarter ended Sept. 11 rose 12.9% to 70 cents from 62 cents a year ago. Wall Street's consensus estimate was 67 cents. Revenue rose 11.7% to $320.4 million.

In the Outdoor Group division, which includes Merrell, Chaco and Patagonia Footwear, revenues increased 5.6% to $121.3 million, reflecting a double-digit increase in unit volume. Fourth quarter backlog for the group reflects “very strong double-digit growth” with 2011 first-half backlog up even higher. Said Grimes, “We expect an acceleration of shipments over the balance of the fiscal year as the pace of incoming product improves, retailers take the balance of their Fall orders and cold weather and replenishment business kicks in.”

Outventure, Merrell's outdoor performance category, “continues to generate excellent growth,” fueled by updates to core programs and a new Avian women's program. Merrell also received “significant retailer commitments “for its Barefoot collection, done in partnership with Vibram. The Spring 2011 launch will be followed by a broader barefoot collection in Fall 2011. Fusion, Merrell's casual collection, saw growth driven by its new men's World collection, its new women's Tetra boot offering and the expansion of its Encore shoe collection for Fall. Merrell apparel posted a double-digit order backlog increase for Spring 2011.

Comps in the Merrell consumer-direct business were up 30% and strong double-digit growth was seen in Merrell's e-commerce segment. Merrell ended the quarter with 128 branded stores and nearly 950 shop-in-shops.

Patagonia footwear “is growing market share in all categories and is experiencing strong sell-through at retail,” benefiting from positive public relations around the brand, including American Express commercials featuring brand founder Yvon Chouinard, according to Krueger.

Chaco “continues to experience accelerated growth,” with much of the recent success attributable to the Fall 2010 launch of closed-toe product. Chaco's online business since the brand was acquired in early 2009 has tripled and is now the company's number two-branded e-commerce site behind Merrell.

In the Wolverine Footwear Group, sales jumped 22.7% to $65.4 million with all three brands Wolverine, Bates and HYTEST – contributing to the growth. The success of 1000 Mile Boot, 1883 and iCS programs has driven a “very large backlog position” in the rugged casual category for Wolverine. Wolverine brand apparel saw a triple-digit backlog gain for Spring 2011.

Revenues in the Heritage Brands segment advanced 14.8% to $63.5 million. Sebago, with strong double-digit growth, benefited from initial product launches at Urban Outfitters, Nordstrom and Saks Fifth Avenue. Caterpillar footwear benefited from better placement, including The Tannery in the U.S., while Harley-Davidson footwear saw “solid increases” in its largest markets.

The Hush Puppies Group's sales nudged up 0.4% to $36.6 million with mid-single-digit unit volume growth.

Wolverine's Other Business segment, comprised of Wolverine Retail and Wolverine Leathers, saw revenues increase 27.3% to $30.5 million.

For 2010, WWW now sees earnings of $2.04 to $2.08 a share, up from its prior view of $1.98 to $2.04. Sales are expected to range between $1.20 billion and $1.22 billion, representing growth of 9.0% to 10.8% for the year.