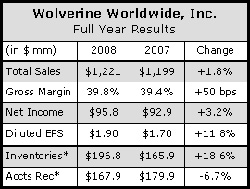

Wolverine managed to maintain full year sales growth despite difficult trading conditions in the fourth quarter that led to decreased sales from last years fourth quarter. Growth for the year was once again driven by the companys Outdoor Group and more specifically, the Merrell brand. However, that division also saw sales decline for the fourth quarter, which led to the overall decrease for the period.

For the fourth quarter, net sales declined 3.2% to $346.1 million from $357.4 million for the year-ago period. Gross profit improved slightly for the quarter, up 10 basis points to 38.5% of sales, but that improvement was more than offset by increased SG&A expenses, which increased 140 basis points to 29.2% of net sales. The increased expenses paired with the decreased sales to create a 5.8% decline in net income to $24.1 million compared to $25.6 million last year. Diluted earnings per share were flat at 49 cents for the quarter.

On a conference call with analysts, management remarked that backlog of future orders is down versus the prior year as retailers remain very cautious. On a constant-currency basis, and excluding “some pretty significant low-margin base business that was in the backlog at this point last year, backlog was down mid-single-digits when measured in dollars and in pairs.

The Outdoor Group, which consists of Patagonia footwear and Merrell, achieved a “single-digit revenue increase for the year.” Revenue decreased mid-single-digits for the fourth quarter, driven by a strengthening U.S. dollar that caused foreign exchange rates to have a negative effect on sales and a generally soft retail environment. Management noted on the call that approximately one-third of the Outdoor Group sales decline can be attributed to currency-exchange rates.

Though net sales for the Group increased only in the single-digits for the year, a focus on back-end operations drove a “strong double-digit” increase in operating earnings. Company President and CEO Blake Krueger noted on the call that “the Merrell brand continues to perform very well at retail, as evidenced by the sell-through reports from our major customers and our own in-store experience.”

He continued by saying that the brands Outventure line saw “continued success” and that the Fusion casual product featured a new Encore collection, which “was a huge success, achieving very high sell-through at retail.” Merrell apparel was said to have generated “improved sell-throughs during the fall season” and to have exceeded sell-through expectations at the new San Francisco flagship store.

Merrell's global retail presence in the fourth quarter continued to expand with store openings in Hong Kong, Taiwan, a second store in Milan and two in Korea. The brand opened three stores in the U.S. in Portland, OR, Indianapolis, IN and Birmingham, AL. The brand ended 2008 with 74 stores and approximately 850 shop-in-shop locations worldwide.

Patagonia footwear, now at the end of its second full year, reported sales were up double-digits for the year. The men's product had “strong sales” in the casual category and “double-digit” sales increases in the smaller performance category. In womens, casual boots experienced strong sell-in.

The Hush Puppies international business posted strong double-digit revenue and earnings increases. During the year, 99 new concept stores and 221 shop-in-shops were opened, bringing the global year-end total for HP to almost 500 stores and 900 shop-in shops.

Management reported its strategy to move the Hush Puppies brand up market in the U.S. is seeing favorable results in spite of the difficult U.S. retail environment. The recently acquired Cushe brand will be part of the Hush Puppies group as it is integrated into the business.

The Heritage Brands Group, which includes Sebago, Caterpillar and Harley-Davidson, had a “solid year” with revenue increases for both Q4 and the year. The group saw improved operating margins and “strong double-digit” Q4 and full-year earnings increases. Sebago achieved a low-single-digit revenue increase for the year and posted a double-digits earnings improvement.

Turning to the Wolverine Footwear Group, revenue was up low-single-digits for the year and up slightly for Q4. Solid gains in the Wolverine, HYTEST and Bates businesses more than offset sales decreases associated with two non-core businesses exited last year.

Track 'n Trail and the Merrell stores had a mid-single-digit comp store salss increase for the year. In addition, the company reported almost a 30% increase last year in its e-commerce business.

The year-end inventory increase was the companys first increase after six consecutive year-over-year inventory declines. The company said it made a strategic decision to make inventory investments in core product prior to anticipated 2009 cost increases.

The company expects 2009 revenue of $1.07 billion to $1.15 billion, including an expected $90 million detriment from continued strengthening of the U.S. dollar.