Wolverine Worldwide Inc. lowered its guidance for full-year revenue growth from 3 to 2 percent Tuesday, saying it expects the retail environment in the United States to be more promotional over the holidays than last year.

Wolverine Worldwide Inc. lowered its guidance for full-year revenue growth from 3 to 2 percent Tuesday, saying it expects the retail environment in the United States to be more promotional over the holidays than last year.

However the owner of Keds, Merrell, Saucony, Sperry Top-Sider and a dozen other footwear brands said it remains confident it can hit both its 2014 and longer range earnings targets.

“As we look toward the fourth quarter, we expect a soft and highly promotional environment at retail, particularly in the U.S., to pressure fourth quarter revenue performance,” WWW VP and CFO Don Grimes said during the company’s third-quarter earnings call.

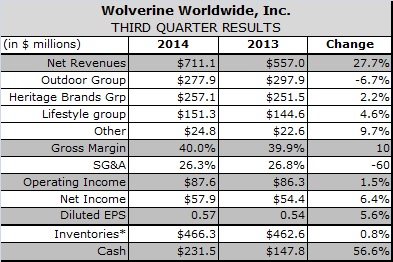

WWW reported consolidated revenue declined 0.8 percent to $711.1 million in third fiscal quarter ended Sept. 6 compared with a year earlier, as mid-single-digit growth from its Heritage Group brands (Wolverine, Cat, Bates, Sebago, Harley Davidson and Hytest) and low-single digit growth from the Performance Group brands (Merrell, Saucony, Chaco, Patagonia and Cushe), were offset by an 11 percent decline in sales by the Lifestyle Group (Hush Puppies, Keds, Sperry Top-Sider, Stride Rite, Soft Style.) Much of the growth came overseas.

WWW reported sales at its Lifestyle Group declined 11 percent due to a double-digit decline in sales of Sperry Top-Sider shoes and the closing of Stride-Rite stores. The decline at Sperry Top-Sider reflects WWW’s decision to halt distribution of the brand to some family footwear retailers, a trend away from women’s boat shoes and tough comps. The brand’s sales surged nearly 20 percent in the third quarter of 2013, but dropped in the subsequent quarter as sell through failed to match sell in. In the just finished third quarter, a decline in Sperry Top-Sider comp store sales slowed to the very low single digits. WWW expects them to grow in the mid-single digits in the fourth quarter.

Lifestyle Group sales were also hurt by the closing of 10 Stride-Rite stores, including seven in the third quarter and three since. WWW is on track to close another 50 after the holidays, leaving 80 to close in 2015. WWW announced a dramatic restructuring of its direct business in mid July that calls for closing 140 underperforming Stride-Rite stores. It plans to invest the estimated $11 million in annual savings to strengthen its digital platform and brands.

Sperry Top-Sider saw significant growth in its men’s business, led by its premium Gold Cup Collection, where year-to-date sales are running 60 percent ahead of last year. Year-to-date, Sperry Top-Sider’s international sales are up 23 percent in dollar terms and now comprise 10 percent of the brand’s sales. That’s up from 5 percent in the third quarter of 2012, just before WWW acquired the Sperry Top-Sider, Saucony, Stride Rite and Keds brands from Collective Brands.

Keds sales also grew in the third quarter thanks to the continued success of its “Brave Girls” marketing campaign with Taylor Swift. Keds will drop a limited edition shoe designed with Swift in coming weeks timed to coincide with the release of her newest album.

At the Performance segment, Saucony sales grew in the mid-single digits on strong demand for the Guide 7, Ride 7 and Kinvara 5. Demand for technical and retro styles was particularly strong in EMEA. At Merrell, strong men’s and international sales, especially in Latin America, offset flat sales in North America, where women’s sales were off due to misses in core casual and sandal styles.

In the Heritage Brands segment, Cat had exceptional results in all geographies and was boosted by new technical work footwear in North America. Wolverine sales grew across the outdoor, heritage and work segments.

Gross margin inched up 10 basis points to 40.0 percent compared to the prior year’s gross margin of 39.9 percent. Chairman, President and CEO Blake Krueger said WWW is working to reduce use of leather, which is one of the few commodities that has become more expensive this year.

SG&A expenses as a percentage of sales declined 60 basis points to 26.3 percent as the company held marketing spending flat. Operating margin expanded 30 basis points to 12.3 percent, while adjusted operating margin, which excludes one-time costs related to acquisitions, debt extinguishment, asset impairment and restructuring costs, expanded 70 basis points to 13.8 percent. Adjusted diluted earnings per share increased 8.6 percent to 63 cents, compared to an adjusted 58 cents per share in the prior year.

Inventory at the end of the third quarter was up slightly-only 0.8 percent-compared to the prior year.

Operating free cash flow increased $16.8 million, or 73.6 percent to $39.6 million in the quarter and was up $90.4 million for the first three fiscal quarters of the year. WWW reduced its debt by approximately $35 million in the quarter, reflecting both scheduled payments and a voluntary $25 million principal payment made in mid-July. The company ended the quarter with cash and cash equivalents of $231.5 million and net debt of $865.1 million, a reduction of $129.2 million, or 13.0 percent from the same period last year.

“As net leverage continues to decline we are increasingly open to acquisition opportunities that would add additional scale to our current business model or address white space in our portfolio,” said Grimes.

WWW lowered its full-year consolidated revenue forecast by $30 million to approximately $2.745 billion, which would represent approximately 2 percent growth over the prior year’s revenue compared with the 3 percent it forecast in July. WWW reaffirmed its earnings forecast, which calls for diluted earnings per share to grow 10-14 percent to $1.57 to $1.63 on an adjusted basis and $1.32 to $1.38 on a GAAP basis.

Despite concerns of slowing global growth, WWW sees its brands momentum in both Europe and the Asia Pacific carrying into the fourth quarter and beyond. “Weve seen no order interruptions,” Krueger said of sales to distributors and licensees in Asia, where WWW’s sales are up about 30 percent so far this year.

WWW is forecasting sales will grow 7 percent in the fourth quarter as overseas expansion continues to offset flat or lower sales in the United States, where executives expect a more promotional holiday environment than a year ago. The forecast anticipates the impact of a broader assortment of cold and wet weather boots, an additional 17th week of sales compared with fiscal 2014, healthy order backlogs, strong boot sales and assumes stable foreign exchange rates.

Sperry Top-Sider’s overall sales are expected to be flat in the fourth quarter, decline 7 to 8 percent in fiscal 2014 and resume growth in fiscal 2015 as its transition from a boat brand to a broader lifestyle brand accelerates. That will start in November with the brand’s launch of its first Gold Cup footwear collection for women.

“We are seeing absolutely no retailer or consumer impediments to expanding that brand into other categories, especially, in casual and boots arena and in active and performance,” said Krueger.

Saucony will launch its new Iso Series Nov. 1 at the New York City Marathon. The series combines the brand’s Isofit upper and Pwrgrid+ platform to provide runners with more cushion and impact protection.

WWW is expecting consolidated revenue growth to accelerate in 2015 as Sperry Top-Sider launches its first Spring apparel line and Merrell launches the Capra speed hiking boot in its first global launch in years. The Capra will debut at the Sun Dance Film festival in Park City, UT, which will again overlap with Outdoor Retailer Winter Market in Salt Lake City in January and be rolled out globally in March. The Capra, which is inspired by the agility of the wild mountain goat, or capra aegagrus, is a synthetic boot designed for walking, running and scrambling in the mountains. Merrell is also looking to its All Out collection of sport and casual shoes to drive growth. Pre-season orders for the line have reached 1 million pairs, driven in part by orders for the All Out Sieve, a hybrid sandal and runner that will debut in Spring 2015. WWW expects Merrell’s sales growth to accelerate next year from the mid-single-digit pace seen thus far in 2014.

The Heritage Brands segment is working on expanding its collection of Made-in-USA shoes for 2015 and beyond. Finally, WWW is looking to reduce its consumption of leather, where demand from the auto and other industries has push prices to all time highs even as other commodity prices fall.

“Were doing what you would expect us to do to offset those input costs,” said Krueger. “One, a lot of our shoes are being reengineered with materials that are not leather or are not 100 percent leather. Frankly, the Millennial consumer is growing up mostly in non-leather shoes and we are re-engineering product – not taking the quality or aesthetics out but reengineering product as appropriate and then we are continuing to diversify our factory base.”