Wish, the online marketplace, has confidentially filed paperwork to go public with the U.S. Securities and Exchange Commission (SEC), the San Francisco-based company announced in a press release.

The company did not provide financial details or reveal how many shares it would sell or at what price. The company submitted a draft registration statement.

Since 2017, the SEC has allowed all companies to file early IPO paperwork without having to make the details public. Filing confidentially enables a company to keep its financials private until 15 days prior to the actual offering to prevent competitors from gaining more detailed knowledge of their operations.

Founded in 2010 by the University of Waterloo classmates Peter Szulczewski, a former Google engineer who now serves as Wish’s CEO, and Danny Zhang, who formerly worked for Yahoo!, the San Francisco–headquartered online marketplace was last valued at $11.2 billion in August 2019.

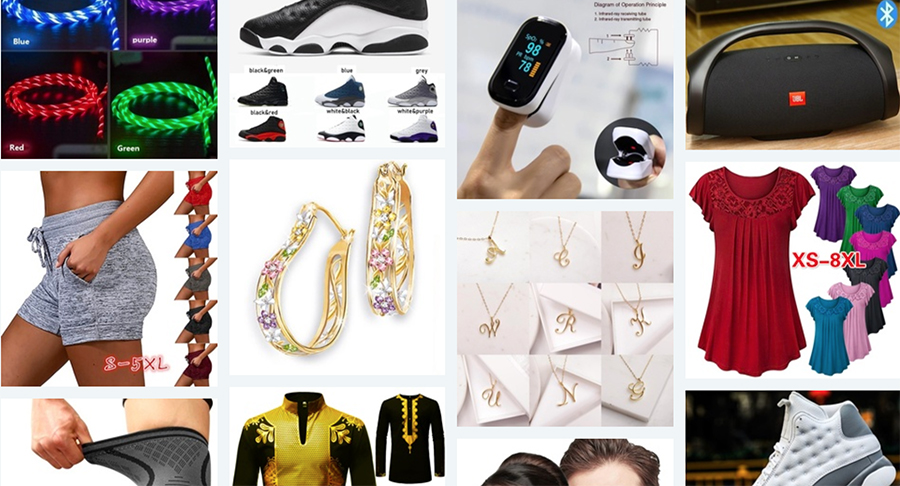

According to a 2019 Wish press release, the e-commerce company has more than 80 million active users with 1 million registered merchants. Through its shopping platform, Wish sells 3 million products per day in an online platform that is focused on bringing apparel, accessories, housewares, and electronics to consumers at low prices. Relying on its technology, Wish seeks to create a more personalized experience for online shoppers.

Photo courtesy Wish