West Marine, Inc. (Nasdaq:WMAR) reported net revenues dipped 0.6 percent to $251.6 million in the second quarter ended July 2 compared to the same period last year. Comparable store sales increased 1.1 percent.

Pre-tax income was $36.4 million compared to pre-tax income of $37.1 million last year in the same period. Earnings per diluted share increased 1 cent to 86 cents per share.

“We are pleased with the progress of our growth strategies, including a 27 percent increase in e-commerce and solid increases in our Waterlife store sales,” said CEO Matt Hyde. “These results were in contrast to a challenging retail environment and unfavorable weather patterns seen earlier in the quarter. We believe that our growth strategies have us on track to deliver our 2016 sales and profit targets.”

Further Progress on Growth Strategies

Sales from e-commerce increased by 26.7 percent compared to the second quarter of 2015 and represented 10.0 percent of total sales, compared to 7.9 percent for the same period last year, showing progress towards the goal of 15 percent of total sales.

Sales through Waterlife stores were 48.6 percent of total sales compared to 45.1 percent last year. This year-over-year increase demonstrates the company’s progress towards the goal of delivering 50 percent of total sales through stores that have been optimized to offer a broader selection of merchandise than traditional stores that focus on core boating products.

Sales in merchandise expansion product lines, which include footwear, apparel, clothing accessories, fishing products and paddle sports equipment, increased 3.3 percent while core product sales were down 1.7 percent, compared to the same period last year.

Results for the Second Quarter of 2016

Net revenues for the quarter ended July 2 decreased by $1.6 million, or 0.6 percent, to $251.6 million compared to $253.2 million for the quarter ended July 4, 2015.

Gross margin declined slightly to 35.5 percent of revenues, compared to 35.8 percent during the same period in 2015.

Selling, general and administrative (“SG&A”) expense decreased year-over-year by $0.8 million, as lower payroll expenses and a partial settlement from the Deepwater Horizon Settlement program were partially offset by higher depreciation and health claims expenses in the quarter.

Net income for the second quarter was $21.6 million, or $0.86 per share, compared to net income of $20.9 million, or $0.85 per share, for the second quarter of 2015.

Inventory at the end of the second quarter was down $4.5 million compared to the same period in 2015, while accounts payable increased $24.0 million. As of July 2, the company had cash and cash equivalents totaling $89.6 million compared to $44.2 million at the same point in 2015.

Guidance

Based on information available as of today, the company reiterated full-year 2016 guidance of total revenue growth in the 1 percent to 4 percent range and pre-tax profit growth of 50 percent over 2015 full-year results.

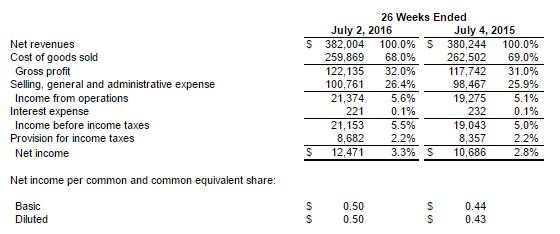

The company results for the first half of the year were as follows: