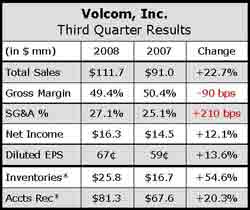

Volcom, Inc. posted strong top-line growth in the third quarter, but decreased margins and increased expenses as a percentage of net sales caused net income to grow at little more than half the rate of quarterly net sales.

Volcom reported its total consolidated revenues increased 22.7% to $111.7 million in the quarter ended Sept. 30, 2008, compared with $91.0 million in the third quarter of 2007. Despite these positive third quarter results, the company lowered its 2008 full-year consolidated revenue guidance by 3% to 12% in anticipation of a difficult fourth quarter ahead.

Snow revenue grew 12% to $15.9 million compared with $14.3 million last year, said CFO Doug Collier. “Were excited to see solid growth in this core category as our Snow products continue to be well-received in the marketplace.”

Volcoms girls product revenue increased 25% to $20 million versus $16 million last year. “The increases in girls revenue was anticipated and was primarily related to stronger business with PacSun,” said Collier. “Outside of PacSun, our girls business decreased 4% compared to Q3 of last year.”

Revenue from PacSun, VLCMs largest customer, increased 83% to $18.8 million for the quarter, or 26% of the U.S. segment product revenue, compared with $10.3 million, or 16%, of U.S. segment product revenue for the comparable period in 2007. The business with PacSun in the third quarter was said to be ahead of plan by about $2 million and reflected strong sales for both the mens and girls lines. Excluding PacSun, revenue from the next four largest accounts increased 11% for the quarter and increased 10% year-to-date.

Consolidated gross margins were 49.4% of consolidated revenue, in Q3, compared with 50.4% of consolidated revenue, in the third quarter of 2007. Consolidated operating income for the third quarter was $24.9 million, or 22.3% of consolidated revenue, compared with $23.0 million, or 25.3% of consolidated revenue, for the year-ago period.

In putting forth its financial outlook for the 2008 fourth quarter and full year, Volcom noted recent, significant changes in the weakening U.S. retail environment as well as the overall global economy. As such, the company now expects total consolidated revenues for the fourth quarter to be approximately $69 million to $71 million, representing an increase of flat to 3% when compared with the 2007 fourth quarter. Fully diluted earnings per share are expected to be in the range of 17 cents to 19 cents.

Volcom has lowered its 2008 full-year consolidated revenue guidance to between $333 million to $335 million. In July, the company expected consolidated revenue of between $344 million to $347 million, and fully diluted earnings per share of $1.50 to $1.53.

“Weve been preparing ourselves for this [financial crisis] over the course of this year,” said Chairman and CEO Richard Woolcott, when commenting on the weakening economy during a conference call with analysts. “Anticipating the slow-down and being strategic in our thinking and in our steps. And so when we came upon this kind of next wave of the down turn and particularly as we are going into Q4, weve been watching the inventories very closely and trying to manage exactly what we believe the retailers expectations and needs will be and planning that accordingly with what weve got on hand now.”