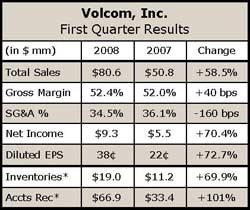

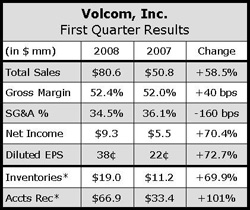

Volcom, Inc. shrugged off the sluggish economy to post strong first quarter sales gains, citing the “a powerful brand will sell regardless” ethos. The company is firing on all cylinders as margins expanded, expenses contracted and the bottom line grew in the strong double-digits. Even the acquired Electric Visual business came in better than expected as it was slightly accretive to earnings instead of the anticipated penny per share charge. Currency exchange rates also boosted results by approximately $2 million, or about four percentage points.

Product revenue in the U.S. segment, which includes everything but Europe, increased 1.9% to $48.7 million, compared to $47.8 million in the year-ago quarter. U.S. men's product revenue increased 2.1% to $24.4 million for Q1 compared with $23.9 million in Q1 last year. U.S. girls product sales decreased 16.4% to $13.8 million versus $16.5 million primarily due to the overall decrease in business at PacSun for the quarter. Outside of PacSun, the U.S. girl's business increased 1% for the quarter.

Boy's revenue increased 24.0% to $4 million compared to $3.2 million in Q1 of 2007. The Creedlers footwear line was flat at $2.1 million, while girl's swim increased 115% to $3.6 million.

International product revenue, which is reported as a part of the U.S. segment and consists primarily of sales in Canada and Japan, increased 4.1% to $12.7 million from $12.2 million last year.

Revenue from PacSun decreased 33.7% to $6.9 million for the quarter, compared with $10.4 million last year. Though well down, the PacSun business was slightly better than anticipated, primarily reflecting the shift of approximately $600,000 in orders from Q2 to Q1.

Product revenue from Europe totaled $25.2 million for the first quarter of 2008, ahead of the companys plan of $21 million. In Europe, men's sales totaled $16.4 million; girl's was $6.1 million; boy's was $730,000; Creedlers was $1.3 million; and girl's swim was $473,000.

Finally, revenue from Electric Visual was $6.2 million, ahead of the companys initial projection of $5 million.

For the U.S. segment, operating income in the quarter dropped 49% to $5 million compared to $9.8 million for the same period in 2007. Operating margin for the U.S. segment was 10% for the quarter compared to 20% in the first quarter of 2007.

In the Europe segment, operating income for the most recent quarter was $9 million compared to an operating loss of $1.8 million for the same period in 2007.

In the Electric Visual segment, operating income for the first quarter was $381,000, including a non-cash acquisition related amortization of approximately $600,000.

For the second quarter, VLCM anticipates total consolidated revenues of approximately $69 million to $70 million, representing an increase of approximately 20% to 21% over second quarter 2007 sales of $57.7 million. Fully diluted earnings per share are expected to be in the range of 16 cents to 17 cents.

For the full year of 2008, Volcom increased its financial outlook to between $343 million to $347 million. The companys previously issued guidance called for revenues of $339 million to $344 million. Earnings per diluted share are expected to be in the range of $1.56 to $1.59, an increase from the previously issued guidance or between $1.50 and $1.53 per share.

to post strong first quarter sales gains, citing the “a powerful brand will sell regardless” ethos. The company is firing on all cylinders as margins expanded, expenses contracted and the bottom line grew in the strong double-digits. Even the acquired Electric Visual business came in better than expected as it was slightly accretive to earnings instead of the anticipated penny per share charge. Currency exchange rates also boosted results by approximately $2 million, or about four percentage points.

to post strong first quarter sales gains, citing the “a powerful brand will sell regardless” ethos. The company is firing on all cylinders as margins expanded, expenses contracted and the bottom line grew in the strong double-digits. Even the acquired Electric Visual business came in better than expected as it was slightly accretive to earnings instead of the anticipated penny per share charge. Currency exchange rates also boosted results by approximately $2 million, or about four percentage points.