Vista Outdoor lowered its revenue guidance for its fiscal year ended March 31 after reporting sales dropped 20 percent in the third quarter. The company posted a loss of $514.6 million, or $8.94 a share, on a massive goodwill write-down but said earnings before charges exceeded Wall Street’s consensus estimates.

The company’s brands include Federal Premium, CamelBak, Savage Arms, Bushnell, Camp Chef, Primos, BLACKHAWK, Bell and Giro.

“Vista Outdoor continues to build on our successes and deliver on our commitments,” said Vista Outdoor Chief Executive Officer Chris Metz. “While we continue to face market pressures, specifically in our ammunition business, we are driving out cost and improving profitability across the portfolio. This has manifested in our delivery of three consecutive quarters of adjusted EPS growth and significant reductions in our adjusted operating expenses. We are also continuing with our portfolio reshaping, having made substantial progress on our planned divestiture of Savage Arms. We have also continued to build a more flexible and resilient Vista Outdoor balance sheet, having completed a refinancing of our primary corporate credit facilities during the third quarter, and we expect to use proceeds from the Savage divestiture to continue our deleveraging process. I am pleased with the progress on our turnaround and remain optimistic that we are making the correct decisions to position our company for success.”

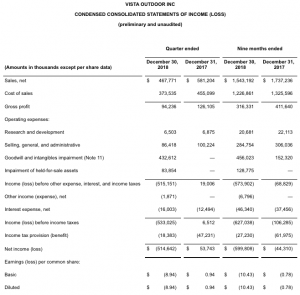

For the third quarter ended December 30, 2018:

- Sales were $468 million, down 20 percent from the prior-year quarter, down 13 percent on an organic basis excluding results from our recently sold Bolle, Serengeti and Cebe brands. Wall Street’s consensus target had been $505 million.

- Gross profit was $94 million, down 25 percent from the prior-year quarter, down 15 percent on an organic basis excluding results from our recently sold Bolle, Serengeti and Cebe brands.

- Operating expenses were $609 million, which reflects a pre-tax, non-cash goodwill and intangible impairment charge of $433 million and an $84 million impairment related to an expected loss on the sale of the company’s held-for-sale assets. This compares to $107 million of operating expenses in the prior-year quarter. Adjusted operating expenses were $80 million compared to $103 million in the prior-year quarter.

- Including the pre-tax, non-cash goodwill and intangible impairment charge, fully diluted earnings per share (EPS) was $(8.94), compared to 94 cents a share in the prior-year quarter. Adjusted EPS was 9 cents a share , compared to 13 cents a share in the prior-year quarter. Wall Street’s consensus estimate on an adjusted basis had been 6 cents.

- Cash flow provided by operating activities year to date was $61 million, compared to $246 million in the prior-year period. Year-to-date free cash flow generation was $51 million, compared to free cash flow of $208 million in the prior-year period.

- Tax rate was 3.4 percent compared to (725.3) percent in the prior-year quarter. The adjusted tax rate was (51.8) percent, compared to 25.9 percent in the prior-year quarter.

Outlook for Fiscal Year 2019

“The company has delivered another solid quarter of results towards our strategic transformation in a very competitive market environment. While lower volumes drove gross profit dollars down, we were successfully able to sequentially improve our gross profit rate by 76 basis points on an organic basis, as well as a 22 percent year over year reduction in adjusted operating expenses, or down 12 percent on an organic basis,” said Vista Outdoor Chief Financial Officer Mick Lopez. “While we are lowering our sales guidance due to continued market challenges, we are pleased to be able to hold our adjusted EPS guidance range through a continued focus on our cost savings initiatives. We remain focused on delivering disciplined progress towards our strategic transformation.”

Vista Outdoor’s current guidance for FY19 is as follows:

- Sales in a range of $2.00 billion to $2.05 billion, compared to $2.10 – $2.16 billion

- Interest expense of approximately $52 million, compared to $55 million

- Tax rate reported of approximately 5 percent and an adjusted tax rate of approximately 20 percent, compared to 10 percent and adjusted rate of 30 percent

- Earnings per share in a range of $(10.36) to $(10.21) and adjusted earnings per share in a range of 20 cents to 35 cents a share , compared to a previous earnings per share in a range of $(1.32) to $(1.17), and adjusted earnings per share 20 cents to 35 cents a share

- Capital expenditures of approximately $45 million, compared to $60 million

- Free cash flow remains in a range of $70 million to $100 million

The guidance does not include the impact of any future strategic acquisitions, divestitures, investments, business combinations or other significant transactions.

Non-recurring items in both periods are summarized below.

For the third quarter ended December 30, 2018:

During the quarter ended December 30, 2018, we recorded a portion of the approximately $10 million of compensation for the Camp Chef earn-out, which will be paid over the next year, subject to continued Camp Chef leadership employment and the achievement of certain incremental profitability growth milestones. Given this balance is related to the purchase price of the company and is not normal compensation of the employees and will not be a continuing cost, we do not believe these costs are indicative of operations of the company. The tax effect of the contingent consideration cost was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended December 30, 2018, we incurred transaction costs associated with possible and completed transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one transaction to another, the company feels these costs are not indicative of operations of the company. The tax effect of the transaction costs that are deductible for tax was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended December 30, 2018, we wrote off debt issuance costs in connection with the refinancing our Amended and Restated Credit Agreement dated April 1, 2016. Given the infrequent and unique nature of the debt issuance write-off costs, the company believes these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended December 30, 2018, we recognized a $433 million total impairment of goodwill and identifiable intangible assets. The trading price of our common stock declined significantly in the quarter ended December 30, 2018, increasing the difference between the market value of Vista Outdoor equity and the book value of the assets recorded on our balance sheet and implying that investors’ may believe that the fair value of our reporting units is lower than their book value. In addition, as a result of a weaker than expected 2018 holiday shopping season and increasing uncertainty from the impact of retail bankruptcies, tariffs and other factors affecting the market for our products, we reduced our sales projections for fiscal year 2020 and beyond for a number of our reporting units for purposes of our long-range financial plan, which is updated annually beginning in our third quarter. As a result of these factors, we determined that a triggering event had occurred during the quarter with respect to our Hunting and Shooting Accessories, Outdoor Recreation, and Action Sports reporting units, which required that we assess the fair value of these reporting units using the income-based and market-based approaches described above. Given the unusual and infrequent nature of this impairment we do not believe these costs are indicative of operations of the company. The tax effect of the goodwill and intangibles impairment charge was determined based on the fact that the goodwill impairment charge of $328 million, a portion of which was non-deductible and the remainder was deductible at a rate of approximately 24 percent for tax purposes, and the remaining intangible asset impairment of $105 million was deductible at a rate of approximately 24 percent. The current quarter impairment caused the company to be in a three-year cumulative loss position, which resulted in a valuation allowance on deferred tax assets to be recorded. Given the unusual and infrequent nature of this valuation allowance, we do not believe the $29 million tax expense related to the valuation allowance of the deferred tax assets is indicative of operations of the company.

During the quarter ended December 30, 2018, Vista Outdoor recognized a loss of $84 million related to the impairment of the firearms held-for-sale assets. Given the infrequent and unique nature of the firearms business divestiture, the company believes these costs are not indicative of ongoing operations. There is no tax effect of this loss because it is not deductible for tax purposes.

During the quarter ended December 30, 2018, Vista Outdoor also incurred business transformation costs related to the sublease of the former corporate headquarters, operational realignments, and the implementation of a new ERP system. Given the infrequent and unique nature of these business transformation costs, the company believes these costs are not indicative of ongoing operations. The tax effect of these costs was calculated based on a blended statutory rate of approximately 24 percent.

For the third quarter ended December 31, 2017:

During the quarter ended December 31, 2017, we recorded a portion of the approximately $10 million of compensation for the Camp Chef earn-out, which is paid over the three years after acquisition, subject to continued Camp Chef leadership employment and the achievement of certain incremental growth milestones. The tax effect of the contingent consideration adjustment was calculated based on a blended statutory rate of approximately 34 percent. Given this contingent consideration amount relates to the purchase price of a company and is not normal ongoing compensation of the employees, we do not believe these costs are indicative of operations.

During the quarter ended December 31, 2017, we incurred transaction costs associated with possible transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one acquisition to another, we feel these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 34 percent.

During the quarter ended December 31, 2017, we completed our search for a permanent CEO and announced the departure of the CFO. During the quarter ended December 31, 2017 we incurred costs related to severance and executive search fees related to the CEO and CFO transitions. We believe these costs are not indicative of the ongoing operations of the company. The tax effect of the costs was calculated based on a blended statutory rate of approximately 34 percent partially offset by a tax deduction shortfall.

During the quarter ended December 31, 2017, we recognized a tax benefit related to the revaluation of the balance sheet as a result of tax legislation which has been enacted in the United States and France. We believe the tax benefit related to the revaluation of the balance sheet is not indicative of the ongoing operations of the company.

During the quarter ended December 31, 2017, we incurred costs related to reorganization. These costs relate to severance costs associated with positions that have been eliminated as well as consulting costs related to the review of our organizational structure and portfolio of brands. Given the infrequent and unique nature of the reorganization, we believe these costs are not indicative of ongoing operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 34 percent.