Vista Outdoor Inc. said its expectations for sales and earnings exceeded plans in the second quarter ended September 30.

“Vista Outdoor delivered a solid quarter, exceeding our expectations for sales and EPS, despite market challenges,” said Vista Outdoor Chief Executive Officer Chris Metz. “Our ongoing efficiency and cost-reduction initiatives are beginning to bear fruit. We also completed the sale of our Eyewear Brands in the quarter which allowed us to pay down $143 million in debt. The Eyewear sale was an important step in our transformation plan, and I’m proud of our team for delivering on both our short-term financial and long-term strategy goals. We’ve also taken considerable steps in our process to divest the Savage Arms brands.”

For the second quarter ended September 30, 2018:

- Sales were $547 million, down 7 percent from the prior-year quarter.

- Gross profit was $109 million, down 22 percent from the prior-year quarter.

- Operating expenses were $128 million, compared to $266 million in the prior-year quarter. Adjusted operating expenses were $94 million compared to $105 million in the prior-year quarter.

- Fully diluted earnings per share (EPS) was $(0.57), compared to $(2.01) in the prior-year quarter. Adjusted EPS was $0.05, compared to $0.34 in the prior-year quarter.

- Cash flow provided by operating activities year to date was $58 million, compared to $112 million in the prior-year period.

- Year-to-date free cash flow generation was $55 million, compared to free cash flow of $80 million in the prior-year period.

- Tax rate was 19.8 percent compared to 17.9 percent in the prior-year quarter. The adjusted tax rate was 49.7 percent, compared to 8.7 percent in the prior-year quarter.

Outlook for Fiscal Year 2019

“The company exceeded expectations within challenging markets,” said Vista Outdoor chief financial officer Mick Lopez. “Our Shooting Sports segment generated sequential sales growth, while our Outdoor Products segment sales remained flat adjusted for eyewear. Overall, we are pleased with these results and our continued efforts to drive profitability.”

Vista’s major brands in these areas include Federal Premium, CamelBak, Bushnell, Primos, Camp Chef and BLACKHAWK!.

Vista Outdoor’s current guidance for FY19 is as follows:

Vista Outdoor’s current guidance for FY19 is as follows:

- Sales in a range of $2.10 billion to $2.16 billion

- Interest expense of approximately $55 million

- Tax rate reported of approximately 10 percent and an adjusted tax rate of approximately 30 percent, compared to 1 percent and adjusted rate of 30 percent

- Earnings per share in a range of $(1.32) to $(1.17) and adjusted earnings per share in a range of $0.20 to $0.35, compared to previous earnings per share in a range of $(0.76) to $(0.56), and adjusted earnings per share in a range of $0.15 to $0.35

- Capital expenditures of approximately $60 million

- Free cash flow in a range of $70 million to $100 million

- The guidance above does not include the impact of any future strategic acquisitions, divestitures, investments, business combinations or other significant transactions.

For the second quarter ended September 30, 2018:

During the quarter ended September 30, 2018, Vista Outdoor recorded a portion of the approximately $10 million of compensation for the Camp Chef earn-out, which will be paid over the next two years, subject to continued Camp Chef leadership employment and the achievement of certain incremental profitability growth milestones. Given this balance is related to the purchase price of the company and is not normal compensation of the employees and will not be a continuing cost, we do not believe these costs are indicative of operations of the company. The tax effect of the contingent consideration cost was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor incurred transaction costs associated with possible and completed transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one transaction to another, the company feels these costs are not indicative of operations of the company. The tax effect of the transaction costs that are deductible for tax was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor wrote off debt issuance costs in connection with the prepayment of principal on our term loan and the reduction of our revolver capacity. Given the infrequent and unique nature of the debt issuance write-off costs, the company believes these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, the loss of a key customer for our stand up paddle boards business during the quarter resulted in a reduction of the projected cash flows for the stand up paddle boards business. Given the associated decrease in projected cash flows, we determined that a triggering event had occurred. This analysis resulted in a $23 million impairment charge related to customer relationship intangibles associated with the business. Given the infrequent and unique nature of the intangible asset impairment, the company believes these costs are not indicative of ongoing operations. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, the Company completed the sale of its Bollé, Serengeti, and Cébé brands (the “Eyewear Brands”). The selling price was $158 million, subject to customary working capital adjustments. As a result, during the quarter ended September 30, 2018, the Company recorded a pretax loss of approximately $5 million, which is included in other income (expense), net. Given the infrequent and unique nature of this divestiture, the company believes these costs are not indicative of ongoing operations. The tax amount is based upon the estimated taxes due on the transaction.

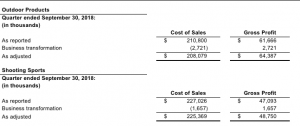

During the quarter ended September 30, 2018, Vista Outdoor incurred business transformation costs related to consulting services associated with a strategic supply chain efficiency initiative. These consulting services costs are directly related to improving efficiencies of inventory procurement and are therefore classified as costs of goods sold. Of the $4.4 million of cost of goods sold, approximately $2.7 million and $1.7 million was incurred by the Outdoor Products and Shooting Sports segments, respectively. During the quarter ended September 30, 2018, Vista Outdoor also incurred business transformation costs related to consulting services for the review of the company’s organizational structure and portfolio of brands, operational realignments, abandonment of certain IT assets, and the implementation of a new ERP system. Given the infrequent and unique nature of these business transformation costs, the company believes these costs are not indicative of ongoing operations. The tax effect of these costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor recognized a tax benefit related to the revaluation of the balance sheet as a result of tax legislation in the United States, which was clarified during the quarter. Vista Outdoor believes the tax benefit related to the revaluation of the balance sheet is not indicative of the ongoing operations of the company.

For the second quarter ended October 1, 2017:

During the quarter ended October 1, 2017, Vista Outdoor incurred transaction costs associated with possible transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one acquisition to another, we feel these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 37 percent.

During the quarter ended October 1, 2017, Vista Outdoor recorded $0.8 million of the $10 million of compensation for the Camp Chef earn-out, which will be paid over the next three years, subject to continued Camp Chef leadership employment and the achievement of certain incremental growth milestones. The tax effect of the contingent consideration adjustment was calculated based on a blended statutory rate of approximately 37 percent. In addition, during the quarter ended October 1, 2017, we reduced by $1 million the liability for the earn-out related to the Bell Powersports product line as a result of changes in expectations and the likelihood of achieving future profitability milestones for the remaining periods of the earn-out. There was no tax effect of this contingent consideration adjustment. Given these contingent consideration amounts relate to the purchase price of the companies and are not normal ongoing compensation of the employees, we do not believe these costs are indicative of operations.

During the quarter ended October 1, 2017, Mark DeYoung, then CEO, retired from Vista Outdoor and Michael Callahan assumed the role of interim CEO. In addition, the company performed a search for a permanent CEO. We recorded approximately $9 million in costs related to severance, retirement benefits, and executive search fees related to the CEO transition. We believe these costs are not indicative of the ongoing operations of the company. The tax effect of the costs was calculated based on a blended statutory rate of approximately 37 percent partially offset by a tax deduction shortfall.

During the quarter ended October 1, 2017, we recognized a $152 million total impairment of goodwill and identifiable intangible assets. The company previously anticipated a return to sales growth in fiscal 2018 for the Hunting and Shooting Accessories and Sports Protection reporting units. However, during the quarter ended October 1, 2017 the company concluded that the return to growth for those reporting units would take longer than previously anticipated. As a result, we reduced the projected cash flows for these reporting units to reflect the lower expected sales volume and higher product discounting. This reduction in our internal projections for these reporting units triggered an analysis of our goodwill and tradename intangibles. Given the unusual and infrequent nature of this impairment we do not believe these costs are indicative of operations of the company. The tax effect of the goodwill and intangibles impairment charge was determined based on the fact that the goodwill impairment charge of $143 million, a portion of which was non-deductible and the remainder was deductible at a rate of approximately 37 percent for tax purposes, and the remaining intangible asset impairment of $9 million was deductible at a rate of approximately 37 percent.

During the quarter ended September 30, 2018, Vista Outdoor recorded a portion of the approximately $10 million of compensation for the Camp Chef earn-out, which will be paid over the next two years, subject to continued Camp Chef leadership employment and the achievement of certain incremental profitability growth milestones. Given this balance is related to the purchase price of the company and is not normal compensation of the employees and will not be a continuing cost, we do not believe these costs are indicative of operations of the company. The tax effect of the contingent consideration cost was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor incurred transaction costs associated with possible and completed transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one transaction to another, the company feels these costs are not indicative of operations of the company. The tax effect of the transaction costs that are deductible for tax was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor wrote off debt issuance costs in connection with the prepayment of principal on our term loan and the reduction of our revolver capacity. Given the infrequent and unique nature of the debt issuance write-off costs, the company believes these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, the loss of a key customer for our stand up paddle boards business during the quarter resulted in a reduction of the projected cash flows for the stand up paddle boards business. Given the associated decrease in projected cash flows, we determined that a triggering event had occurred. This analysis resulted in a $23 million impairment charge related to customer relationship intangibles associated with the business. Given the infrequent and unique nature of the intangible asset impairment, the company believes these costs are not indicative of ongoing operations. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, the Company completed the sale of its Bollé, Serengeti, and Cébé brands (the “Eyewear Brands”). The selling price was $158 million, subject to customary working capital adjustments. As a result, during the quarter ended September 30, 2018, the Company recorded a pretax loss of approximately $5 million, which is included in other income (expense), net. Given the infrequent and unique nature of this divestiture, the company believes these costs are not indicative of ongoing operations. The tax amount is based upon the estimated taxes due on the transaction.

During the quarter ended September 30, 2018, Vista Outdoor incurred business transformation costs related to consulting services associated with a strategic supply chain efficiency initiative. These consulting services costs are directly related to improving efficiencies of inventory procurement and are therefore classified as costs of goods sold. Of the $4.4 million of cost of goods sold, approximately $2.7 million and $1.7 million was incurred by the Outdoor Products and Shooting Sports segments, respectively. During the quarter ended September 30, 2018, Vista Outdoor also incurred business transformation costs related to consulting services for the review of the company’s organizational structure and portfolio of brands, operational realignments, abandonment of certain IT assets, and the implementation of a new ERP system. Given the infrequent and unique nature of these business transformation costs, the company believes these costs are not indicative of ongoing operations. The tax effect of these costs was calculated based on a blended statutory rate of approximately 24 percent.

During the quarter ended September 30, 2018, Vista Outdoor recognized a tax benefit related to the revaluation of the balance sheet as a result of tax legislation in the United States, which was clarified during the quarter. Vista Outdoor believes the tax benefit related to the revaluation of the balance sheet is not indicative of the ongoing operations of the company.

For the second quarter ended October 1, 2017:

During the quarter ended October 1, 2017, Vista Outdoor incurred transaction costs associated with possible transactions, including advisory, legal, and accounting service fees. Given the nature of transaction costs, and differences in these amounts from one acquisition to another, we feel these costs are not indicative of operations of the company. The tax effect of the transaction costs was calculated based on a blended statutory rate of approximately 37 percent.

During the quarter ended October 1, 2017, Vista Outdoor recorded $0.8 million of the $10 million of compensation for the Camp Chef earn-out, which will be paid over the next three years, subject to continued Camp Chef leadership employment and the achievement of certain incremental growth milestones. The tax effect of the contingent consideration adjustment was calculated based on a blended statutory rate of approximately 37 percent. In addition, during the quarter ended October 1, 2017, we reduced by $1 million the liability for the earn-out related to the Bell Powersports product line as a result of changes in expectations and the likelihood of achieving future profitability milestones for the remaining periods of the earn-out. There was no tax effect of this contingent consideration adjustment. Given these contingent consideration amounts relate to the purchase price of the companies and are not normal ongoing compensation of the employees, we do not believe these costs are indicative of operations.

During the quarter ended October 1, 2017, Mark DeYoung, then CEO, retired from Vista Outdoor and Michael Callahan assumed the role of interim CEO. In addition, the company performed a search for a permanent CEO. We recorded approximately $9 million in costs related to severance, retirement benefits, and executive search fees related to the CEO transition. We believe these costs are not indicative of the ongoing operations of the company. The tax effect of the costs was calculated based on a blended statutory rate of approximately 37 percent partially offset by a tax deduction shortfall.

During the quarter ended October 1, 2017, we recognized a $152 million total impairment of goodwill and identifiable intangible assets. The company previously anticipated a return to sales growth in fiscal 2018 for the Hunting and Shooting Accessories and Sports Protection reporting units. However, during the quarter ended October 1, 2017 the company concluded that the return to growth for those reporting units would take longer than previously anticipated. As a result, we reduced the projected cash flows for these reporting units to reflect the lower expected sales volume and higher product discounting. This reduction in our internal projections for these reporting units triggered an analysis of our goodwill and tradename intangibles. Given the unusual and infrequent nature of this impairment we do not believe these costs are indicative of operations of the company. The tax effect of the goodwill and intangibles impairment charge was determined based on the fact that the goodwill impairment charge of $143 million, a portion of which was non-deductible and the remainder was deductible at a rate of approximately 37 percent for tax purposes, and the remaining intangible asset impairment of $9 million was deductible at a rate of approximately 37 percent.

Photo courtesy CamelBak