Moody’s Investors Service placed V.F. Corporations’ long-term ratings on review for downgrade, including its A3 senior unsecured debt rating, (P)A3, senior unsecured shelf rating, (P)Baa1 subordinate shelf rating, and (P)Baa2 preferred shelf rating. The company’s P-2 short-term commercial paper rating was affirmed.

The review for downgrade follows VF Corp’s announcement that it has entered into a definitive agreement to acquire Supreme Holdings, Inc., a direct-to-consumer focused streetwear apparel & accessories company, in an all-cash transaction valued at around $2.1 billion, plus an additional earn-out, based on revenue and gross margin performance. With a multiple of less than 15x Supreme’s projected fiscal 2020 adjusted EBITDA, Moody’s views the transaction as fully priced. VF Corp. plans to fund the acquisition with around $1.5 billion of balance sheet cash and $500 million of commercial paper. Subject to certain conditions, Supreme’s founder will receive a portion of the purchase price in VF Corp equity over time. The transaction is expected to close by the end of the calendar year 2020.

“The acquisition of Supreme will complement existing streetwear components in VF Corp’s core brand portfolio and accelerate VF Corp’s consumer-driven, retail-centric and hyper-digital transformation,” stated Moody’s apparel analyst, Mike Zuccaro. “However, the transaction occurs at a time of high risk and uncertainty stemming from the global coronavirus pandemic. Recent severe revenue and earnings declines, along with $3 billion of incremental debt initially used to boost liquidity, have led to a significant increase in VF Corp’s financial leverage, which will likely remain elevated for several years. Of particular concern now is the aggressive use of cash for the acquisition, that was initially raised to boost liquidity in the face of the global coronavirus pandemic, as well as the use of incremental short term debt and VF Corp’s ongoing sizeable dividend payments.”

Moody’s added in its statement, “The affirmation of VF Corp.’s P-2 short term commercial paper ratings reflects Moody’s expectation that VF Corp’s liquidity will remain excellent, supported by its remaining balance sheet cash and operating cash flow. The affirmation also reflects Moody’s expectation that any downgrade to VF Corp.’s long term ratings would likely be limited to one notch at the conclusion of the review.

“Moody’s review will focus on VF Corp.’s integration plans and potential for long- and short-term revenue and cost synergies, the Supreme brand’s fit within the overall VF Corp portfolio, VF Corp’s ability to maintain long term brand strength and growth potential, VF Corp’s future governance considerations and financial policy including its ability and willingness to accelerate de-leveraging in the currently challenging global economic environment.”

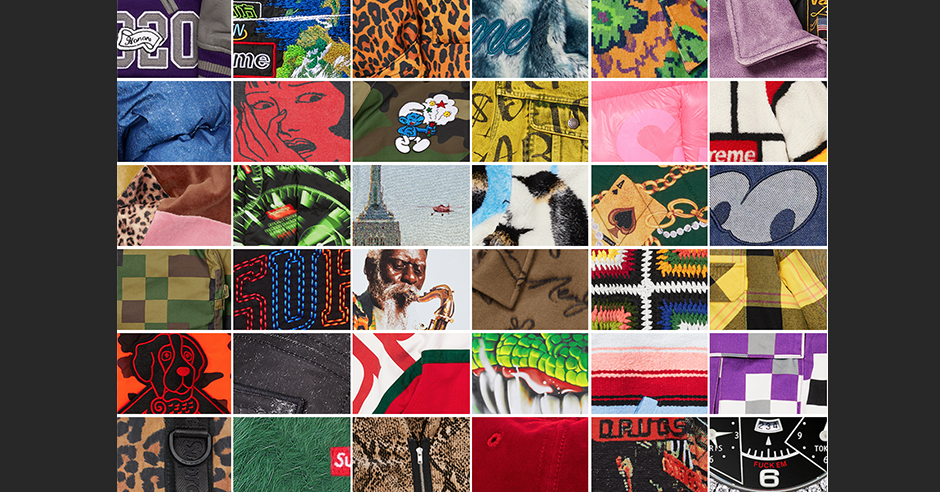

Photo courtesy Supreme FW20