Vail Resorts, Inc. reported total fiscal 2023 net revenue increased 14.4 percent to $2.89 billion for the period ended July 31.

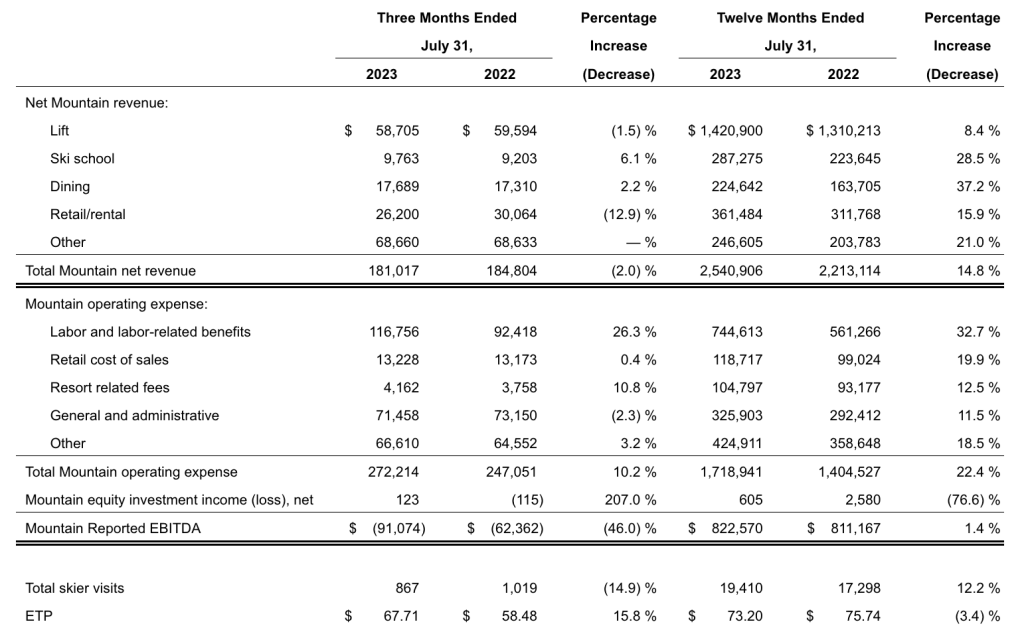

Mountain Segment

Total lift revenue increased 8.4 percent to $1.42 billion in fiscal 2023 due to increases in both pass product revenue and non-pass product revenue. Pass product revenue increased 8.5 percent primarily as a result of an increase in pass product sales for the 2022/2023 North American ski season compared to the prior year, as well as an increase in pass product sales for the 2022 Australian ski season compared to the prior year. Non-pass revenue increased 8.3 percent primarily due to an increase in non-pass ETP, excluding Andermatt-Sedrun, of 7.8 percent, as well as incremental non-pass revenue from Andermatt-Sedrun of $13.2 million. Total non-pass ETP, including the impact of Andermatt-Sedrun, increased 4.3 percent. The increase in non-pass revenue also benefited from an increase in visitation at the company’s Australian ski areas in the first quarter of fiscal 2023, which experienced record visitation and favorable snow conditions during the 2022 Australian ski season following periodic COVID-related closures and restrictions in the prior season.

Ski school revenue increased 28.5 percent, dining revenue 37.2 percent, and retail/rental revenue increased 15.9 percent for the year, each primarily driven by the greater impact of COVID-19 and related limitations and restrictions in the prior year, including staffing challenges which limited our ability to operate at full capacity, as well as increased skier visitation.

Operating expense increased $314.4 million, or 22.4 percent, which was primarily attributable to investments in employee wages and salaries and increased headcount to support more normalized staffing and operations at our resorts, as well as increased variable expenses associated with increased revenue, the impact of inflation and incremental expenses associated with Andermatt-Sedrun and the Seven Springs Resorts.

Mountain Reported EBITDA increased $11.4 million, or 1.4 percent, for the year, which includes $21.2 million of stock-based compensation for fiscal 2023 compared to $20.9 million in the prior year.

Mountain Segment Operating Results

(In thousands, except Effective Ticket Price (“ETP”))

Lodging Segment

Lodging segment net revenue (excluding payroll cost reimbursements) increased 7.6 percent, primarily due to increases in dining and ancillary revenue as a result of fewer COVID-19-related limitations and restrictions as compared to the prior year and a return to more normalized operations, as well as incremental revenue from the Seven Springs Resorts.

Operating expenses, excluding reimbursed payroll costs, increased $36.3 million, or 13.2 percent, which was primarily attributable to investments in employee wages and salaries and increased headcount to support more normalized staffing and operations at the resorts, as well as increased variable expenses associated with increased revenue, the impact of inflation and incremental expenses associated with the Seven Springs Resorts.

Lodging Reported EBITDA decreased $13.5 million, or 52.4 percent, which includes $4.0 million of stock-based compensation expense in fiscal 2023 compared to $3.7 million in the prior year.

Resort | Combination of Mountain and Lodging Segments

Resort net revenue was $2.88 billion for fiscal 2023, an increase of 14.1 percent, compared to the resort net revenue of $2.53 billion for fiscal 2022.

Resort Reported EBITDA was $834.8 million for fiscal 2023, a decrease of $2.1 million, or 0.2 percent, compared to fiscal 2022.

Consolidated net income attributable to Vail Resorts, Inc. was $268.1 million for fiscal 2023 compared to net income attributable to Vail Resorts, Inc. of $347.9 million for fiscal 2022. The decrease in net income attributable to Vail Resorts, Inc. compared to the prior year is primarily attributable to a large gain on the disposal of fixed assets in fiscal 2022 and an increase in fiscal 2023 expense associated with a change in the estimated fair value of the contingent consideration liability related to the Park City resort lease.

Commenting on the company’s fiscal 2023 results, company CEO Kirsten Lynch said, “Given the significant weather-related challenges this past season, we are pleased with our overall results for the year, with strong growth in 2022/23 North American ski season visitation and spending compared to the prior year, further supported by the stability created by our advance commitment products. The return to normal staffing levels enabled our mountain resorts to deliver a strong guest experience resulting in a significant improvement in guest satisfaction scores, which exceeded pre-COVID levels at our destination mountain resorts.

“Visitation growth was achieved through strong growth in pass sales, the addition of Andermatt-Sedrun in Switzerland, the full-year impact of Seven Springs Mountain Resort, Hidden Valley Resort and Laurel Mountain Ski Area, and record visitation and resort net revenue in March and April. Ancillary businesses, including ski school, dining, and retail/rental, experienced strong growth compared to the prior period, when those businesses were impacted by capacity constraints driven by staffing, and in the case of dining, by operational restrictions associated with COVID-19. Our dining business rebounded strongly from the prior year, though underperformed expectations for the year as guest dining behavior did not fully return to pre-COVID levels following two years of significant operational restrictions associated with COVID-19. Our overall results throughout the 2022/2023 North American ski season highlight the stability of the advance commitment from season pass products in a season with challenging conditions, including travel disruptions during the peak holiday period, abnormal weather conditions that significantly reduced operating days, terrain availability, and activity offerings across our 26 Midwest, Mid-Atlantic and Northeast resorts (collectively, “Eastern” U.S. resorts), and severe weather disruptions at our Tahoe resorts. This past season, approximately 75 percent of skier visitation at our North American resorts, excluding complimentary visits, was from pass product holders who committed in advance of the season, which compares to approximately 72 percent for the 2021/22 North American ski season.”

Regarding the company’s fiscal 2023 fourth-quarter results, Lynch said, “The fourth quarter declined from the prior year, primarily driven by the company’s fiscal 2023 investments in employees, as well as a below-average snowfall and snowmaking temperatures that limited terrain availability during the Australian winter season. North American summer operations also underperformed expectations driven by a combination of lower demand for destination mountain travel, which we believe was primarily driven by a broader shift in summer travel behavior associated with the wider variety of vacation offerings available following various travel restrictions in the prior two years, and weather-related operational disruptions.”

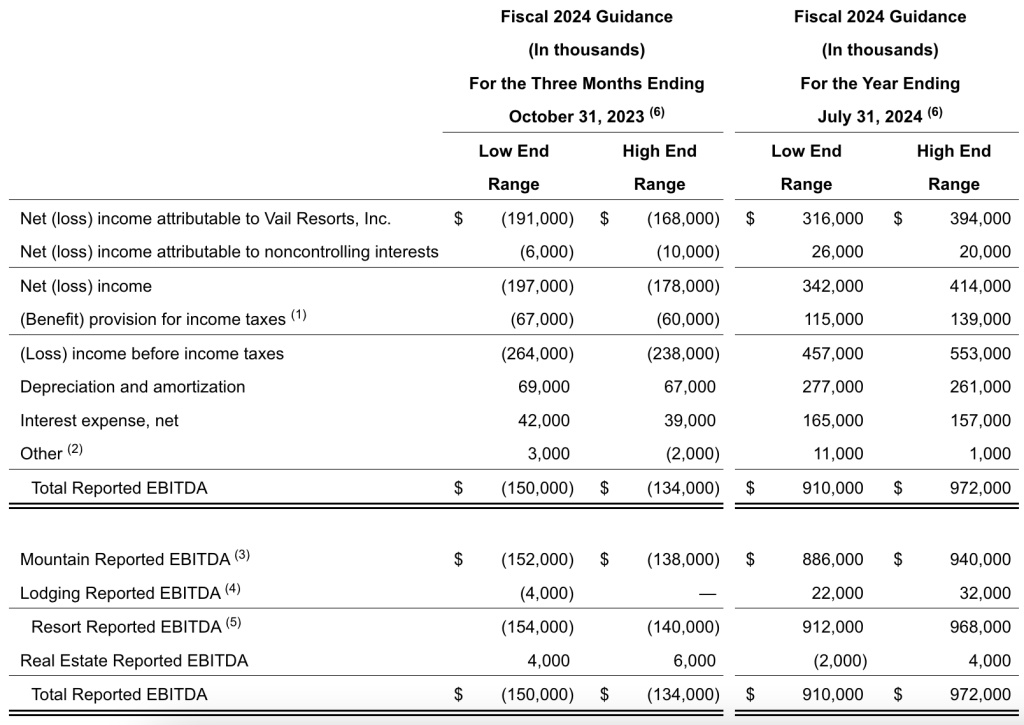

Fiscal 2024 Guidance

Commenting on guidance, Lynch said, “As we head into fiscal year 2024, we are encouraged by the strength in advance commitment product sales and remain committed to delivering a strong guest experience while maintaining cost discipline. We expect meaningful growth for fiscal 2024 relative to fiscal 2023 with a strong Resort EBITDA margin. Our guidance for net income attributable to Vail Resorts, Inc. is estimated to be between $316 million and $394 million for fiscal 2024. We estimate Resort Reported EBITDA for fiscal 2024 will be between $912 million and $968 million. We estimate Resort EBITDA Margin for fiscal 2024 to be approximately 31.0 percent using the midpoint of the guidance range.

“Fiscal 2024 guidance includes an expectation that the first quarter of fiscal 2024 will generate net loss attributable to Vail Resorts, Inc. between $191 million and $168 million and Resort Reported EBITDA between negative $154 million and negative $140 million. At the midpoint of the guidance range, first quarter fiscal 2024 Resort Reported EBITDA assumes a negative impact of approximately $46 million compared to the first quarter of fiscal 2023 excluding exchange rate impacts, primarily driven by cost inflation, including a $7 million impact of our fiscal 2023 employee investment which went into effect in October 2022, lower results from our Australian resorts from the continuation of the weather-related challenges that impacted terrain in the fourth quarter of fiscal 2023, and lower results from North American summer operations from the continuation of the lower demand for destination mountain travel experienced in the prior fiscal quarter. Relative to fiscal 2023, fiscal 2024 full-year guidance also reflects a negative Resort Reported EBITDA impact of approximately $3 million as a result of the company’s fiscal 2023 exit of its retail and rental locations in Telluride and Aspen.

“The guidance assumes a continuation of the current economic environment and normal weather conditions for the 2023/2024 North American and European ski season and the 2024 Australian ski season. The guidance assumes an exchange rate of $0.74 between the Canadian Dollar and U.S. Dollar related to the operations of Whistler Blackcomb in Canada, an exchange rate of $0.64 between the Australian Dollar and U.S. Dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and an exchange rate of $1.10 between the Swiss Franc and U.S. Dollar related to the operations of Andermatt-Sedrun in Switzerland. The current fiscal 2024 exchange rate assumptions result in an expected $5 million negative impact relative to fiscal 2023 results and an expected $10 million negative impact relative to our original fiscal 2023 guidance provided in September 2022.”

The following table reflects the forecasted guidance range for the company’s fiscal 2024 first quarter ending October 31, 2023 and full year ending July 31, 2024 for Total Reported EBITDA (after stock-based compensation expense) and reconciles net (loss) income attributable to Vail Resorts, Inc. guidance to such Total Reported EBITDA guidance.

Vail Resorts, Inc.

Total Reported EBITDA Guidance

Photo courtesy Beaver Creek Resort