Vail Resorts, Inc. reported that total net revenue increased 0.7 percent to $260.3 million for the fiscal 2025 first quarter ended October 31, with increases across all segments. The net loss attributable to Vail Resorts, Inc. was $172.8 million, or a loss of $4.61 per diluted share, for the first quarter of fiscal 2025, compared to a net loss attributable to Vail Resorts, Inc. of $175.5 million, or a loss of $4.60 per diluted share, in the prior-year Q1 period.

Vail Resorts, Inc. reported that total net revenue increased 0.7 percent to $260.3 million for the fiscal 2025 first quarter ended October 31, with increases coming across all segments. The net loss attributable to Vail Resorts, Inc. was $172.8 million, or a loss of $4.61 per diluted share, for the first quarter of fiscal 2025, compared to a net loss attributable to Vail Resorts, Inc. of $175.5 million, or a loss of $4.60 per diluted share, in the prior-year Q1 period.

“Our first fiscal quarter historically operates at a loss, given that our North American and European mountain resorts are generally not open for ski season,” explained Kirsten Lynch, CEO, Vail Resorts, Inc. “The quarter’s results were driven by winter operations in Australia and summer activities in North America, including sightseeing, dining, retail, lodging, and administrative expenses.”

Lynch said Resort Reported EBITDA was consistent with the prior year, driven by growth in the North American summer business from increased activities spending and lodging results.

“This growth was offset by a decline in Resort Reported EBITDA of $9 million compared to the prior year from our Australian resorts due to record low snowfall and lower demand, cost inflation, the inclusion of Crans-Montana, and approximately $2.7 million of one-time costs related to the two-year resource efficiency transformation plan and $0.9 million of acquisition and integration related expenses,” she continued in her prepared statement accompanying the company’s fiscal q1 report.

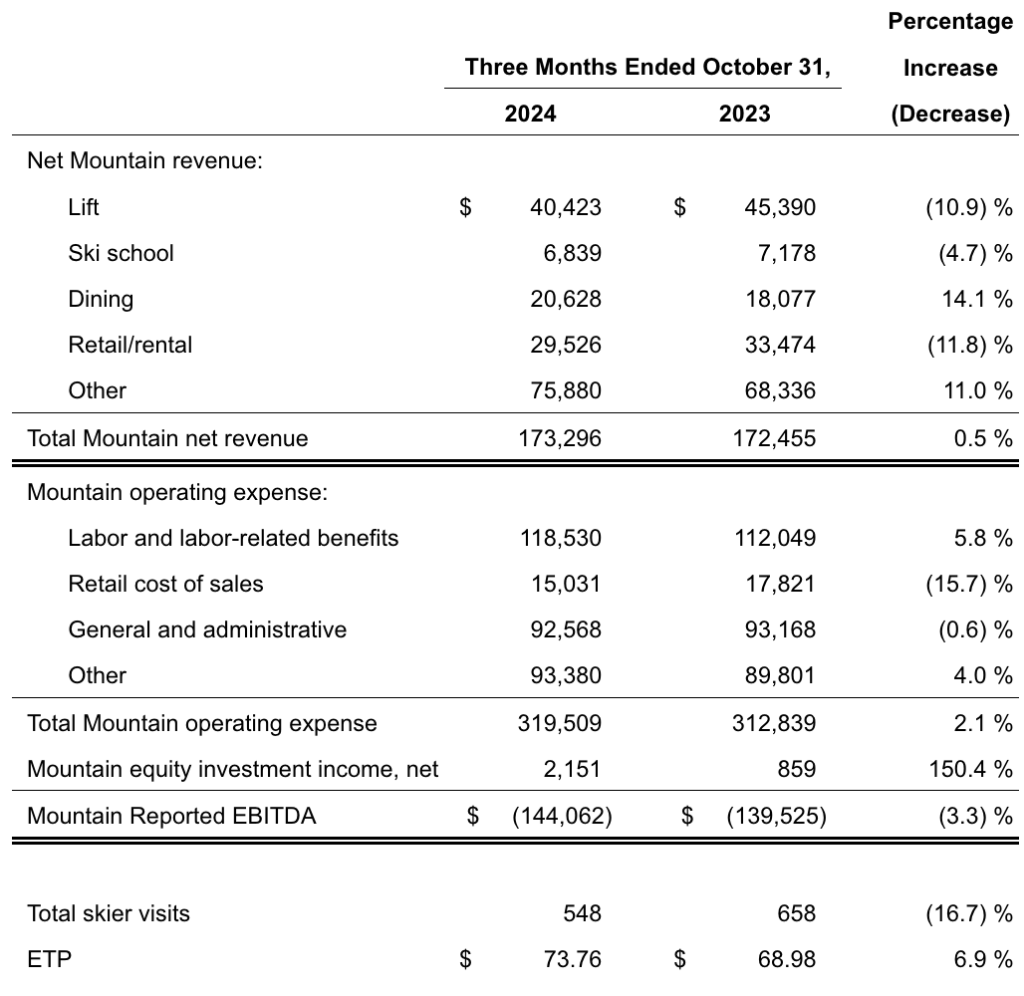

Mountain Segment

Mountain segment net revenue increased $0.8 million, or 0.5 percent, to $173.3 million for the fiscal first quarter as compared to the prior-year Q1 period, primarily driven by an increase in summer visitation at the company’s North American resorts as a result of improved weather conditions compared to the prior year, which generated increases in on-mountain summer activities revenue, sightseeing revenue and dining revenue. These increases were partially offset by a decrease in lift revenue from its Australian resorts as a result of reduced visitation from weather-related challenges that impacted terrain and resulted in early closures in the current year, and a decrease in retail/rental revenue driven by the impact of broader industry-wide customer spending trends which negatively impacted retail demand, particularly at its Colorado City store locations.

Mountain Reported EBITDA loss was $144.1 million for the fiscal first quarter, which represents a decrease of $4.5 million, or 3.3 percent, as compared to Mountain Reported EBITDA loss for the prior-year Q1 period, primarily driven by the company’s Australian operations, which experienced weather-related challenges that impacted terrain and resulted in early closures, as well as incremental off-season losses from the addition of Crans-Montana (acquired May 2, 2024), partially offset by an increase in summer operations at its North American resorts, which benefited from warm weather conditions late in the season. Mountain segment results also include one-time operating expenses attributable to its resource efficiency transformation plan of $2.0 million for the fiscal first quarter and the acquisition and integration-related expenses of $0.9 million and $1.8 million for the fiscal first quarter and 2023, respectively.

Lodging Segment

Lodging segment net revenue, excluding payroll cost reimbursements, increased $5.4 million, or 6.9 percent, to $83.8 million for the fiscal first quarter as compared to the prior-year Q1 period, primarily driven by favorable weather conditions in the Grand Teton region, which enabled increased room pricing and drove increases in owned hotel rooms revenue. Additionally, dining and golf revenue increased primarily due to increased summer visitation at its North American mountain resort properties.

Lodging Reported EBITDA was $4.4 million for the fiscal first quarter, which represents an increase of $4.6 million, as compared to Lodging Reported EBITDA loss for the prior-year Q1 period, primarily as a result of favorable weather conditions which drove increased visitation in the Grand Teton region and at its mountain resort properties. Lodging segment results include one-time operating expenses attributable to the company’s resource efficiency transformation plan of $0.7 million for the fiscal first quarter.

Resort (Mountain and Lodging Segments Combined)

Resort net revenue was $260.2 million for the fiscal first quarter, an increase of $5.9 million as compared to Resort net revenue of $254.3 million for the prior-year Q1 period.

Resort Reported EBITDA loss was $139.7 million for the fiscal first quarter, compared to Resort Reported EBITDA loss of $139.8 million for the prior-year Q1 period.

Real Estate Segment

Real Estate Reported EBITDA was $15.1 million for the fiscal first quarter, an increase of $9.7 million as compared to Real Estate Reported EBITDA of $5.4 million for the prior-year Q1 period. During the fiscal first quarter, the company recorded a gain on the sale of real property for $16.5 million related to the resolution of the October 2023 Eagle County District Court final ruling and valuation regarding the Town of Vail’s condemnation of the company’s East Vail property that was planned for Vail Resorts’ incremental affordable workforce housing project, as compared to the prior-year Q1 period, during which we recorded a gain on sale of real property for $6.3 million related to a land parcel sale in Beaver Creek, CO.

Outlook

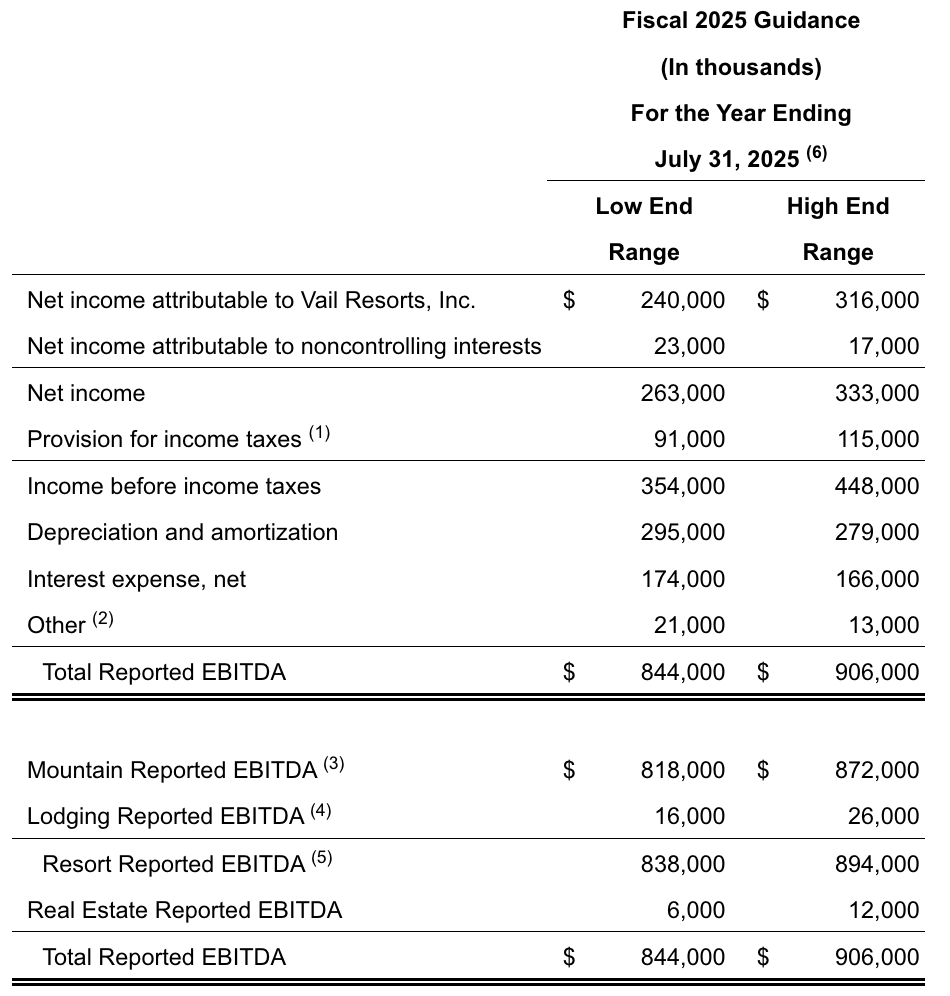

The company said its Resort Reported EBITDA guidance for the year ending July 31, 2025, is unchanged from the prior guidance provided on September 26, 2024. However, the company is updating its guidance for net income attributable to Vail Resorts, Inc., which it now expects to be between $240 million and $316 million, up from the prior guidance range of $224 million to $300 million for the year. The primary difference in the guidance is reportedly due to a $17 million increase from the gain on the sale of real property related to the resolution of the October 2023 Eagle County District Court final ruling and valuation regarding the Town of Vail’s condemnation of the company’s East Vail property that was planned for Vail Resorts’ incremental affordable workforce housing project. This transaction was recorded as Real Estate Reported EBITDA.

Additionally, the guidance was updated to include a decrease in expected interest expense of approximately $2 million, which assumes that interest rates will remain at current levels for the remainder of fiscal 2025. These changes have no impact on expected Resort Reported EBITDA. The company continues to expect Resort Reported EBITDA for fiscal 2025 to be between $838 million and $894 million, including approximately $27 million of cost efficiencies and an estimated $15 million in one-time costs related to the multi-year resource efficiency transformation plan, and an estimated $1 million of acquisition and integration related expenses specific to Crans-Montana.

As compared to fiscal 2024, the fiscal 2025 guidance includes the assumed benefit of a return to normal weather conditions after the challenging conditions in fiscal 2024, more than offset by a return to normal operating costs and the impact of the continued industry normalization, impacting demand. Additionally, the guidance reflects the negative impact of the record low snowfall and related shortened seasons in Australia in the first quarter of fiscal 2025, which negatively impacted demand and resulted in a $9 million decline in Resort Reported EBITDA compared to the prior year period. After considering these items, the company expects Resort Reported EBITDA to grow from price increases and ancillary spending, the resource efficiency transformation plan, and the addition of Crans-Montana for the full year.

The guidance also assumes:

- A continuation of the current economic environment;

- Normal weather conditions for the 2024/25 North American and European ski season, the 2025 Australian ski season; and

- Foreign currency exchange rates as of our original fiscal 2025 guidance issued September 26, 2024.

Foreign currency exchange rates have experienced recent volatility. Relative to the current guidance, if the currency exchange rates as of yesterday, December 8, 2024, of $0.71 between the Canadian Dollar and U.S. Dollar related to the operations of Whistler Blackcomb in Canada, $0.64 between the Australian Dollar and U.S. Dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and $1.14 between the Swiss Franc and U.S. Dollar related to the operations of Andermatt-Sedrun and Crans-Montana in Switzerland were to continue for the remainder of the fiscal year, the company expects this would have an impact on fiscal 2025 guidance of approximately negative $5 million for Resort Reported EBITDA.

The following table reflects the forecasted guidance range for the company’s fiscal year ending July 31, 2025, for Total Reported EBITDA (after stock-based compensation expense) and reconciles net income attributable to Vail Resorts, Inc. guidance to such Total Reported EBITDA guidance.

Fiscal 2025 Full Year Guidance

Image courtesy Heavenly/Vail Resorts, Inc.