Vail Resorts Inc. reported season pass sales for the North American ski season are up approximately 14 percent in units and approximately 20 percent in sales dollars through December 3, 2017.

The company also reposted results for the first quarter of fiscal 2018 ended October 31, 2017 and provided certain early ski season indicators.

Highlights

- Net loss attributable to Vail Resorts Inc. was $28.4 million for the first fiscal quarter of 2018 compared to a net loss attributable to Vail Resorts Inc. of $62.6 million in the same period in the prior year. Fiscal 2018 first quarter net loss included a tax benefit of approximately $51.8 million (or $1.29 earnings per diluted share) related to employee exercises of equity awards, primarily attributable to the CEO’s exercise of expiring stock appreciation rights (SARs) during the quarter. This tax benefit is recorded in net income (loss) as a result of the adoption of revised accounting guidance related to employee stock compensation.

- Resort Reported EBITDA loss was $54.1 million for the first fiscal quarter of 2018, which includes $0.7 million of acquisition and integration related costs and approximately $1.9 million of additional payroll taxes related to the CEO’s exercise of expiring SARs, compared to a Resort Reported EBITDA loss of $53.3 million in the same period in the prior year, which included $2.8 million of acquisition and integration related expenses.

- Season pass sales through December 3, 2017 for the upcoming 2017/18 North American ski season increased approximately 14 percent in units and 20 percent in sales dollars as compared to the period in the prior year through December 4, 2016, including Whistler Blackcomb and Stowe pass sales in both periods, adjusted to eliminate the impact of foreign currency by applying current period exchange rates to the prior period.

- The company reaffirmed its core operating guidance for fiscal year 2018, with certain adjustments related to the CEO’s exercise of expiring SARs and currency fluctuations.

- The company announced a transformational capital program at Whistler Blackcomb, with a new state-of-the-art gondola and two new high-speed chairlifts, and major improvements at Park City to the culinary experience and to family and beginner terrain.

Commenting on the company’s fiscal 2018 first quarter results, Rob Katz chief executive officer, said: “Our first fiscal quarter historically operates at a loss given that our North American mountain resorts are not open for ski operations during the period. The quarter’s results are primarily driven by winter operating results from Perisher and our North American resorts’ summer activities, dining, retail/rental and lodging operations, and administrative expenses. Perisher performed very well in the first quarter with outstanding conditions in September that led to strong visitation and revenue growth across the business. Whistler Blackcomb’s robust summer business also performed well with strong performance in its world class mountain biking operations, summer activities and sightseeing. Our U.S. summer business was impacted, as expected, by the same operational challenges we noted last quarter, including the Heavenly Coaster closure due to damage from last winter and the delayed launch of Epic Discovery at Breckenridge , all of which were included in our fiscal 2018 guidance assumptions. Our lodging results for the first fiscal quarter were encouraging with revenue per available room (RevPAR) increasing 8.5 percent compared to the same period in the prior year. In particular, our properties in Colorado benefited from increased visitation to our resort communities and Grand Teton Lodge Company benefited from higher ancillary yields and 6 percent growth in average daily rate (ADR).”

Regarding Real Estate, Katz said, “Real Estate Reported EBITDA was a loss of $1.1 million for the first fiscal quarter, as compared to a gain of $5.1 million in the same period the prior year, which included $6.5 million of Real Estate Reported EBITDA related to the sale of a land parcel in Breckenridge. We remain in discussions with developers on a number of potential land sales at the base of our resorts.”

Katz continued, “Our balance sheet at quarter end remains very strong. We ended the quarter with $140.4 million of cash on hand, $95 million of borrowings under the revolver portion of our senior credit facility and total long-term debt, net (including long-term debt due within one year) of $1.3 billion . As of October 31, 2017 , we had available borrowing capacity under the revolver component of our senior credit facility of $234 million. In addition, we had $127.1 million available under the revolver component of our Whistler Blackcomb credit facility. Our Net Debt was 2 times trailing twelve months Total Reported EBITDA, which includes $330.2 million of long-term capital lease obligations associated with the Canyons transaction. I am also very pleased to announce that our Board of Directors has declared a quarterly cash dividend on Vail Resorts’ common stock. The quarterly dividend will be $1.053 per share of common stock and will be payable on January 10, 2018 to shareholders of record on December 27, 2017.”

Moving on to early ski season indicators, Katz said, “Sales of our season passes continue to deliver outstanding results. As we approach the end of our selling period, season pass sales for the North American ski season are up approximately 14 percent in units and approximately 20 percent in sales dollars through December 3, 2017 compared to the prior year period ended December 4, 2016. Whistler Blackcomb pass sales are adjusted to eliminate the impact of foreign currency by applying the current period exchange rates to the prior period. This year, we have continued to drive significant growth in our destination markets which represent approximately 60 percent of our increase in pass units. We continue to see strength across all geographies, with particularly strong performance in Northern California , the Pacific Northwest and the Northeast and continued solid growth in Colorado and British Columbia . We also saw strong growth across our international markets, with particular strength in Australia , the United Kingdom , Brazil and Asia. It’s clear that the addition of Whistler Blackcomb and Stowe have further strengthened our network and the appeal of our season pass to destination guests in North America and around the world, while our more sophisticated and more targeted marketing efforts have been critical to driving the success of this program. We expect our total season pass holders this year will exceed 740,000 (including Whistler Blackcomb products and Epic Australia passes), representing an incredible group of highly loyal and passionate guests and the most successful pass program in the worldwide ski industry.”

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the company’s Form 10-Q for the first fiscal quarter ended October 31, 2017 , which was filed today with the Securities and Exchange Commission. The following are segment highlights:

Mountain Segment

- Mountain segment net revenue increased $37.4 million, or 33.7 percent, to $148.1 million for the three months ended October 31, 2017 as compared to the same period in the prior year, which was primarily attributable to incremental revenue from Whistler Blackcomb and strong growth at Perisher.

- Mountain Reported EBITDA loss was $58.4 million for the three months ended October 31, 2017, which represents an incremental loss of $1.8 million, or 3.1 percent, as compared to the Mountain Reported EBITDA loss for same period in prior year.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) increased $4.5 million , or 6.9 percent, to $68.8 million for the three months ended October 31, 2017 as compared to the same period in the prior year.

- Lodging Reported EBITDA was $4.4 million for the three months ended October 31, 2017, which represents an increase of $1 million , or 31.1 percent, as compared to the same period in the prior year.

Resort – Combination of Mountain and Lodging Segments

- Resort net revenue increased $42 million, or 23.6 percent, to $220.2 million for the three months ended October 31, 2017 as compared to the same period in the prior year, which was primarily attributable to incremental revenue from Whistler Blackcomb and strong growth at Perisher.

- Resort Reported EBITDA loss was $54.1 million for the three months ended October 31, 2017 , which includes $0.7 million of acquisition and integration related expenses attributable to the acquisitions of Whistler Blackcomb and Stowe and approximately $1.9 million of payroll taxes related to the CEO’s exercise of expiring SARs. This compares to a Resort Reported EBITDA loss of $53.3 million in the same period in the prior year, which included $2.8 million of acquisition and integration related expenses attributable to the acquisition of Whistler Blackcomb.

Total Performance

- Total net revenue increased $42.6 million , or 23.9 percent, to $220.9 million for the three months ended October 31, 2017 as compared to the same period in the prior year, which was primarily attributable to incremental revenue from Whistler Blackcomb and strong growth at Perisher.

- Net loss attributable to Vail Resorts, Inc. was $28.4 million , or a loss of 71 cents per diluted share, for the first quarter of fiscal 2018 compared to a net loss attributable to Vail Resorts, Inc. of $62.6 million , or a loss of $1.70 per diluted share, in the first quarter of the prior year. Net loss for the first quarter of fiscal 2018 included a tax benefit of approximately $51.8 million (or $1.29 earnings per diluted share) related to employee exercises of equity awards (primarily related to the CEO’s exercise of expiring SARs) which, beginning August 1, 2017 , is recorded in net income (loss) as a result of the adoption of revised accounting guidance related to employee stock compensation.

Return of Capital

The company declared a quarterly cash dividend of $1.053 per share of Vail Resorts common stock that will be payable on January 10, 2018 to shareholders of record on December 27 , 2017. Additionally, a Canadian dollar equivalent dividend on the exchangeable shares of Whistler Blackcomb Holdings Inc. will be payable on January 10, 2018 to shareholders of record on December 27, 2017 . The exchangeable shares were issued to certain Canadian persons in connection with our acquisition of Whistler Blackcomb Holdings Inc.

Capital Improvements

Commenting on the company’s new improvements for the 2017/18 winter season, Katz said, “We are thrilled to welcome guests to all of our resorts as the 2017/2018 ski season kicks off. Our integration efforts at Whistler Blackcomb are largely complete, and we are excited to now offer an enhanced experience for local, regional and destination guests at North America’s largest resort. This year marks the first time in our history that we had lift upgrades at all four Colorado resorts, with significant increases to capacity. At Vail Mountain, we have improved lift capacity at one of the resort’s busiest chairlifts by upgrading the Northwoods high-speed four-person chair (#11) to a new high-speed six-person chairlift. At Breckenridge, we upgraded the Peak 10 Falcon Chair from a four-person high-speed chair to a six-person high-speed chair, allowing more guests to experience some of the best intermediate and advanced terrain on the mountain. At Keystone, we invested significant capital to enhance the experience at this outstanding family focused resort. We upgraded the four-person Montezuma chair to a six-person high-speed chair to improve circulation on the front side of the mountain, and have renovated and significantly expanded mountain dining capacity at Labonte’s restaurant by adding 150 indoor seats at the fourth most visited resort in the U.S. At Beaver Creek, we upgraded the fixed grip two-person Drink of Water chair (#5) to a four-person high-speed chair, increasing the capacity for important beginner and intermediate terrain. Including these most recent projects we have invested over $115 million in discretionary projects at our Colorado resorts over the past five years, including 12 new or upgraded lifts, the addition or renovation of four food and beverage locations, significant terrain expansions and extensive additional investments including enhanced and efficient snowmaking.”

Regarding calendar year 2018 capital expenditures, Katz said, “We remain committed to reinvesting in our resorts, creating an experience of a lifetime for our guests and generating strong returns for our shareholders. While we will announce our complete capital plan for calendar year 2018 in March 2018 , we are pleased to announce several signature investments that we intend to construct in 2018 for the 2018/2019 ski season.”

Katz continued, “We are very excited to announce a transformational investment at Whistler Blackcomb to further enhance the most visited mountain resort in North America and refocus the spirit of the previously announced Renaissance project back to the guest experience on the mountain. We plan to make a discretionary investment of approximately $42 million ( C$53 million ) at Whistler Blackcomb, as part of an approximate $52 million ( C$66 million ) total capital plan at the resort, the largest annual capital investment in the resort’s history. We believe this plan will dramatically improve the on-mountain experience for our guests with enhanced lift capacity, improved circulation and a significantly elevated experience for skiers, riders and sightseeing guests. The centerpiece of this investment will be a new gondola running from the base to the top of Blackcomb Mountain, replacing the Wizard and Solar four person chairs with a single state-of-the-art gondola, providing an experience protected from the elements, an expected 47 percent increase in uphill capacity and a mid-station to allow guests to access and circulate around Blackcomb Mountain. We also plan to upgrade the four-person Emerald express chairlift to a high speed six-person chairlift, providing increased capacity and reduced lift line wait times for important beginner and intermediate terrain on Whistler Mountain. Finally, we expect to upgrade the three-person fixed grip Catskinner chairlift to a four-person high speed lift with an improved lift alignment to provide increased capacity, better access and improved circulation to critical teaching terrain and terrain parks at the top of Blackcomb Mountain. Together, these investments are expected to result in an approximate 43 percent increase in lift capacity relative to the existing lifts that will be replaced. We believe these transformational, mountain-focused investments are the most significant improvements we can undertake to support Whistler Blackcomb’s long-term growth and our commitment to pursue the most impactful projects to enhance the guest experience. We expect these discretionary investments will drive additional Resort Reported EBITDA of C$9 million to C$10 million for the 2018/2019 ski season, incremental to the resort’s typical expected organic growth. Following this one-time signature investment, we will continue to include Whistler Blackcomb in our normal annual capital improvement plan. While we remain intrigued by the water park that was previously proposed as part of the Renaissance project, we intend to keep our focus on core mountain improvements and will defer consideration of a water park to our longer-term planning for the resort.

“At Park City, we will continue our transformational investments with a focus on enhancing the family, food and service experience for our guests from around the world. In the Canyons area of Park City , we plan to upgrade the fixed grip High Meadow chair to a four person high speed lift, improve grading and expand snowmaking to create a world-class beginner and family learning zone. We also plan to make two significant investments in the dining experience at Park City. We will expand Cloud Dine, a unique modern mountain dining experience overlooking the resort, with 200 additional seats and will be renovating and upgrading the Park City Mid-Mountain Lodge to create a signature dining experience that will bring fine-dine quality cuisine to what we expect will be one of the premier fast-casual, on-mountain restaurants in the industry. Each of these projects reinforces our commitment to Park City’s position as the best resort for families and culinary experiences and continues to build on the significant improvements we’ve made at Park City over the last four years, including the Quicksilver Gondola, the new Miner’s Camp restaurant, the expanded and upgraded Red Pine Lodge and the renovated Summit House restaurant.

“At Heavenly, we plan to replace the Galaxy two-person chairlift with a three-person chairlift to increase capacity and allow us to re-open 400 acres of high quality intermediate terrain. At Perisher, we plan to upgrade the Leichhardt T-bar to a four-person chairlift and a significant upgrade to snowmaking, enabling better beginner access and a reduction of crowding and wait times, as well as the addition of new terrain. All of our resort projects are subject to regulatory approval.

“We also plan to continue to invest in enhanced enterprise wide technology improvements that support our increased scale, improve the guest experience and continue to build our data-based marketing efforts.

“We expect our capital plan for calendar 2018 will total approximately $150 million excluding the integration of Stowe and summer investments. With the signature one-time discretionary investment at Whistler Blackcomb of approximately US$42 million , we have reduced our spending elsewhere in the network to accommodate the projects and expect to return to our long-term capital guidance in calendar 2019, which, without any new acquisitions or summer investments, would be approximately $131 million . We will be providing further detail on our calendar year 2018 capital plan, including expected Stowe integration and summer investments, in March 2018 .”

Outlook

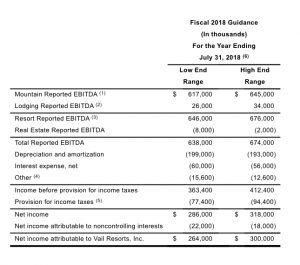

Commenting on fiscal 2018 guidance, Katz continued, “Given our first quarter results and the indicators we are seeing for the upcoming season, we remain confident in our outlook for fiscal 2018, which remains predicated on a stable economic environment and normal weather conditions for the key parts of the ski season at our resorts. The ski season has just begun at our North American resorts, with our primary earnings period still in front of us. While we are reiterating our fiscal 2018 core operating performance expectations included in our September earnings release, we are updating our fiscal 2018 guidance to reflect a few non-core adjustments, including: approximately $1.9 million of lower Resort Reported EBITDA in the first fiscal quarter results associated with payroll tax expense related to the CEO’s exercise of expiring SARs; approximately $40 million of incremental tax benefit recognized during the first fiscal quarter 2018 primarily related to the CEO’s exercise of expiring SARs, $4 million in lower Resort Reported EBITDA and $1 million of reduced depreciation and amortization expense to reflect a decline in the Canadian Dollar from 81 cents to 79 cents and a decline in the Australian Dollar from 80 cents to 76 cents, assuming that foreign exchange rates remain at current levels for the remainder of fiscal 2018 and (iv) the first fiscal quarter loss of $7.3 million on intercompany notes related to foreign exchange movements. We now expect fiscal 2018 Resort Reported EBITDA to be between $646 million and $676 million and net income attributable to Vail Resorts to be between $264 million and $300 million. Our guidance does not include any benefit to our U.S. taxes from potential legislative changes being discussed to the U.S. tax code.”

The following table reflects the forecasted guidance range for the company’s fiscal year ending July 31, 2018 , for Reported EBITDA (after stock-based compensation expense) and reconciles such Reported EBITDA guidance to net income attributable to Vail Resorts, Inc. guidance for fiscal 2018.

Photo courtesy Vail Resorts