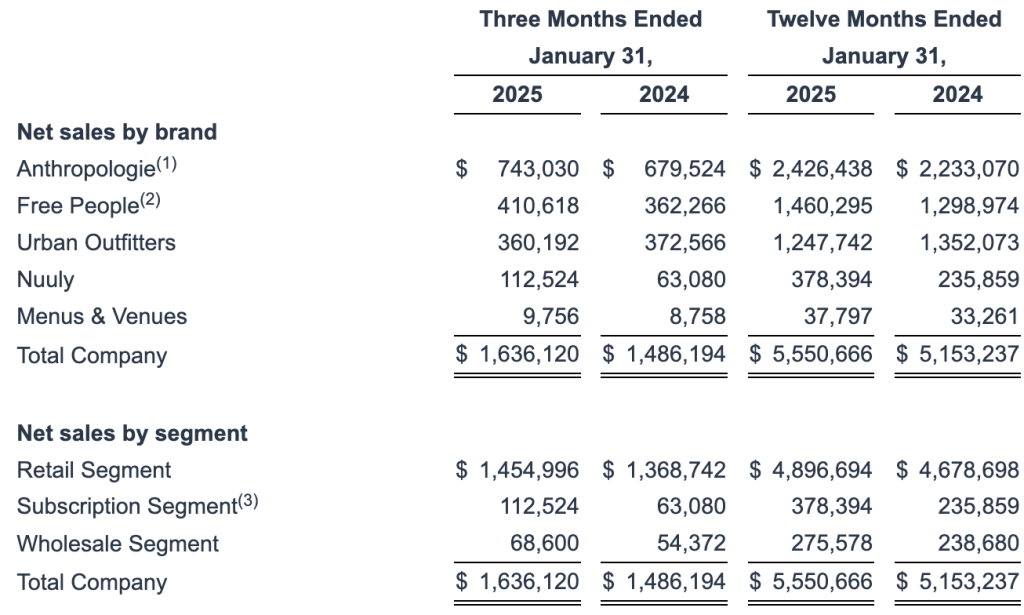

Urban Outfitters, Inc., parent of the Anthropologie, Free People, FP Movement, Urban Outfitters, and Nuuly brands, reported that total company net sales for the fiscal 2025 fourth quarter ended January 31 increased 10.1 percent to a record $1.64 billion. Total company net sales for the period increased 9.4 percent compared to total company adjusted net sales for the prior-year Q4 period.

Total Retail segment net sales increased 6.3 percent, with comparable Retail segment net sales increasing 5.1 percent. The increase in Retail segment comparable net sales was reportedly driven by high-single-digit positive growth in Digital channel sales and low-single-digit positive growth in Retail Store sales. Comparable Retail segment net sales increased 8.3 percent at Anthropologie, 8.0 percent at Free People and decreased 3.5 percent at Urban Outfitters.

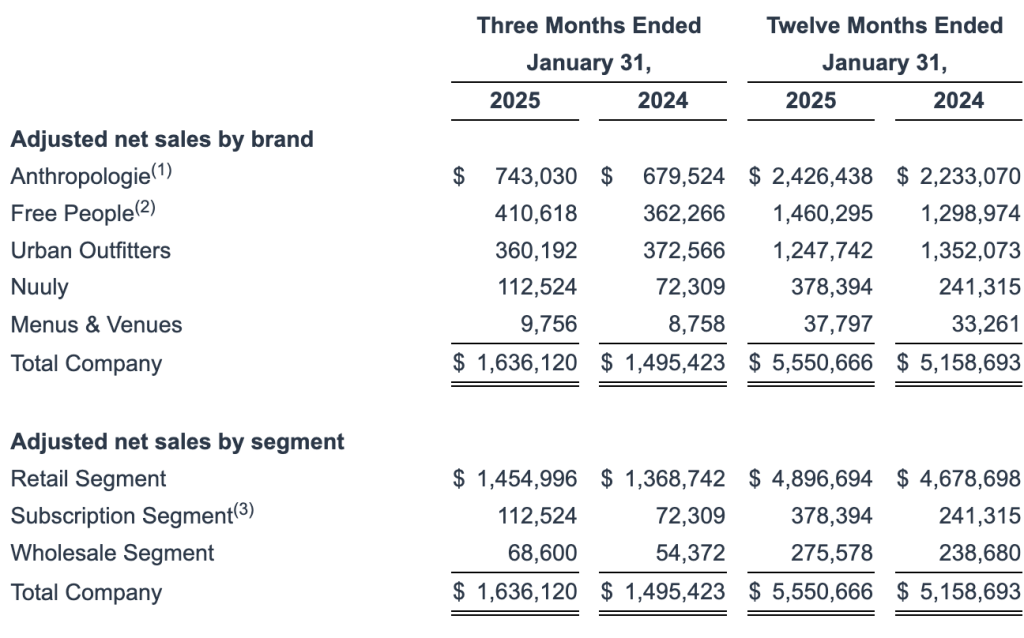

Subscription segment net sales increased 78.4 percent year-over-year. Subscription segment net sales increased by 55.6 percent compared to Subscription segment adjusted net sales for the prior-year Q4 period. The Subscription segment adjusted net sales increase was said to be primarily driven by a 53.5 percent increase in average active subscribers in the current quarter versus the prior-year quarter.

Wholesale segment net sales increased 26.2 percent, driven by a 27.0 percent increase in Free People wholesale sales due to an increase in sales to specialty customers and department stores.

Net Sales by Brand and Segment

- Anthropologie includes the Anthropologie and Terrain brands.

- Free People includes the Free People and FP Movement brands.

- The Subscription segment, formerly the Nuuly segment, includes the Nuuly brand, which is primarily a monthly women’s apparel subscription rental service.

Adjusted Net Sales by Brand and Segment

Income Statement Summary

Gross profit margin increased by 304 basis points compared to the prior-year Q4 period, and gross profit dollars increased 21.5 percent to $527.7 million from $434.2 million. For the fiscal 2025 fourth quarter, the gross profit rate as a percentage of net sales increased by 203 basis points compared to the adjusted gross profit rate as a percentage of adjusted net sales in the prior-year Q4 period.

Adjusted gross profit dollars increased by 16.8 percent to $527.7 million in Q4 from $451.9 million in fiscal Q4 2024. The increase in adjusted gross profit rate was said to be primarily due to improved Retail segment markdowns driven by lower markdowns at Urban Outfitters, partially offset by an increase at Free People. The increase in adjusted gross profit dollars was due to higher adjusted net sales and the improved adjusted gross profit rate.

Selling, general and administrative (SG&A) expenses increased by $31.9 million, or 8.6 percent, in the fiscal 2025 fourth quarter, compared to the prior-year Q4 period. SG&A expenses reportedly leveraged 33 basis points as a percentage of net sales and expressed as a percentage of adjusted net sales leveraged 18 basis points compared to the prior-year Q4 period. The leverage in SG&A expenses, as a rate to adjusted net sales, was primarily related to a leverage in store payroll expenses due to the Retail segment stores net sales growth. The dollar growth in SG&A expenses was primarily related to increased marketing expenses to support customer growth and increased sales in the Retail and Subscription segments, as well as increased store payroll expenses to support the Retail segment stores net sales growth.

The company’s effective tax rate for the fiscal 2025 fourth quarter was 8.1 percent, compared to 25.4 percent in the prior-year Q4 period. The company’s effective tax rate for the year ended January 31, 2025, was 19.5 percent, compared to 24.6 percent in the year ended January 31, 2024. The decrease in the effective tax rate for the three months and year ended January 31, 2025, was primarily due to the tax benefit from the release of a portion of income tax reserves as a result of a lapse of the statute of limitations for federal tax purposes. The adjusted effective tax rate for the fiscal 2025 fourth quarter was 25.0 percent, compared to 25.3 percent for the prior-year Q4 period. The company’s adjusted effective tax rate for the year ended January 31, 2025, was 23.9 percent, compared to 24.6 percent in the year ended January 31, 2024.

Net income for the fiscal 2025 fourth quarter was $120.3 million, and earnings per diluted share were $1.28. Adjusted net income for Q4 was $98.1 million and adjusted earnings per diluted share were $1.04 a share.

Inventory

As of January 31, 2025, total inventory increased by $70.9 million, or 12.9 percent, compared to total inventory as of January 31, 2024. Total Retail segment inventory increased 10.1 percent. Retail segment comparable inventory increased 11.3 percent. Wholesale segment inventory increased 43.7 percent. The increase in inventory for both segments was to support increased sales and planned early receipts.

Share Repurchase Program

On June 4, 2019, the company’s Board of Directors authorized the repurchase of 20 million common shares under a share repurchase program. During the twelve months ended January 31, 2025, the company repurchased and subsequently retired 1.2 million shares for approximately $52 million. As of January 31, 2025, 18.0 million common shares remained under the program.

Stores Information

During the twelve months ended January 31, 2025, the company opened 57 new retail locations, including 37 Free People stores (including 25 FP Movement stores), 13 Anthropologie stores and 7 Urban Outfitters stores. It closed 30 retail locations, including 14 Urban Outfitters stores, 11 Anthropologie stores and 5 Free People stores.

Image courtesy Urban Outfitters, Inc.