Unifi, Inc. reported that its fiscal fourth-quarter net sales increased 6 percent to $157.5 million for the period ended June 30, from $151.1 million in the prior-year Q4 period. The growth is said to be primarily due to higher sales volumes for each segment, partially offset by lower average selling prices associated with sales mix changes and lower raw material costs, particularly in the Americas Segment. Competitive market share gains helped secure additional sales volumes in both the Americas Segment and the Brazil Segment.

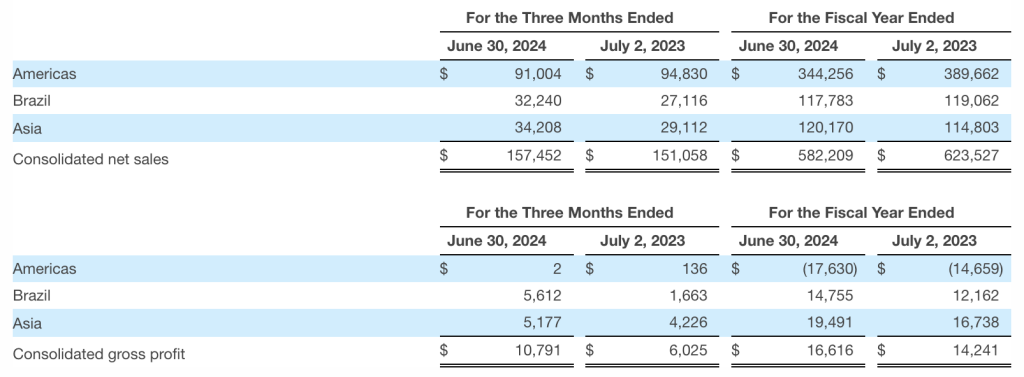

Net Sales and Gross Profit by Segment

The recycled and synthetic yarn manufacturer said that gross profit increased to $10.8 million in fiscal Q4 from $6.0 million in the 2023 Q4 period. Brazil Segment gross profit improved by $3.9 million, primarily due to pricing and market share gains, while Asia Segment gross profit improved by $1.0 million, primarily due to higher sales volumes.

Operating loss for the fourth quarter was $0.8 million, compared to $13.7 million in the year-ago quarter. Unifi said the underlying improvement was primarily due to the increase in gross profit, while the prior year’s operating loss included an impairment charge of $8.2 million for abandonment of specialized machinery constructed in the Americas.

The net loss for the quarter was $4.0 million in 2024, compared to $15.3 million in Q4 2023. Adjusted loss per share was 22 cents per share in Q4 2024, compared to 39 cents per share in Q4 2023.

Adjusted EBITDA was $5.9 million in the fourth quarter, compared to $1.7 million in the year-ago quarter.

Subsequent to the quarter-end, the company reported that it had launched two new Repreve Fiber products that would help support future growth.

“We are pleased to close our fiscal 2024 with growing momentum and believe the proactive, strategic initiatives we took throughout the year have positioned Unifi to pivot to growth and stronger profitability as we move forward,” commented Eddie Ingle, CEO of Unifi, Inc. “Our financial performance over the last few quarters has shown consistent top-line growth, and we reported our third consecutive quarter of gross profit improvement. To maintain this progress, we have been reinvesting our cost savings and increased profits into areas of our business that we believe will drive additional revenue and margin-enhancing opportunities over the long term. Some of these reinvestment efforts have already begun to take shape, evident by our recent innovation announcements, including our new ThermaLoop Insulation solution and the broadening of our Textile Takeback program across filament and staple fiber. We are excited about the global opportunities that lie ahead of us, and we believe that we remain on the right path toward increasing shareholder value.”

Fiscal 2025 Outlook

First Quarter Fiscal 2025

Unifi expects the following first-quarter fiscal 2025 results.

- Net sales between $147.0 million and $153.0 million;

- Adjusted EBITDA between $1.0 million and $3.0 million;

- Capital expenditures between $3.0 million and $4.0 million; and

- Continued volatility in the effective tax rate.

Full Year Fiscal 2025

Unifi expects the following for fiscal 2025.

- Net sales are expected to increase more than 10 percent over fiscal 2024 as the underlying portfolio and Repreve Fiber momentum continues. Macroeconomic and inflationary uncertainties remain pronounced in the second half of calendar 2024.

- Gross profit, gross margin, and Adjusted EBITDA expected to increase significantly from fiscal 2024 to fiscal 2025, benefiting from higher sales volumes, initiatives from the previously announced Profitability Improvement Plan, and portfolio strength.

- Capital expenditures to range from $10.0 million to $12.0 million.

Ingle concluded, “As we look towards fiscal 2025 and beyond, our proactive innovation and cost initiatives we’ve taken over the last several quarters have positioned us to pivot to growth in both our Repreve Fiber business and our beyond apparel initiatives. We continue to remain focused on diligently managing our balance sheet and operations to ensure that we are well-positioned to not only support our customers’ needs with innovative products, but also deliver value for our stakeholders through improved financial performance.”

Image and data tables courtesy Unifi, Inc.