Not much has changed in the two weeks since Wall  Street punished Under Armour, Inc. for its guidance that 2008 first half profits would sink due to increased marketing spending to support the launch of its performance trainers, but perhaps the market is warming up to the idea that the Super Bowl ad the brand ran last night may really be the start of something bigger, instead of just a one-time event that others use to help launch a brand or concept. Rather, the market may notice that this is, after all, a marketing company, second only to their rivals in

Street punished Under Armour, Inc. for its guidance that 2008 first half profits would sink due to increased marketing spending to support the launch of its performance trainers, but perhaps the market is warming up to the idea that the Super Bowl ad the brand ran last night may really be the start of something bigger, instead of just a one-time event that others use to help launch a brand or concept. Rather, the market may notice that this is, after all, a marketing company, second only to their rivals in

The big question will undoubtedly revolve around whether Under Armour can re-create a training category that has degenerated into white leather footcovering for backyard barbeques from its heyday as the shoes that Bo knew when Nike was fueling growth in the cross training category. The message is certainly resonating, at least with competitors, if not the consumer. Nike will launch its performance trainer a month ahead of the Under Armour launch and New Balance has also redoubled its efforts in the performance training arena.

UA shares were up 22.7% for the week to close at $42.78, which represents a 52.7% increase in share price in the last two weeks, putting the shares just over flat for the year. Both Susquehanna International Group and Goldman Sachs initiated coverage on the company over the last two weeks, possibly countering the negative comments coming out of Wachovia Securities two weeks ago.

Kevin Plank, company chairman and CEO, clearly understands that footwear is essential to putting Under Armour into the growth mode that made the brand an industry darling at first and then a Wall Street darling when it launched its IPO. Big advances in apparel will be tough as the company explores new categories, but the days of high double-digit and triple-digit growth may be well behind them on the apparel.

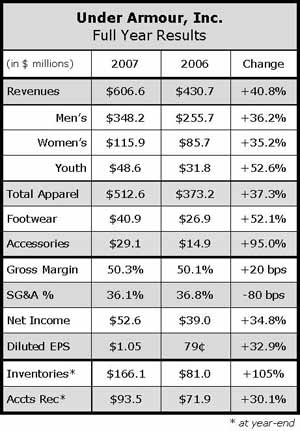

Apparel revenues grew 37.3% for the full year and “just” 29.5% in the fourth quarter, compared to 42.5% apparel revenue growth for the 2006 full year and 43.2% growth in the 2006 fourth quarter. The company said 2007 fourth quarter apparel revenues benefited from continuing gains in the compression and training categories, while new offerings in the mountain product category also drove healthy contributions to the revenue line.

Net sales from the companys direct-to-consumer business, which includes website sales, catalog sales and retail outlet stores, grew 80% for the quarter on top of 118% growth in Q4 last year, growth that had a positive impact on gross margins. The reduction in lower-margin cleated footwear sales may have helped gross margins as well. Gross margins were up 140 basis points to 52.0% of sales for the quarter, compared to 50.6% in the prior year period.

SG&A expenses were down 160 basis points to 35.8% of sales in Q4 from 37.4% of sales last year, thanks in large part to a decline in marketing expenditures during the period. Fourth quarter marketing expense was 11.2% of net revenues versus 12.6% of net revenues last year. The companys marketing expenditures for the year were still in the target range of 10% to 12%, coming in at 11.7% of sales, about 50 basis points higher than the prior year.

Increased investments in growth initiatives, including international, footwear and direct-to-consumer accounted for more than 40% of UAs quarter-over-quarter dollar increase in SG&A.

Fourth quarter net income increased 69.4% to $16.9 million, or 34 cents per diluted share, compared to net income of $11.9 million, or 24 cents per diluted share, in the 2006 fourth quarter. Net income for Q4 2006 got a $1.0 million, or two cents per diluted share, boost from state tax credits. The full year saw a $3.3 million, or 7 cents per share, tax credit in the prior year.

While the company is clearly focused on the footwear initiative, the apparel business is expected to continue to rack up sales gains in 2008. Men's full-year growth is planned in the range of the long-term annual growth target of 20% to 25%, while all the other apparel businesses are projected to grow at a faster pace.

Year-end inventories were up 105% versus the end of 2006. Core inventory, or that product available for “the next 12 months and beyond,” represents approximately 60% of the total inventory on-hand, or double the level of safety stock in core auto replenishment items. Management sees more opportunities in higher fulfillment rates in core products, which have historically run in the low-80% range, to reach the mid-90% range for 2008.

Management also explained that they took receipt of an entire season of ColdGear product by the end of October 2007 to take advantage of “significantly favorable duty rates” out of

Seasonal inventory represents approximately 30% of the total inventory and prior inventory, which is that product destined for the outlet stores, represents 10% of total inventory.

For owned-retail, Under Armour is planning to open three to four new test stores in new geographic markets over the next year.

UA is forecasting that 2008 net revenues will increase between 26% and 28% to a range between $765 million and $775 million. They see first half sales in line with full-year growth targets, but they see 2008 earnings to be more heavily weighted towards the back half.

Gross margins are expected to improve 40 to 50 basis points as a result of growth in the higher margin direct-to-consumer sales, outpacing growth in the overall business, offset in part by anticipated growth in footwear, which will be most evident in the second quarter.

On the SG&A side, UA plans to spend 12% to 13% of full year net revenues on marketing initiatives and launches, “specifically the performance training shoe in Q2.” The shift will see Under Armour spend about half their marketing budget for the year in the first half versus 40% as in years past.

Consequently, UA expects to see 2008 earnings more weighted toward the back half. First half EPS is estimated to be in the range of 3 cents to 5 cents per share, compared to 31 cents in the 2007 first half.