Topgolf Callaway Brands ended 2023 on a positive note, beating fourth-quarter internal expectations for both revenue and EBITDA. On a conference call with analysts, company President and CEO Chip Brewer said the performance for the quarter was driven by continued strength in both the Golf Equipment business, the TravisMathew business in the Active Lifestyle segment, as well as better-than-expected performance at Topgolf, where same-venue sales outperformed on strong holiday results, and where he said they continue to drive improvements in venue level profitability.

The company reported consolidated net revenues for the fourth quarter grew 5.4 percent, or +4.8 percent on a constant-currency (CC) basis, to $897.1 million as a result of revenue growth across each of its operating segments.

The company said it typically reports an operating loss in the fourth quarter due to the seasonality of its businesses, but that loss was better (smaller) in the fourth quarter of this year compared to the prior year due in large part to Topgolf and the Active Lifestyle business during the holiday period.

On a GAAP basis, loss from operations improved 6.1 percent. On a non-GAAP basis, loss from operations improved 73.5 percent. The improvements were generally driven by the increased revenue as well as increased segment operating income at Topgolf and the Active Lifestyle businesses.

The net loss for the fourth quarter was up 10.6 percent year-over-year to a $56.2 million, or a loss of 30 cents per diluted share, compared to a loss of $50.8 million, or a loss of 27 cents per diluted share, in Q4 2022.

Topgolf

Topgolf segment fourth-quarter revenue grew 7.2 percent (+7.0 percent CC) to $439.0 million, said to be driven primarily by new venues, partially offset by a better-than-expected 3 percent decline in same-venue sales.

“The beat in Q4 same-venue sales was driven by better-than-expected traffic in our one- and two-bay consumer business, which benefited from a strong holiday season and year-over-year favorable weather in December,” offered CFO Brian Lynch.

Topgolf’s operating income increased to $23.1 million, or 5.3 percent of segment revenue, in the fourth quarter, compared to $2.5 million, or 0.6 percent of segment revenue, in the prior-year quarter, and adjusted EBITDA increased $30 million to $73 million. These improvements were said to be driven primarily by the increased revenue as well as continued operational efficiency gains in the venues. Lynch said the operational gains included improved labor management, the impact of the PIE initiative being rolled out in all venues, and lower food and beverage costs due to Topgolf’s increased scale.

Golf Equipment

Golf Equipment revenue increased 4.9 percent (+4.6 percent CC) to $199.4 million, said to be primarily due to the expected shift in golf club launches, partially offset by a decline in golf ball sales, as the company prepared for the 2024 launch for its new Chrome Tour Ball, which launched on February 2.

- Golf Club sales increased 16.5 percent (+16.2 percent CC) to $160.2 million in the fourth quarter.

- Golf Ball sales fell 25.3 percent (-25.7 percent CC) to $39.2 million for the Q4 period.

Golf Equipment operating income (loss) decreased $20.6 million YoY to a loss of $19.9 million in the quarter, reportedly due to the expected lower production volumes in the second half of 2023 as compared to the prior-year quarter, resulting in unfavorable cost absorption as well as a return to normal promotional levels as the company pointed out on the Q3 call.

Active Lifestyle

Active Lifestyle segment revenue grew 2.7 percent (+1.3 percent CC) to $258.7 million in Q4, primarily due to increased apparel sales which was led by TravisMathew.

- Apparel revenues for Q4, which consists of TravisMathew and Jack Wolfskin, increased 3.9 percent (+2.6 percent CC) to $181.9 million.

- Gear, Accessories & Other revenues were flat for the quarter at $76.8 million, or down 1.8 percent on a constant-currency basis.

Active Lifestyle segment operating income increased to $20.2 million in Q4, compared to breakeven in the prior-year corresponding quarter. This increase was reportedly driven by increased revenue and margin as a result of a higher mix of margin accretive direct-to-consumer sales as well as tailwinds from lower input costs year-over-year.

Regional Results

- The U.S. market posted a 7.1 percent increase in sales for Q4, with revenues totaling $646.3 million for the period.

- Europe was down 2.0 percent (-7.4 percent) to $117.3 million in the quarter.

- Asia revenues were flat in reported terms to $112.8 million, and up 1.1 percent in constant-currency terms.

- Rest of World regional revenues jumped 33.5 percent (+34.2 percent CC) to $20.7 million in the period.

The company’s net loss increased 6.1 percent on a GAAP basis and 10.6 percent on a non-GAAP basis. This increase was primarily attributable to a $15.3 million increase in interest expense related to additional term loan debt and increased venue financing interest, partially offset by the improvement in operating loss.

Adjusted EBITDA grew 90.7 percent, driven primarily by revenue growth in each of the three segments and significant improvement in operational efficiencies at Topgolf.

Full Year Results

Full-year revenues increased 7.2 percent (+7.9 percent CC) to $4.28 billion.

At Topgolf, Brewer said the company delivered 1 percent same-venue sales growth for the full year, on top of 7 percent growth in 2022, “as well as an impressive 100 basis points of venue level adjusted EBITDA margin expansion.” He said the company also added 12 new venues with 11 new builds and one purchased via the BigShots acquisition. Revenues were up 13.7 percent for the year to $1.76 billion.

The Golf Equipment segment delivered “excellent brand performance” for the full year, maintaining its leadership positions in golf club market shares and the overall technology and innovation ranking, but the year also saw a 1.4 percent decline (+0.1 percent CC) in sales to $1.39 billion.

The Active Lifestyle segment delivered “solid growth” in revenue and profitability, driven by continued momentum at TravisMathew. Sales were up 9.2 percent (+9.7 percent CC) to $1.14 billion for the year.

Operating income was down 419.1 million, or 7.4 percent, year-over-year to $237.7 million.

Net income was down 41.2 percent year-over-year to $93.0 million, or 49 cents per diluted share, in 2023, compared to $158.2 million, or 82 cents per diluted share, in 2022.

EBITDA was up 6.9 percent (+9.8 percent CC) to $596.6 million in 2023, compared to $558.1 million in full-year 2022.

Brewer also said 2023 marked an important financial inflection point for the company with the transition to positive free cash flow.

“Our results showed $160 million of free cash flow at the consolidated level and $49 million at the Topgolf level” Brewer noted on the call. “As you know, given the variable timing of REIT reimbursements, we believe the most appropriate cash flow metric is embedded cash flow, which is free cash flow excluding new venue and store growth CapEx. Using this metric, we delivered $221 million and $94 million at the total company and Topgolf levels. These numbers reflect positive trends in our fundamentals.”

Looking forward, the company expects cash flow will remain “meaningfully positive from here” and embedded cash flow will increase slightly this year.

“We anticipate our EBITDA, cash flow, and EPS growth will all ramp significantly in 2025 through 2028 due to the leveling off of corporate investments, the tipping point of economies of scale across our businesses, and lower overall corporate interest expense as our positive cash flow allows us to pay down debt over time,” he continued.

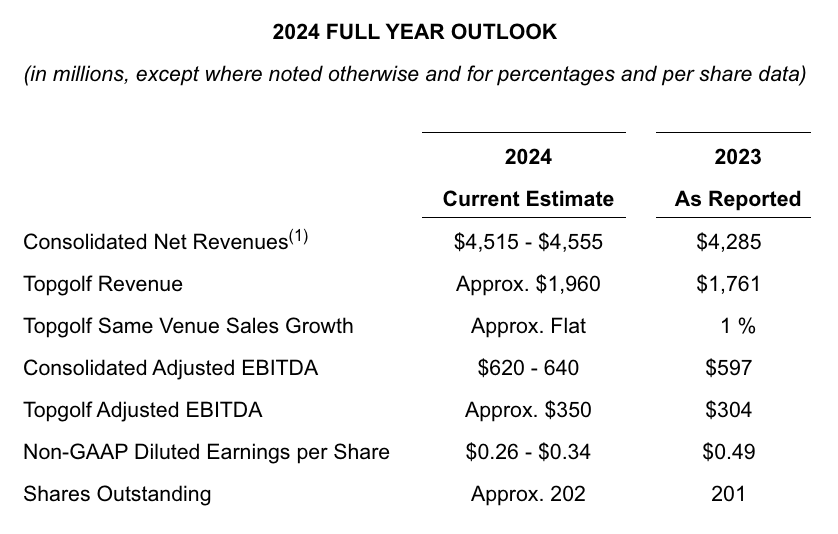

Outlook

The company said its 2024 outlook reflects a potentially softer consumer environment in 2024 and approximately $20 million in pre-tax income headwinds related to foreign currency. Despite these headwinds, Topgolf expects revenue growth, Adjusted EBITDA and Embedded Cash Flow given the strength of its three operating segments and the momentum it has entering 2024, including the strength of its new golf equipment product line. The 2024 projections below are based on the company’s best estimates at this time. (1) 2024 includes an estimated $10 million unfavorable year-over-year foreign currency impact on revenue and an estimated $6.5 million unfavorable foreign currency impact on profit translation. 2023 As Reported amounts include $13.4 million in positive hedge gains.

(1) 2024 includes an estimated $10 million unfavorable year-over-year foreign currency impact on revenue and an estimated $6.5 million unfavorable foreign currency impact on profit translation. 2023 As Reported amounts include $13.4 million in positive hedge gains.

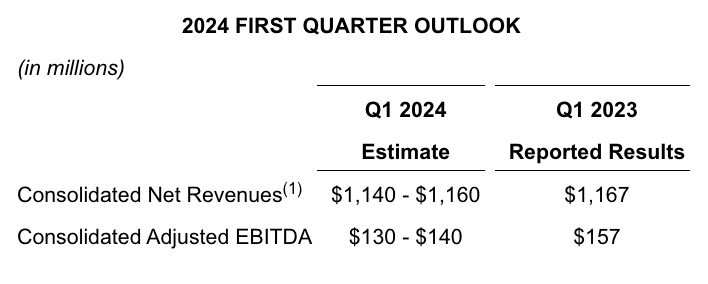

(1) 2024 estimates include approximately $6 million of unfavorable foreign currency impacts on revenue and approximately $3 million of unfavorable foreign currency impacts on profit translation. Q1 2023 As Reported amounts include minimal hedge gains.

(1) 2024 estimates include approximately $6 million of unfavorable foreign currency impacts on revenue and approximately $3 million of unfavorable foreign currency impacts on profit translation. Q1 2023 As Reported amounts include minimal hedge gains.

Image, data and charts courtesy Topgolf Callaway Brands, Inc.