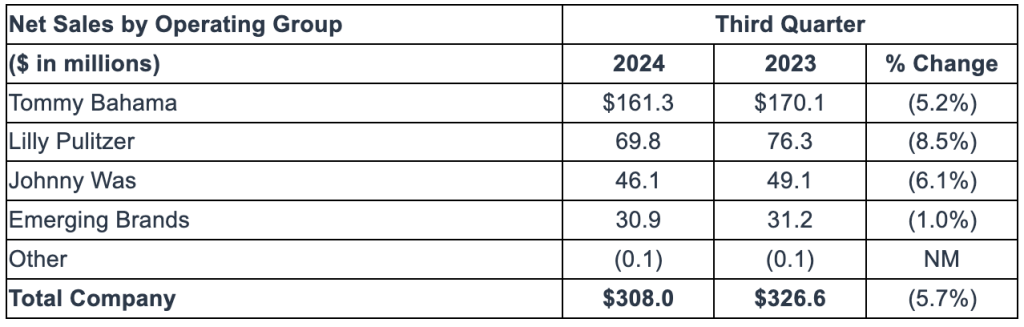

Oxford Industries, Inc. reported consolidated net sales in the third quarter of fiscal 2024 were $308 million compared to $327 million in the third quarter of fiscal 2023.

- Full-price direct-to-consumer (DTC) sales decreased 8 percent to $200 million versus the third quarter of fiscal 2023.

- Full-price retail sales of $99 million were 6 percent lower than prior-year Q3 period.

- E-commerce sales of $101 million were 11 percent lower than prior-year Q3 period.

- Outlet sales of $17 million were 3 percent higher than prior-year Q3 period.

- Food & Beverage sales were $24 million, a 4 percent increase versus prior-year Q3 period.

- Wholesale sales of $67 million were 2 percent lower than the third quarter of fiscal 2023.

“Following a difficult third quarter, we are pleased with the beginning of the holiday season now that some recent headwinds have started to abate,” commented Tom Chubb, chairman and CEO, Oxford Industries, Inc. “The cumulative effects of several years of high inflation combined with distractions from the U.S. elections and other world events, led to less frequent and more tentative consumer spending behavior during the third quarter which is traditionally our smallest volume quarter of the year. Additionally, our most significant and important market, the Southeastern United States, was impacted by two major hurricanes in quick succession that resulted in estimated lost sales of $4 million and an estimated impact of 14 cents per share. When combined with a highly competitive and promotional environment, these headwinds led to financial performance that was weaker than expected.”

Income Statement Summary

Gross margin was 63.1 percent of net sales on a GAAP basis in Q3, compared to 62.9 percent in the third quarter last year. The increase in gross margin was primarily due to a $4 million lower LIFO accounting charge and lower discounts at Lilly Pulitzer. This was partially offset due to full-price retail and e-commerce sales representing a lower proportion of net sales at Tommy Bahama, Lilly Pulitzer and Johnny Was with more sales occurring during promotional and clearance events. Adjusted gross margin, which excludes the effect of LIFO accounting, decreased to 63.0 percent compared to 64.0 percent on an adjusted basis in the prior-year period.

SG&A was $205 million compared to $195 million last year. On an Adjusted basis, SG&A was $201 million compared to $191 million in the prior-year period. The increase in SG&A was primarily driven by:

- Expenses related to 33 new store openings since the third quarter of fiscal 2023, including four Tommy Bahama Marlin Bars.

- Pre-opening expenses related to approximately five additional stores planned to open in the fourth quarter of fiscal 2024, including two additional Tommy Bahama Marlin Bars that are expected to open in the next few months.

- The addition of Jack Rogers.

Royalties and other operating income of $4 million were comparable to the third quarter of fiscal 2023.

Operating loss was $6 million, or negative 2.0 percent of net sales, compared to operating income of $14 million, or 4.4 percent of net sales, in the third quarter of fiscal 2023. On an adjusted basis, operating income decreased to an operating loss of $3 million, or negative 1.1 percent of net sales, compared to operating income of $21 million, or 6.6 percent of net sales, in the third quarter of fiscal 2023. The decreased operating income includes the impact of decreased net sales and increased SG&A as the company continues to invest in the business.

Interest expense decreased from $1 million in the prior year period. The decreased interest expense was primarily due to a lower average outstanding debt balance during the third quarter of fiscal 2024 than the third quarter of fiscal 2023.

Due to lower earnings during the third quarter as compared to the company’s other fiscal quarters, certain discrete or other items have a more pronounced impact on the effective tax rate. The company’s effective income tax rate of 42.5 percent for the third quarter of fiscal 2024 included the impact of discrete, favorable U.S. federal return-to-provision adjustments primarily related to an increase in the research and development tax credit and certain adjustments to the US taxation on foreign earnings. For the third quarter of fiscal 2023, the company’s effective income tax rate of 18.6 percent included the favorable utilization of the research and development tax credit and adjustments to the US taxation on foreign earnings which reduced the effective tax rate.

Loss per share on a GAAP basis was 25 cents in Q3, compared to net earnings per share of 68 cents in the third quarter of fiscal 2023. On an Adjusted basis, loss per share was 11 cents, compared to net earnings per share of $1.01 in the third quarter of fiscal 2023.

Balance Sheet and Liquidity

Inventory at quarter-end decreased $3 million, or 2 percent, on a LIFO basis, and increased $2 million, or 1 percent, on a FIFO basis compared to the end of the third quarter of fiscal 2023. Inventory balances were comparable in all operating groups.

During the first nine months of fiscal 2024, cash flow from operations was $104 million compared to $169 million in the first nine months of fiscal 2023. The cash flow from operations in the first nine months of fiscal 2024, along with borrowings of $29 million, provided sufficient cash to fund $92 million of capital expenditures and $33 million of dividends.

During the third quarter of fiscal 2024, long-term debt decreased to $58 million compared to $66 million of borrowings outstanding at the end of the third quarter of fiscal 2023 as cash flow from operations exceeded increased capital expenditures primarily associated with the project to build a new distribution center in Lyons, Georgia, payments of dividends and working capital requirements. The company had $7 million of cash and cash equivalents versus $8 million of cash and cash equivalents at the end of the third quarter of fiscal 2023.

Dividend

The Board of Directors declared a quarterly cash dividend of 67 cents per share. The dividend is payable on January 31, 2025 to shareholders of record as of the close of business on January 17, 2025. The company has paid dividends every quarter since it became publicly owned in 1960.

Outlook

Chubb concluded, “Encouragingly, consumers have responded favorably to our recent product introductions and marketing campaigns, driving a nice improvement in comp store trends once the holiday season got underway. However, due to the weaker than expected consumer environment before the election and the fourth quarter impact of the hurricanes, which we project will include an additional $3 million of lost revenue and 11 cents per share, we have lowered our fiscal 2024 sales and EPS guidance. We are confident that our business model will drive profitable growth and long-term shareholder value well into the future. We could not do this without our exceptional team of people, to whom we extend our sincere gratitude.”

The company now expects net sales in a range of $1.50 billion to $1.52 billion for fiscal 2024 ending on February 1, 2025, as compared to net sales of $1.57 billion in fiscal 2023. In fiscal 2024, GAAP EPS is expected to be between $5.78 and $5.98 compared to fiscal 2023 GAAP EPS of $3.82. Adjusted EPS is expected to be between $6.50 and $6.70, compared to fiscal 2023 adjusted EPS of $10.15.

For the fourth quarter of fiscal 2024, the company expects net sales to be between $375 million and $395 million compared to net sales of $404 million in the fourth quarter of fiscal 2023. GAAP EPS is expected to be between $1.02 and $1.22 in the fourth quarter compared to a GAAP loss per share of $3.85 in the fourth quarter of fiscal 2023 that included non-cash impairment charges totaling $114 million, or $5.31 per share. Adjusted EPS is expected to be between $1.18 and $1.38 compared to adjusted EPS of $1.90 in the fourth quarter of fiscal 2023.

The company anticipates interest expense of $3 million in fiscal 2024, with interest expense expected to be $1 million in the fourth quarter of fiscal 2024. The company’s effective tax rate is expected to be approximately 23 percent for the full year of fiscal 2024.

Capital expenditures in fiscal 2024, including the $92 million in the first nine months of fiscal 2024, are expected to be approximately $150 million compared to $74 million in fiscal 2023. The planned year-over-year increase in capital expenditures includes approximately $75 million now budgeted in fiscal 2024 for the distribution center project in Lyons, Georgia. Additionally, the company has reportedly been investing in new brick and mortar locations, relocations and remodels of existing locations resulting in a year-over-year net increase of full price stores of approximately 30 by the end of fiscal 2024, which includes approximately five planned to open in the fourth quarter of the year. Oxford will also continue with its investments in various technology systems initiatives, including e-commerce and omni-channel capabilities, data management and analytics, customer data and insights, cybersecurity, automation, including artificial intelligence, and infrastructure.

Image courtesy Tommy Bahama/Oxford Industries, Inc.