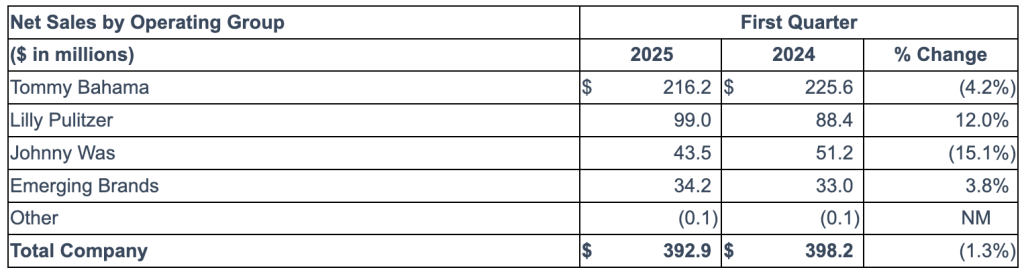

Oxford Industries, Inc., parent of the Tommy Bahama, Lilly Pulitzer and Johnny Was brands, reported consolidated net sales for the fiscal 2025 first quarter ended May 3 were $392.9 million, a 1.3 percent decline compared to $398.2 million in the fiscal 2024 first quarter.

- Full-price direct-to-consumer (DTC) sales decreased 3 percent to $249 million versus the fiscal 2024 first quarter.

- Full-price retail sales of $135 million were 1 percent lower than the prior-year period.

- E-commerce sales of $114 million were 5 percent lower than the prior-year period.

- Outlet sales of $18 million were comparable to the prior period.

- Food and beverage sales were $34 million, a 3 percent decrease versus the prior-year period.

- Wholesale sales increased 4 percent to $92 million versus the fiscal 2024 first quarter.

First Quarter of Fiscal 2025 versus Fiscal 2024

Profitability & Expense Summary

Gross margin was 64.2 percent of net sales in the first quarter on a GAAP basis, compared to 64.9 percent in the fiscal 2024 first quarter. On an Adjusted basis, gross margin was 64.3 percent of net sales in Q1 2025, compared to 65.4 percent in Q1 2024.

The decreased gross margin on a GAAP basis was said to be primarily due to:

- Increased freight expenses to e-commerce customers at Tommy Bahama,

- Increased markdowns during clearance events at Lilly Pulitzer and Johnny Was; and

- A change in sales mix with wholesale sales, including off-priced wholesale sales, representing a higher proportion of net sales.

The company also incurred $1 million of additional charges in cost of goods sold in the 2025 first quarter resulting from the U.S. tariffs on imported goods implemented in the first quarter. These decreases were said to be partially offset by a $2 million lower LIFO accounting charge in the fiscal 2025 first quarter compared to the fiscal 2024 first quarter.

SG&A was $223 million in the fiscal 2025 first quarter, compared to $213 million in fiscal Q1 last year, with approximately $6 million, or 59 percent, of the increase related to increases in employment costs, occupancy costs and depreciation expense due to the opening of 31 new brick & mortar retail locations since the fiscal 2024 first quarter.

This reportedly includes the eight net new stores including 2 Tommy Bahama Marlin Bars opened in the fiscal 2025 first quarter. We also incurred pre-opening expenses related to some of the approximately 7 additional stores planned to open during the remainder of fiscal 2025, including an additional Tommy Bahama Marlin Bar. On an adjusted basis, SG&A was $221 million in Q1 2025 compared to $210 million in the prior-year Q1 period.

Royalties and Other Operating Income decreased $1 million to $7 million in the fiscal 2025 first quarter primarily due to decreased royalty income in Tommy Bahama reflecting the lower sales of our licensing partners.

Operating Income was $36 million, or 9.2 percent of net sales, compared to $52 million, or 13.2 percent of net sales, in the fiscal 2024 first quarter. On an adjusted basis, operating income decreased to $39 million, or 9.8 percent of net sales, compared to $57 million, or 14.4 percent of net sales, in the fiscal 2024 first quarter.

Interest Expense increased to $2 million from $1 million in the prior year period. The increased interest expense was primarily due to a higher average outstanding debt balance during the fiscal 2025 first quarter than the fiscal 2024 first quarter.

The effective income tax rate in the fiscal 2025 first quarter was 24.1 percent which primarily reflects the benefit derived from a reduction in income tax expense as a result of the receipt of interest from a U.S. federal income tax receivable and the re-measurement of deferred tax balances due to changes in state tax rates partially offset by a net increase to uncertain tax positions during the quarter.

The effective tax rate in the fiscal 2024 first quarter was 25.6 percent which primarily reflects the unfavorable re-measurement of deferred tax assets and an increase to uncertain tax positions partially offset by a favorable return-to-provision adjustment for a foreign subsidiary.

EPS on a GAAP basis was $1.70 per share in Q1 2025 compared to $2.42 per share in the fiscal 2024 first quarter. On an Adjusted basis, EPS was $1.82 per share in Q1 compared to $2.66 per share in the fiscal 2024 first quarter.

Tom Chubb, Chairman and CEO, commented, “We were able to deliver sales and adjusted EPS within our guidance ranges for the first quarter despite uncertain tariff and trade dynamics that are significantly impacting our industry and operating landscape. Despite the increasing headwinds, we were led by a low double digit increase at Lilly Pulitzer as the brand’s current assortment is resonating strongly with its core consumer, and overall sales were only modestly lower than last year. At the same time, we were able to maintain strong gross margins above 64 percent.”

Balance Sheet and Liquidity

The company had $8 million of cash and cash equivalents at the end of both the fiscal 2025 first quarter and the fiscal 2024 first quarter.

During the fiscal 2025 first quarter, cash used in operations was $4 million compared to cash provided by operations of $33 million in the fiscal 2024 first quarter. The cash used in operations reflects the result of lower net earnings, working capital needs, including accelerating inventory purchases, and $12 million of capitalizable implementation costs associated with cloud computing arrangements.

Borrowings outstanding increased to $118 million at the end of the fiscal 2025 first quarter compared to $19 million and $31 million of borrowings outstanding at the end of the fiscal 2024 first quarter and the fourth quarter of fiscal 2024, respectively.

During the fiscal 2025 first quarter, share repurchases of $51 million, capital expenditures of $23 million primarily associated with the project to build a new distribution center in Lyons, Georgia, and the opening of eight new stores, including two Tommy Bahama Marlin Bars, $12 million of capitalizable implementation costs associated with cloud computing arrangements, dividend payments of $10 million, and working capital requirements exceeded cash flow from operations.

Inventory at quarter-end reportedly increased $18 million, or 12 percent, on a LIFO (Last In, First Out) basis and $20 million, or 9 percent, on a FIFO (First In, First Out) basis compared to the end of the fiscal 2024 first quarter.

Inventories increased in all operating segments with the exception of Johnny Was due primarily to impacts associated with the U.S. tariffs that were implemented in fiscal 2025 first quarter including accelerated purchases of inventory before the anticipated implementation of increased tariffs, and increased costs capitalized into inventory after the implementation of the tariffs.

At the end of the fiscal 2025 first quarter, inventory balances included an additional $3 million of costs associated with the increased tariffs implemented in the fiscal 2025 first quarter.

Dividend

The Oxford Industries Board of Directors declared a quarterly cash dividend of $0.69 per share. The dividend is payable on August 1, 2025 to shareholders of record as of the close of business on July 18, 2025. The company has paid dividends every quarter since it became publicly owned in 1960.

Outlook

For fiscal 2025 ending on January 31, 2026, the company has revised its sales and EPS guidance.

Full Year 2025 Guidance

Oxford Industries now expects net sales in a range of $1.475 billion to $1.515 billion as compared to net sales of $1.52 billion in fiscal 2024.

In fiscal 2025, GAAP EPS is expected to be between $2.28 and $2.68 per share, compared to fiscal 2024 GAAP EPS of $5.87 per share. Adjusted EPS is expected to be between $2.80 and $3.20 per share, compared to fiscal 2024 adjusted EPS of $6.68 per share.

The revised fiscal 2025 EPS and adjusted EPS guidance includes $40 million in additional tariff costs, or $2.00 per share on an after-tax basis.

Second Quarter Guidance

For the second quarter of fiscal 2025, the company expects net sales to be between $395 million and $415 million, compared to net sales of $420 million in the second quarter of fiscal 2024.

GAAP EPS is expected to be between 92 cents and $1.12 per share in the second quarter of fiscal 2025 compared to a GAAP EPS of $2.57 per share in the second quarter of fiscal 2024. Adjusted EPS is expected to be between $1.05 and $1.25 per share in Q2, compared to adjusted EPS of $2.77 per share in the second quarter of fiscal 2024.

The revised second quarter of fiscal 2025 EPS guidance includes $15 million in additional tariff costs, or 75 cents per share on an after-tax basis.

The company anticipates interest expense of $8 million in fiscal 2025, with interest expense expected to be between $1 million and $2 million per quarter for the remainder of fiscal 2025. The company’s effective tax rate is expected to be approximately 26 percent for the full year of fiscal 2025.

Capital expenditures in fiscal 2025, including the $23 million in the fiscal 2025 first quarter, are expected to be approximately $120 million compared to $134 million in fiscal 2024. The planned year-over-year decrease relates primarily to lower anticipated new store openings in fiscal 2025.

The company expects a year-over-year net increase of approximately 15 full price stores by the end of fiscal 2025, including three new Marlin Bars. The $120 million in expected capital expenditures in fiscal 2025 includes capital expenditures of approximately $70 million related to the completion of the project to build a new distribution center in Lyons, Georgia, including $10 million in the fiscal 2025 first quarter, and capital expenditures related to new stores and Tommy Bahama Marlin Bars.

Image courtesy Tommy Bahama Marlin Bar / Oxford Industries, Inc.