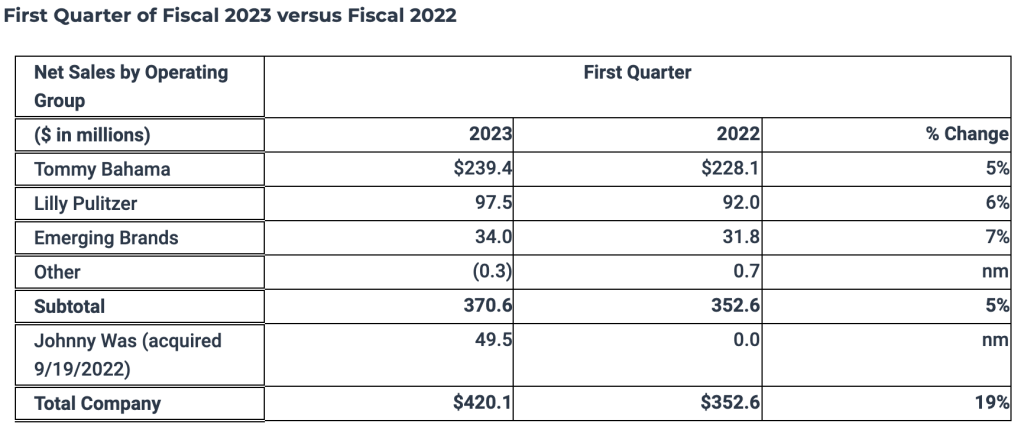

Oxford Industries, Inc. reported that consolidated net sales in the first quarter ended April 29 increased 19 percent to $420 million compared to $353 million in the first quarter of fiscal 2022. EPS on a GAAP basis increased to $3.64 a share compared to $3.45 in the first quarter of fiscal 2022. On an adjusted basis, EPS increased to $3.78 compared to $3.50 in the first quarter of fiscal 2022.

First quarter full-price direct-to-consumer (DTC) sales increased 27 percent to $266 million versus the first quarter of fiscal 2022, including $36 million of DTC sales in Johnny Was and a 10 percent aggregate increase in DTC sales in Tommy Bahama, Lilly Pulitzer and Emerging Brands.

Full-price retail sales of $140 million were 17 percent higher than the prior-year period. This includes full-price retail sales in Johnny Was of $17 million for the first quarter of fiscal 2023. Full-price retail sales in Tommy Bahama, Lilly Pulitzer and Emerging Brands, in the aggregate, grew 2 percent.

Full-price e-commerce sales grew 41 percent to $126 million versus last year. This includes full-price e-commerce sales in Johnny Was of $19 million. Full-price e-commerce sales in Tommy Bahama, Lilly Pulitzer and Emerging Brands, in the aggregate, grew 20 percent.

Outlet sales were $17 million, a 10 percent increase versus prior-year results. The first quarter of fiscal 2023 included $1 million of Johnny Was outlet sales, with Tommy Bahama increasing 5 percent.

There were no Lilly Pulitzer flash sales in the first quarter of fiscal 2023 compared to $7 million of Lilly Pulitzer flash sales in the first quarter of fiscal 2022.

Food and beverage sales grew 4 percent to $32 million versus last year.

Wholesale sales of $105 million were 18 percent higher than the first quarter of fiscal 2022. Johnny Was contributed wholesale sales of $13 million for the first quarter of fiscal 2023, with the other businesses in the aggregate increasing 4 percent.

Gross margin increased 130 basis points to 65.5 percent of sales on a GAAP basis and 65.8 percent of sales on an adjusted basis. The increased gross margin was said to be primarily due to lower freight costs, the inclusion of the higher gross margin Johnny Was business and improved initial product margins.

SG&A was $203 million compared to $157 million in Q1 last year, increasing primarily due to $31 million of Johnny Was SG&A in the first quarter of 2023, which includes $3 million of amortization of intangible assets. Across all operating groups, SG&A increased due to increases in employment costs, advertising costs, variable expenses, occupancy costs and other expenses to support sales growth. On an adjusted basis, SG&A was $200 million compared to $157 million in the prior-year period.

Royalties and other operating income increased by $1 million to $8 million versus last year. This increase included a $2 million gain on the sale of the Merida, Mexico manufacturing facility previously operated by the Lanier Apparel operating group which the company exited in 2021.

Operating income was $80 million, or 19.1 percent of net sales, in the first quarter, compared to $76 million in the first quarter of fiscal 2022. On an adjusted basis, operating income increased to $83 million, or 19.8 percent of net sales, compared to $77 million in last year’s first quarter. The increased operating income includes the impact of the higher sales and gross margins partially offset by higher SG&A as the company invests in the business to fuel future growth.

Interest expense was $2 million compared to less than $1 million in the prior-year period. The increased interest expense was due to the increased debt levels as a result of the acquisition of Johnny Was in fiscal 2022.

The effective tax rate was 25 percent compared to 24 percent for the prior-year period, which included the benefit of certain favorable discrete items.

Tom Chubb, Chairman and CEO, commented, “Our strong brands, exceptional products, aspirational messaging and balanced mix of direct retail, e-commerce and wholesale allowed us to deliver solid results for the first quarter of 2023. While the year started strong, as the quarter progressed, we did see macroeconomic pressures drive the consumer to become more cautious in her discretionary spending and a high level of promotional activity within the marketplace. In light of these factors, we are moderating our growth forecast for the year.

“That said, we still expect a strong 2023 from an operating income and cash flow perspective and will continue investing in the future of our business. We are no less bullish on our ability to continue to deliver profitable growth and strong cash flow on a sustained basis. Looking forward to next year and beyond, the factors that drove our success in the first quarter will allow us to grow sales in the mid to upper single digits with an operating margin above 15 percent and return enhanced value to our shareholders for many years to come.”

Inventory increased $57 million on a LIFO basis and $60 million, or 32 percent, on a FIFO basis at quarter-end compared to the end of the first quarter of fiscal 2022. The inventory increase reflects: $17 million of Johnny Was inventory, anticipated sales increases in fiscal 2023, higher levels of core product and (iv) higher product costs.

During the first quarter of fiscal 2023 cash flow from operations were $53 million compared to $22 million in the first quarter of fiscal 2022. The cash flow from operations in the first quarter of fiscal 2023 provided sufficient cash to fund $17 million of capital expenditures, $10 million of dividends and $25 million to repay outstanding debt.

As of April 29, 2023, the company had $94 million of borrowings outstanding under its revolving credit agreement, compared to no borrowings at the end of the first quarter of last year. Also, the company had $10 million of cash and cash equivalents versus $166 million of cash, cash equivalents and short-term investments at the end of the first quarter of fiscal 2022. Both changes were due to the acquisition of Johnny Was.

Looking ahead, Oxford revised its sales and EPS guidance for fiscal 2023 ending on February 3, 2024.

The company now expects net sales in a range of $1.59 billion to $1.63 billion as compared to net sales of $1.41 billion in fiscal 2022. In fiscal 2023, GAAP EPS is expected to be between $10.18 and $10.58 compared to fiscal 2022 GAAP EPS of $10.19. Adjusted EPS is expected to be between $10.80 and $11.20, compared to fiscal 2022 adjusted EPS of $10.88 a share.

For the second quarter of fiscal 2023, the company expects net sales between $415 million and $435 million compared to net sales of $363 million in the second quarter of fiscal 2022. GAAP EPS is expected to be in a range of $3.14 to $3.34 per share in the second quarter compared to GAAP EPS of $3.49 in the second quarter of fiscal 2022. Adjusted EPS is expected to be between $3.30 and $3.50 a share compared to adjusted EPS of $3.61 in the second quarter of fiscal 2022.

Oxford anticipates interest expense of $5 million in fiscal 2023, including the $2 million in the first quarter of fiscal 2023, with interest expense expected to be $1 million or less during each of the second, third and fourth quarters of fiscal 2023 as strong cash flows will be used to repay debt significantly during fiscal 2023. The company’s effective tax rate is expected to be approximately 24 percent for the second quarter of fiscal 2023 and 25 percent for the full year of fiscal 2023.

Capital expenditures in fiscal 2023, including the $17 million in the first quarter of fiscal 2023, are expected to be approximately $90 million compared to $47 million in fiscal 2022. The planned increase is primarily due to increased investment in new brick-and-mortar retail stores and food and beverage locations as well as certain relocations and remodels of existing locations, various technology systems initiatives, and the anticipated spend associated with a multi-year project at the company’s Lyons, Georgia distribution center to enhance its direct-to-consumer throughput capabilities for its brands.

Photo courtesy of Tommy Bahama