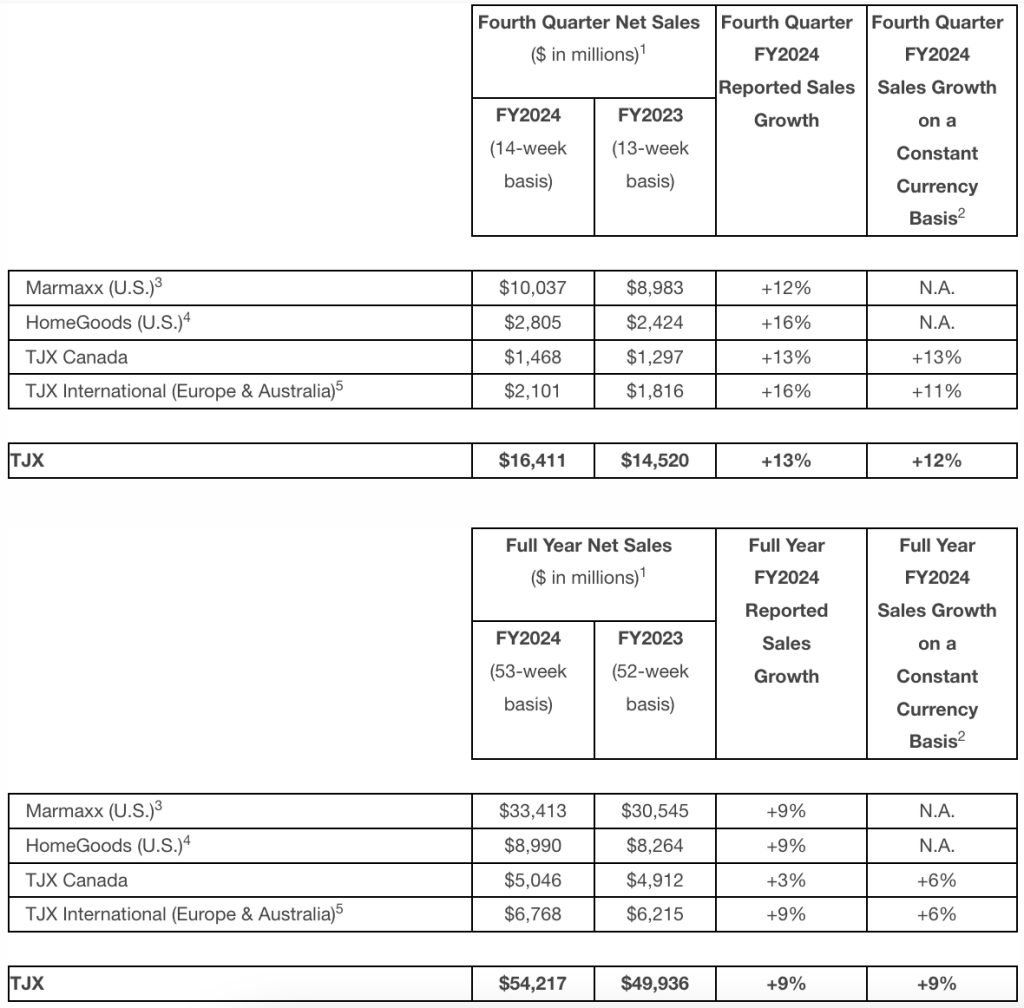

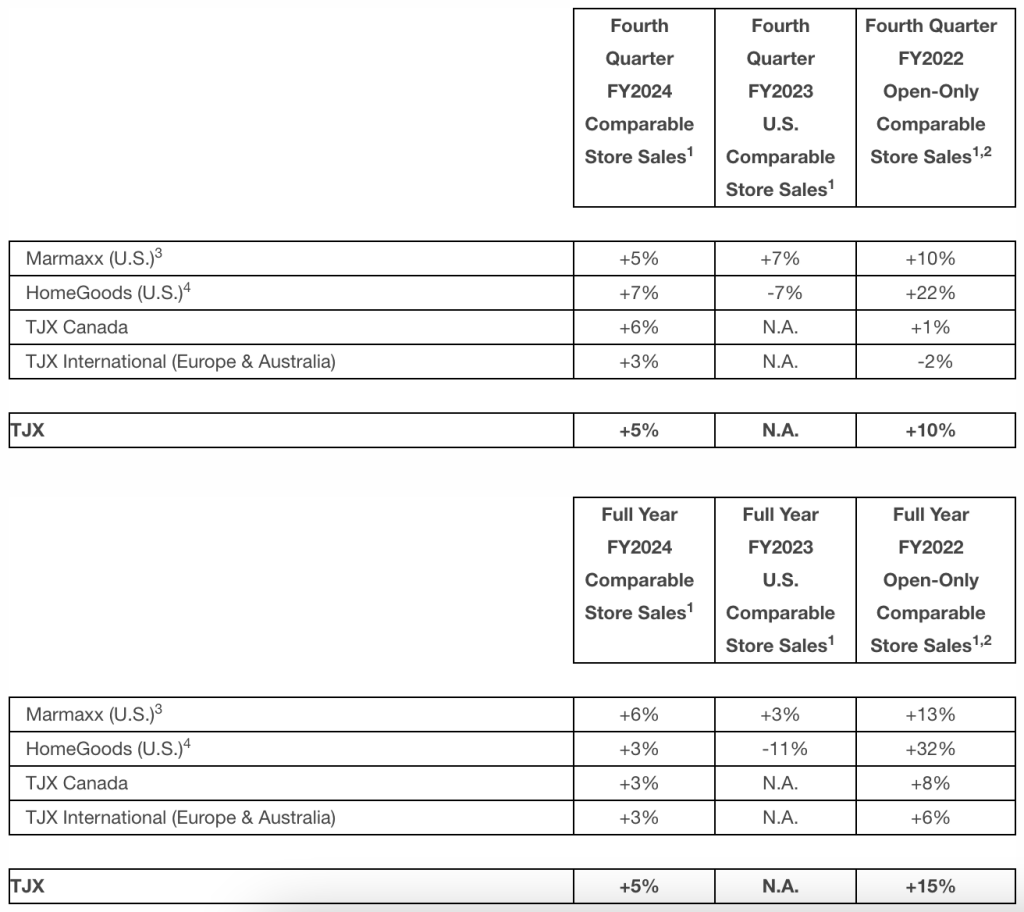

The TJX Companies, Inc., parent of the TJ Maxx, Marshalls, Sierra, and Home Goods retail brands, among others, in the U.S. and worldwide, reported net sales for the fiscal 2024 fourth quarter were $16.4 billion, an increase of 13 percent versus the 13-week fourth quarter of Fiscal 2023. Consolidated comparable store sales increased 5 percent.

For the fiscal 2024 fourth quarter, the company’s pretax profit margin was 11.2 percent, up 2.0 percentage points versus the fiscal 2023 fourth-quarter pretax profit margin of 9.2 percent. Excluding an estimated 0.3 percentage point benefit from the extra week in the fiscal 2024 fourth quarter, adjusted pretax profit margin was 10.9 percent, up 1.7 percentage points versus last year. This was said to be above the company’s plan due to a higher merchandise margin as well as expense leverage on the above-plan sales. The higher merchandise margin includes a larger-than-expected benefit from lower inventory shrink expense, lower freight costs, lower markdowns, and better mark-on.

Ernie Herrman, president and CEO, of The TJX Companies, Inc., stated, “I am extremely proud of the performance of our teams again in 2023. Thanks to their excellent execution of our great business model, we delivered outstanding results on both the top and bottom lines that exceeded our expectations. We surpassed $50 billion in annual sales, a milestone for our company. We brought our customers exciting values on great brands and fashions and a treasure-hunt shopping experience, every day. Throughout the holiday season, we shipped a fresh assortment of gift-giving selections to our stores and online which resonated with consumers. Comparable store sales for the company increased 5 percent both for the fourth quarter and full year, well above our original plans for 2023. We saw comp sales growth at every division driven by customer transactions, which underscores our confidence in our ability to gain market share across all of our geographies. We had a very strong finish to 2023 and start the new year in a position of strength with the first quarter off to a good start. We are energized and laser-focused on capitalizing on our opportunities for the year ahead and, as always, we’ll strive to beat our plans. Longer term, we are excited about the potential we see to strategically grow our business, capture additional market share, and increase the profitability of our company.”

Gross profit margin for the fiscal 2024 fourth quarter was 29.8 percent of net sales, a 3.7 percentage point increase versus the fiscal 2023 fourth-quarter gross profit margin of 26.1 percent. Excluding an estimated 0.3 percentage point benefit from the extra week in the 2024 fourth quarter, adjusted gross profit margin was 29.5 percent, up 3.4 percentage points versus last year. The year-over-year increase was reportedly driven by a significant benefit from lower freight costs and lower inventory shrink expense, strong mark-on, and lower markdowns, partially offset by supply chain investments.

SG&A costs as a percent of sales for the fiscal 2024 fourth quarter were 18.9 percent, a 1.9 percentage point increase versus the fiscal 2023 fourth quarter SG&A costs of 17.0 percent. This year-over-year increase was said to be primarily due to higher incentive compensation accruals and incremental store wage and payroll costs. SG&A as a percent of sales for the fourth quarter Fiscal 2024 was reportedly not impacted by the extra week in the calendar.

Net interest income benefitted fiscal 2024 fourth-quarter pretax profit margin by 0.1 percentage point versus the prior-year period.

Net income was $1.4 billion, or $1.22 per diluted earnings per share, in the fourth quarter, up 37 percent year-over-year versus 89 cents in the fourth quarter of fiscal 2023. Excluding an estimated benefit of 10 cents from the extra week in the fiscal 2024 fourth quarter, adjusted diluted earnings per share on a 13-week basis were $1.12, up 26 percent versus the prior-year corresponding quarter.

Inventory

Total inventories at quarter-end were $6.0 billion, compared to $5.8 billion at the end of fiscal 2023. Consolidated inventories on a per-store basis as of February 3, 2024, including distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were up 1 percent on both a reported and constant-currency basis. The constant-currency basis reflects inventory adjusted for the impact of foreign currency exchange rates, if any.

TJX said it is well-positioned to take advantage of the outstanding availability of quality, branded merchandise in the marketplace and flow fresh goods to its stores and online this spring.

TJX had 95 Sierra stores at year-end.

First Quarter and Full Year Fiscal 2025 Outlook

For the first quarter of fiscal 2025, the company is planning consolidated comparable store sales to be up 2 percent to 3 percent, pretax profit margin to be in the range of 10.5 percent to 10.6 percent, and diluted EPS to be in the range of 84 cents to 86 cents per diluted share.

For full-year fiscal 2025, the company is planning consolidated comparable store sales to be up 2 percent to 3 percent, pretax profit margin to be in the range of 10.9 percent to 11.0 percent, and diluted EPS to be in the range of $3.94 to $4.02 per diluted share.

Image courtesy The TJX Companies, Inc.