The TJX Companies Inc. reported same-store sales at Marmaxx, which includes results at T.J. Maxx, Marshalls and Sierra Trading Post, increased 3.0 percent in the third quarter compared with the same period a year ago.

Net sales at MarMaxx increased 5.4 percent to $4.93 billion.

Total net sales at The TJX Companies, which also includes its Homegoods and International results, increased 5 percent to $7.8 billion and consolidated comparable store sales increased 5 percent over last year’s 2 percent increase. Net income for the third quarter was $587 million and diluted earnings per share were $.86 versus last year’s $.85.

|

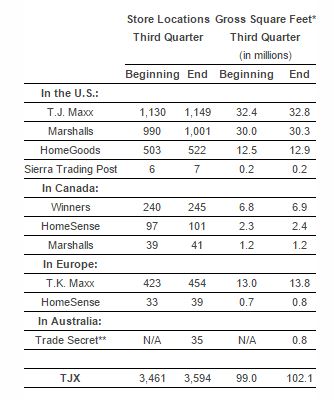

| Square feet figures may not foot due to rounding. **TJX acquired Trade Secret on Oct. 25, 2015. |

“I am extremely pleased with our third quarter performance as our momentum continued,” said Chairman and CEO Carol Meyrowitz. “Our 5 percent consolidated comparable store sales growth, over a 2 percent increase last year, continued our excellent trend from the first two quarters and significantly exceeded our plans. Our $.86 in earnings per share was also well above our expectations. We are delighted that strong customer traffic drove our entire consolidated comp and was the primary driver of our comp increases at every division. Our excellent traffic gains and strong performance across our apparel, accessories and home categories, demonstrate that our brands globally are offering the right values and merchandise mix. Again this quarter, we saw strong sales at every division. I am particularly pleased with our ability to simultaneously deliver exceptional value to consumers while maintaining strong merchandise margins, which speaks to the flexibility of our off-price business model.”

Margins hold

For the third quarter of Fiscal 2016, the company’s consolidated pretax profit margin was 12.1 percent, a 0.9 percentage point decrease compared with the prior year.

Gross profit margin for the third quarter of Fiscal 2016 was 29.0 percent, down 0.4 percentage points versus the prior year. The decrease was primarily due to transactional foreign exchange at the company’s international divisions and increased supply chain costs related to a substantial increase in units sold during the quarter. Merchandise margins remained strong.

Selling, general and administrative costs as a percent of sales were 16.7 percent, up 0.5 percentage points versus the prior year’s ratio, primarily due to the company’s wage initiative and increased supply chain costs, as the company had anticipated.

Inventory up 10 percent

Total inventories as of Oct. 31 were $4.4 billion, compared with $4.0 billion at the end of the third quarter last year. Consolidated inventories on a per-store basis, including the distribution centers, but excluding inventory in transit and the company’s e-commerce businesses, were up 4 percent on a reported basis (or 6 percent currency-netural).

Executives said they are very comfortable with its inventory position, which it strategically increased ahead of the fourth quarter to provide more flexibility to flow fresh merchandise to its stores with greater precision throughout the holiday season. The company said it enters the fourth quarter in an excellent position to take advantage of the plentiful buying opportunities for branded, quality merchandise it is seeing in the marketplace.

Fourth Quarter and Full Year Fiscal 2016 Outlook

“As to the fourth quarter, we are pleased to see that traffic continues to be up and we could not be more excited about the holiday selling season,” said Meyrowitz.

For the fourth quarter of Fiscal 2016, the company expects diluted earnings per share to be in the range of $.91 to $.93 compared to $.93 last year. This guidance reflects an assumption that the combination of foreign currency, transactional foreign exchange, the company’s wage initiative, incremental investments to support growth, and pension costs would have a 9 percent negative impact on EPS growth. This guidance also reflects a negative impact to EPS from the acquisition of Trade Secret that was not contemplated in the company’s prior guidance. This EPS outlook is based upon estimated consolidated comparable store sales growth of 2 percent to 3 percent.

For the fiscal year ending January 30, 2016, the company continues to expect diluted earnings per share to be in the range of $3.26 to $3.28 versus $3.15 in Fiscal 2015. Excluding a $.01 debt extinguishment charge in Fiscal 2015, this guidance would represent a 3 percent to 4 percent increase over the adjusted $3.16 in Fiscal 2015. This guidance for EPS growth reflects a 9 percent negative impact from the same factors affecting estimated EPS growth in the fourth quarter, detailed above. This guidance also now reflects a $.02 to $.03 negative impact to EPS from the acquisition of Trade Secret, which was not contemplated in the company’s prior guidance. This EPS outlook is now based upon a raised estimate of consolidated comparable store sales growth of 4 percent to 5 percent.

The company’s earnings guidance for the fourth quarter and full year Fiscal 2016 assumes that currency exchange rates will remain unchanged from the levels at the beginning of the fourth quarter.