The TJX Companies, Inc., parent of the TJ Maxx, Marshalls, HomeGoods and outdoor-oriented Sierra retail nameplates, reported net sales for the 13-week fourth quarter of fiscal 2025 ended February 1 were $16.4 billion, flat versus the 14-week fourth quarter of fiscal 2024.

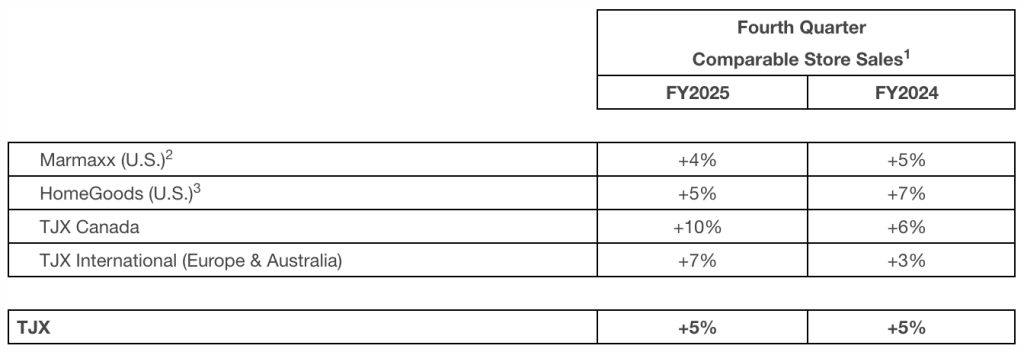

Fourth quarter fiscal 2025 consolidated comparable store sales increased 5 percent.

1 – Comparable store sales excludes e-commerce. 2 – Includes TJ Maxx, Marshalls, and Sierra stores.

3 – Includes HomeGoods and Homesense stores.

Income Statement Summary

Gross profit margin for the 13-week fourth quarter was 30.5 percent, up 70 basis points year-over-year versus the prior year’s 14-week fourth quarter gross profit margin of 29.8 percent. Fourth quarter gross profit margin was up 100 basis points versus last year’s adjusted gross profit margin of 29.5 percent, which excluded an estimated 30 basis-point benefit from the extra week in the company’s fourth quarter fiscal 2024 calendar. This year-over-year increase was primarily driven by lower inventory shrink expense and strong markon.

Selling, general and administrative (SG&A) costs as a percent of sales for the fourth quarter of fiscal 2025 were 19.2 percent, a 0.3 percentage point increase versus last year’s 18.9 percent. This year-over-year increase was due to incremental store wage and payroll costs.

Net interest income for the fourth quarter of fiscal 2025 was neutral to pretax profit margin versus the prior year.

Fourth quarter pretax profit margin was 11.6 percent of net sales, up 40 basis points versus pretax profit margin of 11.2 percent in the prior-year quarter. Fourth quarter pretax profit margin was up 700 basis points versus the prior year’s Q4 adjusted pretax profit margin of 10.9 percent, which excluded an estimated30 basis-point benefit from the extra week in the company’s fourth quarter fiscal 2024 calendar.

The company’s fourth quarter fiscal 2025 pretax profit margin was said to be above the high-end of its plan by 70 basis points, primarily driven by lower than expected inventory shrink expense as well as expense leverage on the above-plan sales, partially offset by higher incentive compensation accruals.

Net income was $1.4 billion, or $1.23 per diluted share, up 1 percent compared to Q4 fiscal 2024. Fourth quarter diluted earnings per share increased 10 percent versus the prior year’s adjusted diluted earnings per share of $1.12, which excluded an estimated benefit of 10 cents from the extra week in the company’s fourth quarter fiscal 2024 calendar.

Full Year Sales and Net Income Summary

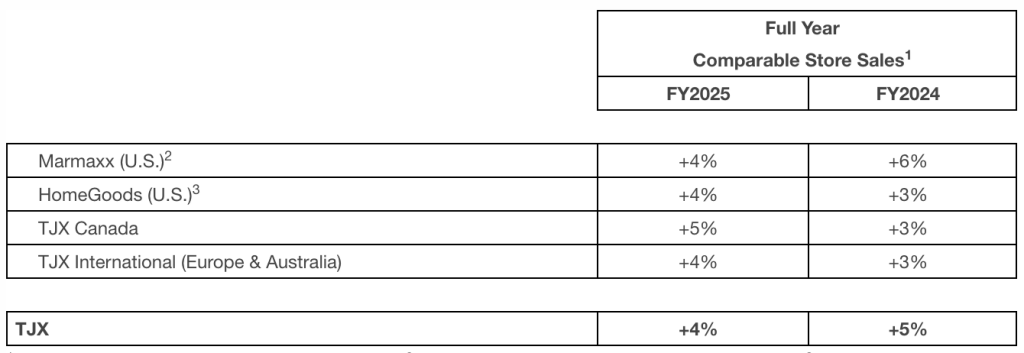

For the 52-week fiscal year ended February 1, 2025, net sales were $56.4 billion, an increase of 4 percent versus the 53-week fiscal 2024 year. fiscal 2025 consolidated comparable store sales increased 4 percent.

Full-year net income was $4.9 billion and diluted earnings per share were $4.26, up 10 percent versus $3.86 in the 53-week fiscal 2024 year. Full year fiscal 2025 diluted earnings per share increased 13 percent versus full year fiscal 2024 adjusted diluted earnings per share of $3.76, which excluded an estimated benefit of $.10 from the extra week in the company’s fiscal 2024 calendar.

1 – Comparable store sales excludes e-commerce. 2 – Includes TJ Maxx, Marshalls, and Sierra stores.

1 – Comparable store sales excludes e-commerce. 2 – Includes TJ Maxx, Marshalls, and Sierra stores.

3 – Includes HomeGoods and Homesense stores.

Ernie Herrman, president and CEO, The TJX Companies, Inc., stated, “I am very proud of the performance of our hard-working Associates in 2024. We delivered outstanding top-and bottom-line results that exceeded our guidance for the year. We surpassed $56 billion in annual sales, drove a 4 percent comparable store sales increase, significantly increased profitability, and opened our 5,000th store during the year. Further, each of our divisions saw strong, consistent full year comp store sales growth of 4 percent or above. Our fourth quarter sales, profitability, and earnings per share were all well above our expectations. I am particularly pleased that our overall comp store sales growth of 5 percent for the quarter was due to strong increases in comp sales and customer transactions at every division. Throughout the year, we offered our wide range of customers compelling values on good, better, and best brands and on-point fashions, and an exciting treasure-hunt shopping experience. As we begin a new year, we are confident that remaining focused on the off-price fundamentals of our great company will continue to serve us well, as it has over many decades, and as always, we will strive to beat our plans. Longer term, we see many opportunities to successfully grow our business and deliver value to even more consumers around the world.”

Inventory

Total inventories as of February 1 were $6.4 billion, compared to $6.0 billion at the end of fiscal 2024. Consolidated inventories on a per-store basis as of February 1, 2025, including distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were up 1 percent on both a reported and constant-currency basis versus last year. The constant-currency basis reflects inventory adjusted for the impact of foreign currency exchange rates. The company enters the new fiscal year in an excellent inventory position and is set up well to take advantage of the outstanding availability in the marketplace and flow fresh assortments to its stores and online this spring.

Fiscal 2026 Outlook

For the full year fiscal 2026, the company is planning consolidated comparable store sales to be up 2 percent to 3 percent. The company is planning full year fiscal 2026 pretax profit margin to be in the range of 11.3 percent to 11.4 percent, down 10 basis points to 20 basis points versus the prior year’s 11.5 percent.

The company said it is planning full year fiscal 2026 diluted earnings per share to be in the range of $4.34 to $4.43 per share, which would represent a 2 percent to 4 percent increase over the prior year’s $4.26 per share.

The company’s full year fiscal 2026 outlook reflects an assumption that unfavorable foreign currency exchange rates and transactional foreign exchange would have an approximately 20 basis-point negative impact to pretax profit margin and an approximately 3 percent negative impact to earnings per share growth.

First Quarter

For the first quarter of fiscal 2026, the company is planning consolidated comparable store sales to be up 2 percent to 3 percent. The company is planning first quarter fiscal 2026 pretax profit margin to be in the range of 10.0 percent to 10.1 percent, down 100 basis points to 110 basis points versus the prior year’s 11.1 percent.

The company is planning first quarter fiscal 2026 diluted earnings per share to be in the range of 87 cents to 89 cents, which would represent a 4 percent to 6 percent decrease versus the prior year’s 93 cents per share.

The company’s first quarter fiscal 2026 pretax profit margin and diluted earnings per share outlook is planned lower than the company’s outlook for the last nine months of the year primarily due to a benefit from lower incentive compensation accruals planned in the last nine months of fiscal 2026, a lapping of a benefit from a reserve release in the first quarter of fiscal 2025, and the expected timing of certain expenses.

TJX said that the company’s first quarter and fiscal 2026 outlook implies that in the last nine months of fiscal 2026, consolidated comparable store sales would be up 2 percent to 3 percent, pretax profit margin would be in the range of 11.6 percent to 11.7 percent, flat to up 0.1 percentage point versus the prior year, and diluted earnings per share would be in the range of $3.47 to $3.54, up 4 percent to 6 percent versus the prior year.

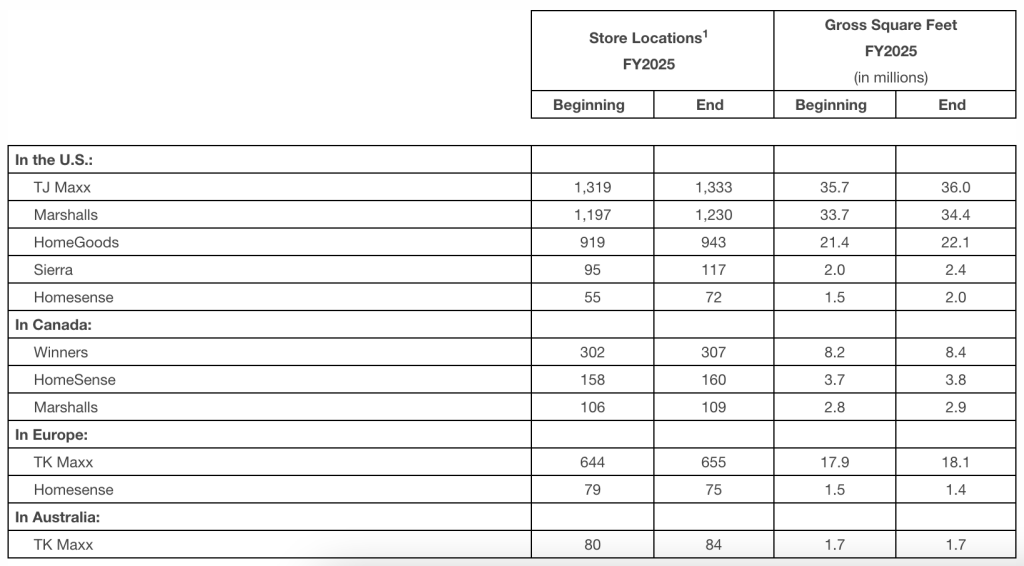

Stores by Concept

During the fiscal year ended February 1, 2025, the company increased its store count by 131 stores overall to a total of 5,085 stores and increased square footage by 2 percent versus the prior year.

Image and tables courtesy The TJX Companies, Inc.