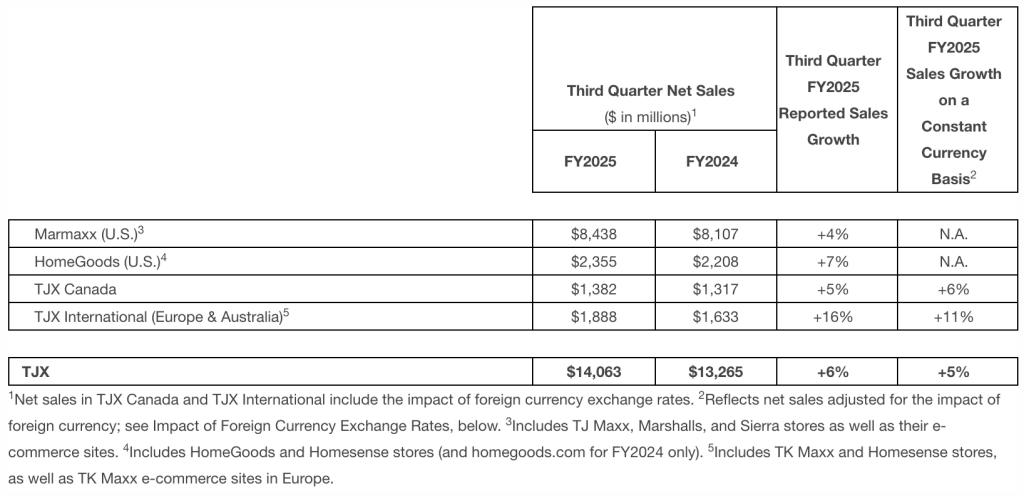

The TJX Companies, Inc., parent of the TJ Maxx, Marshall’s, Home Goods, and Sierra outdoor specialty retail brands, reported that net sales for fiscal Q3 were $14.1 billion, an increase of 6 percent versus the third quarter of Fiscal 2024. Third quarter Fiscal 2025 consolidated comparable store sales increased 3 percent year-over-year (y/y).

For the first nine months of Fiscal 2025 (YTD), net sales were $40.0 billion, an increase of 6 percent versus the first nine months of Fiscal 2024 (prior-year YTD). Consolidated comparable store sales for the YTD period increased 3 percent. Net income for the YTD period was $3.5 billion.

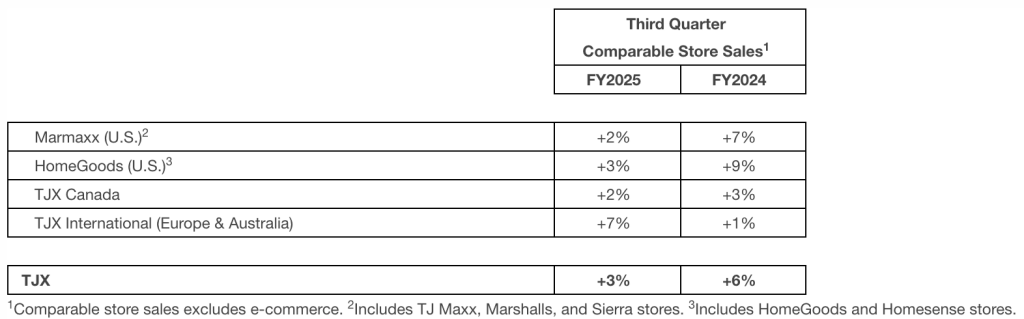

Comparable Store Sales by Division

The company’s comparable store sales by division for fiscal Q3 and Fiscal 2024 were as follows:

Net Sales by Division

“I am very pleased with our third quarter results and the strong execution of our off-price business fundamentals by our teams,” offered Ernie Herrman, president and CEO, The TJX Companies, Inc. ‘Our comp store sales increase of 3 percent was at the high-end of our plan, and both pretax profit margin and earnings per share came in well above our expectations. Across the company, customer transactions drove our comp sales increases, which tells us that our values and treasure hunt shopping experience are appealing to a wide range of customers. I want to specifically highlight our European team for their strong results, which drove the 7 percent comp increase at our TJX International division.”

Herrman continued, reporting on the guidance shift to the positive for the fiscal year.

“With our above-plan profitability results in the third quarter, we are raising our full year guidance for pretax profit margin and earnings per share. The fourth quarter is off to a strong start, and we are excited about our opportunities for the holiday selling season,” the CEO added.

Income Statement Summary

For fiscal Q3, the company’s pretax profit margin was 12.3 percent of sales, up 0.3 percentage points versus last year’s third quarter pretax profit margin of 12.0 percent.

The company’s third quarter pretax profit margin was above the high-end of its plan by 40 basis points, primarily driven by the timing of certain expenses, expense savings, and higher net interest income.

Gross profit margin for fiscal Q3 was 31.6 percent, up 50 basis points versus Q3 last year, primarily due to an increase in merchandise margin.

Selling, general and administrative (SG&A) costs as a percent of sales for fiscal Q3 were 19.5 percent, a basis-point increase versus Q3 last year.

Net income for fiscal Q3 was $1.3 billion and diluted earnings per share were $1.14, up 11 percent versus $1.03 per share in the third quarter of Fiscal 2024. For the YTD period, diluted earnings per share were $3.03, up 14 percent y/y versus $2.65 per share in the prior-year YTD period.

Impact of Foreign Currency Exchange Rates

Changes in foreign currency exchange rates affect the translation of sales and earnings of the company’s international businesses into U.S. dollars for financial reporting purposes. In addition, ordinary course, inventory-related hedging instruments are marked to market at the end of each quarter. Changes in currency exchange rates can have a material effect on the magnitude of these translations and adjustments when there is significant volatility in currency exchange rates. Given the global operations of the company, to facilitate comparability, the company has provided sales growth and inventory on a constant currency basis, which assumes a constant exchange rate between periods for translation based on the rate in effect for the prior period.

The movement in foreign currency exchange rates had a one percentage point positive impact on the company’s net sales growth in fiscal Q3 versus the prior-year third quarter. The overall net impact of foreign currency exchange rates had a 1 cent positive impact on third quarter diluted earnings per share.

The movement in foreign currency exchange rates had a neutral impact on the company’s net sales growth in the YTD period versus the prior-year YTD period. The overall net impact of foreign currency exchange rates had a 1 cent positive impact on the YTD period diluted earnings per share.

Inventory

Total inventories as of November 2, 2024 were $8.4 billion, compared to $8.3 billion at the end of the third quarter of Fiscal 2024. Consolidated inventories on a per-store basis as of November 2, 2024, including distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were down 2 percent on both a reported and constant-currency basis versus the end of Q3 last year. Inventory on a constant-currency basis reflects inventory adjusted for the impact of foreign currency exchange rates, if any.

The company said it is well-positioned to take advantage of the outstanding availability in the marketplace and deliver an eclectic mix of exciting gifts to its stores and online throughout this holiday season.

“Further, we have some great merchandise plans for our U.S. e-commerce sites in our Sierra business,” commented John Klinger, CFO, The TJX Companies, Inc., the only mention of the Sierra business on the quarterly conference call with analysts.

Cash and Shareholder Distributions

For fiscal Q3, the company generated $1.0 billion of operating cash flow and ended the quarter with $4.7 billion of cash.

During fiscal Q3, the company returned a total of $997 million to shareholders. The company repurchased $574 million of TJX stock, retiring 5.0 million shares, and paid $423 million in shareholder dividends during the quarter.

During the current YTD period, the company returned a total of $2.9 billion to shareholders. The company repurchased a total of $1.7 billion of TJX stock, retiring 15.4 million shares, and paid $1.2 billion in shareholder dividends.

The company now expects to repurchase approximately $2.25 to $2.5 billion of TJX stock during the fiscal year ending February 1, 2025. The company may adjust the amount purchased under this plan up or down depending on various factors. The company remains committed to returning cash to its shareholders while continuing to invest in the business to support the near- and long-term growth of TJX.

Fourth Quarter and Full Year Fiscal 2025 Outlook

For the fourth quarter of Fiscal 2025, the company continues to expect consolidated comparable store sales to be up 2 percent to 3 percent. The company now expects pretax profit margin to be in the range of 10.8 percent to 10.9 percent and diluted earnings per share to be in the range of $1.12 to $1.14. The change in the company’s fourth quarter pretax profit margin and earnings per share guidance is due to the expected reversal of the third quarter benefit from the timing of certain expenses.

For the full year Fiscal 2025, the company continues to expect consolidated comparable store sales to be up 3 percent. The company is increasing its outlook for pretax profit margin to be 11.3 percent of sales and raising its diluted earnings per share outlook to be in the range of $4.15 to $4.17 per share.

Last year’s fourth quarter and full year pretax profit margin and earnings per share benefited from an extra week in the company’s fiscal calendar.

Joint Venture in Mexico with Grupo Axo

During fiscal Q3, the company completed its investment in the joint venture with Grupo Axo, S.A.P.I. de C.V. (Axo) an operator of global brands in Mexico and South America that includes both full- and off-price formats.

The purchase price for TJX was $179 million in cash. Under the terms of the definitive agreements, TJX owns 49 percent and Axo owns 51 percent of the joint venture.

The joint venture is comprised of Multibrand Outlet Stores, S.A.P.I. de C.V., Axo’s off-price, physical store business in Mexico, which includes a total of over 200 stores for its Promoda, Reduced, and Urban Store banners. TJX has the option to increase its ownership interest in the joint venture over the long term. Both TJX and Axo expect to make additional future investments in the joint venture to support the expected growth of the business. TJX does not expect this joint venture to have a material impact on its fourth quarter or full year Fiscal 2025 financial results.

Investment in Brands for Less

After the end of fiscal Q3, the company completed its investment for a 35 percent non-controlling, minority equity stake in Brands For Less (BFL) for $344 million. BFL is based in Dubai and is the region’s only major off-price branded apparel, toys, and home fashions retailer. BFL currently operates over 100 stores, primarily in the UAE and Saudi Arabia, as well as an e-commerce business. The company does not expect this investment to have a material impact on its fourth quarter or full year Fiscal 2025 financial results.

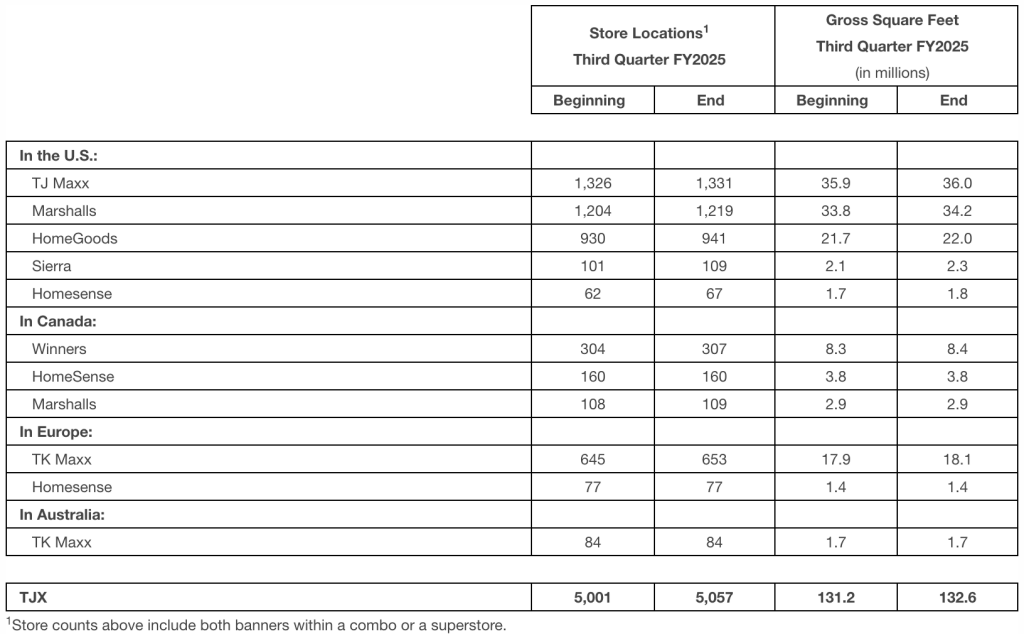

Stores by Concept

During the fiscal quarter ended November 2, 2024, the company increased its store count by 56 stores overall to a total of 5,057 stores and increased square footage by 1.1 percent versus the prior quarter.

Image courtesy Sierra