Tilly’s, Inc.'s first-quarter profits came in line with expectations but its second-quarter guidance came in at the lower end of projections.

For the first quarter ended May 3, 2014:

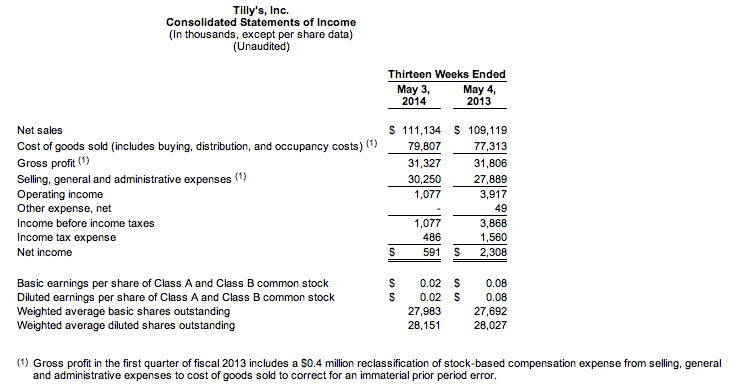

Total net sales were $111.1 million, an increase of 1.8 percent compared to $109.1 million in the first quarter of 2013.

Comparable store sales, which include e-commerce sales, decreased 6.8 percent compared to the same 13-week period in 2013. E-commerce sales were $12.7 million, an increase of approximately 1.2 percent compared to the same thirteen-week period in 2013.

Gross profit was $31.3 million compared to $31.8 million in the first quarter of 2013. Gross margin was 28.2 percent compared to 29.1 percent in the first quarter of 2013. Product margins increased approximately 60 basis points, offset primarily by deleverage in occupancy costs as a result of the negative comparable store sales.

Operating income was $1.1 million and compares to operating income of $3.9 million in the first quarter of 2013.

Net income was $0.6 million, or $0.02 per diluted share, based on a weighted average diluted share count of 28.2 million shares and an effective tax rate of approximately 45 percent, reflecting a discrete item related to stock option forfeitures. This compares to net income in the first quarter of 2013 of $2.3 million, or $0.08 per diluted share, based on a weighted average diluted share count of 28.0 million shares and an effective tax rate of 40 percent.

When it reported fourth-quarter earnings on March 19, the action sports retailer projected earnings to be flat to a profit of 4 cents a share.

Balance Sheet and Liquidity

“Earnings results were in line with our expectations and reflect the continuation of a tough retail environment and the planned reduction in our clearance merchandise, which put pressure on our comparable store sales. We delivered strong product margin improvement through careful inventory management and operating discipline, and our inventory is well positioned for the summer selling season. We also advanced our strategic initiatives including the opening of our new dedicated e-commerce fulfillment center,” commented Daniel Griesemer, president and chief executive officer. “We remain focused on maintaining the continued health and relevance of our brand, and are confident in our ability to capitalize on the long-term opportunities to grow our business.”

As of May 3, 2014, the company had $52.4 million of cash and marketable securities and no borrowings or debt outstanding on its revolving credit facility.

Second Quarter 2014 Outlook

Zumiez said, “We continue to experience weak traffic trends and a highly promotional environment in teen retail. If these trends continue, we would expect second quarter comparable store sales to decline in the high single digits, and net income per diluted share to be in the range of $0.03 to $0.07. This assumes an anticipated effective tax rate of 40 percent and a weighted average diluted share count of 28.2 million shares. Second quarter 2013 net income was $4.3 million, or $0.15 per diluted share, based on a weighted average diluted share count of 28.1 million shares.”

Wall Street's consensus estimate had been 13 cents a share.

As of May 28, Tilly's operated 201 stores.