Tilly's Inc. reported comparable store sales rose 2.9 percent in its fiscal fourth quarter on slight improvements in response rates to its marketing efforts.

Tilly's Inc. reported comparable store sales rose 2.9 percent in its fiscal fourth quarter on slight improvements in response rates to its marketing efforts.

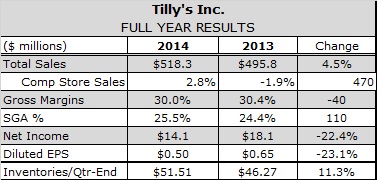

Total net sales were $152.8 million for the quarter ended Jan. 31, up 9.2 percent compared to $139.9 million in the fiscal fourth quarter ended Feb. 2, 2014. Comparable store sales, which include e-commerce sales, increased 2.9 percent compared with a 4.9 percent decline a year earlier. The increase reflected higher average transaction value and conversions partially offset by lower traffic. Sales of men's, women's, accessories and kid's continued to improve during the quarter.

The action sports retailer ended the quarter with 212 stores, up 17 from a year earlier, including four full-price stores and one outlet opened during the quarter. All new stores are meeting the company's more stringent financial requirements, said President and CEO Daniel Griesemer. The company plans to open 15 new stores in fiscal 2015.

While the company launched a new e-commerce platform and carried a higher percentage of exclusive products during the quarter compared with a year earlier, Griesemer continues to see slight improvements in the challenging teen retail environment.

“When we look across all of the metrics in the business, we are seeing some consumer trends that indicate a slight improvement,” Griesemer said. “We see it, across conversion rates and average transaction values in response to our marketing efforts and things like that. We don't want to overstate it, but it is certainly a slight improvement from what we were talking about – say maybe – a year ago.”

TLYS' gross profit increased 13.2 percent to $49 million, or 32.1 percent of net sales, up 110 basis points (bps) from the fourth quarter of 2013. The gain was driven by a 40 bps increase in product margins and lower buying, distribution and occupancy costs as a percentage of sales due to the positive comparable store sales.

Operating income rose 32.3 percent to $11.2 million, or 7.3 percent of revenues, up from 6.1 percent in the year earlier quarter. Net income was $7.1 million, or 25 cents per diluted share, up 31.2 and 31.6 percent respectively compared with the year earlier quarter.

“We achieved healthy product margins and exited this period with inventory well positioned for the Spring season,” Griesemer said.

The company expects first quarter comparable store sales to increase in the low single digits, and net income per diluted share to be in the range of 3-to-5 cents, compared with fiscal first quarter 2014 net income per diluted share was2 cents.

“We believe we have a little bit of room to increase, slightly, product margins in the first quarter,” Griesemer said.