Teamworks, the athlete engagement platform for collegiate and professional organizations, announced it has raised $25 million in Series C funding led by Delta-v Capital.

The round includes participation from new investors Afia Capital, a private investment platform backed by professional athletes, and Stadia Ventures, a global sports innovation hub for entrepreneurs, industry partners and investors. Returning investors participating in the round include General Catalyst, Seaport Capital, DUMAC, Steve Pagliuca and Reggie Love.

The latest round of financing will allow Teamworks to continue its momentum and global growth. The company has partnered with organizations from four continents over the last year, adding to the more than 3,000 teams worldwide that leverage the platform to engage their athletes.

“In this environment, we know the need for strong communication, strategic risk management and meaningful preparation is vital,” said Zach Maurides, CEO and founder of Teamworks. “Now more than ever, we’re seeing how Teamworks empowers organizations to be successful, throughout any circumstances. We’re thrilled to partner with Delta-v and use these resources to deepen our commitment to athletes and those who serve them.”

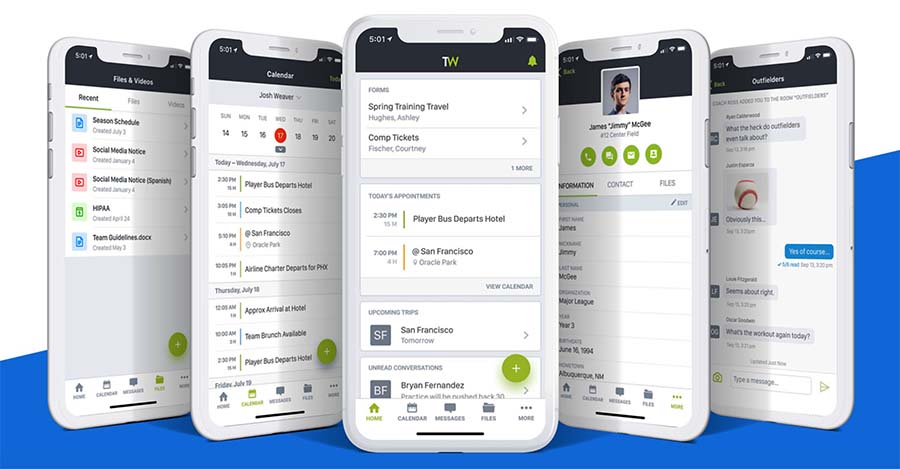

Teamworks partners with more than 2,000 Division I teams; nearly half of teams in the NFL, MLB, NHL and NBA; collegiate and professional conferences; and national governing bodies. Organizations use Teamworks to operate efficiently and effectively by streamlining communication, scheduling, file sharing and travel, ultimately allowing athletes, coaches and staff to eliminate time wasted on logistics.

“We believe that sports is an emerging frontier for software adoption, and Teamworks is at the center of that wave providing the market leading platform for collaboration and engagement with athletes,” said Dan Williams, partner at Delta-v Capital. “Prior to this pandemic, Teamworks’ customers raved about their product, but like Zoom, it has become even more mission critical at a time when sports organizations are operating in a remote environment. We are excited to partner with Teamworks and their amazing team on this next phase of growth.”

The investment brings Teamworks’ total funding to more than $45 million, with previous rounds led by General Catalyst and Seaport Capital. In the last year, Teamworks joined forces with INFLCR, the premium social media content delivery platform in sports and gained recognition as a Triangle Business Journal’s Best Places to Work for the second year in a row.

Inner Circle Sports LLC, a boutique investment bank focused on the global sports and media industry, served as financial advisor to Teamworks.

Photo courtesy Teamworks