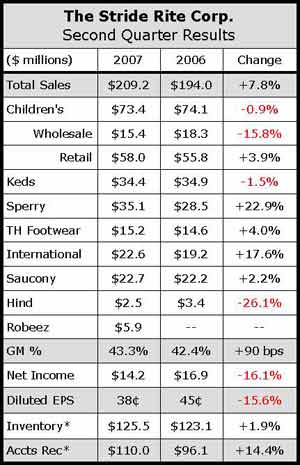

The Stride Rite Corporation reported a strong performance in its Sperry Top-Sider division, as well as in its International business, but softness in the Kids Wholesale, Hind, and Keds segments offset much of the gains. Sales increased 7.8% for SRR during the quarter when including the Robeez business, which was acquired in September for $27.5 million. Excluding Robeez from the equation, organic sales improved approximately 4.8%. Despite the organic growth, the company saw a sharply increased tax rate cause net income to take a downturn for the second quarter.

Stride Rite Children's Group wholesale net sales were down 16% for the quarter due mainly to decreased sales in the Stride Rite and Tommy Hilfiger product lines, as well as a decrease in closeout products sales. Offsetting these declines were positive sales of Sperry Top-Sider and Saucony children's products.

Childrens Group Retail sales increased 4% for the quarter as a result of 22 new stores, representing 7% growth, that opened during the trailing 12 months. Comparable store sales decreased 2.5% for the quarter. At quarter-end, the group operated 326 stores, including 11 Saucony stores. For the fiscal year, SRR expects to open 32 Stride Rite doors, while closing seven Stride Rite and eight Saucony stores.

Keds saw its difficulties continue in the second quarter with sales decreasing 1.5%, an improvement from the 9.3% decline in Q1. On a conference call with analysts, management said “womens was up very slightly, while childrens was down and Grasshoppers was up.” Furthermore, young and higher-end product was said to have performed well, while “the classic white product was down.” On the bright side, management anticipates “the third and fourth quarter to be up,” as current backlogs are “up for the third and fourth quarter.”

Saucony sales improved just over 2% for the quarter on “excellent response to [the] updated technical running line.” In addition, management said the brands share in technical running stores hit a new high in April and that new athletic lifestyle product will hit shelves in time for BTS.

In discussing the issues at Hind, where sales were well down for the quarter, Richard Thornton, SRR president and COO, would say only that they “have started to talk very preliminarily with the Payless people as to where that brand might best exist under the new umbrella.” He did comment that SRR continues to produce and ship Hind product, but strategically noted that Saucony apparel will debut in the first quarter of next year.

The growth in International was driven by strong Keds sales in Canada, Europe, and Australia as well as success with Saucony in Europe and Australia. Tommy Hilfiger was said to be “up in Latin America.”

Sperry Top-Sider and Stride Rite Childrens Group wholesale “drove most of the gross profit rate expansion” in the quarter, but the largest influence on the bottom-line was the increase in tax rate year-on-year. Last years 19.3% tax rate – due to a favorable tax audit resulting from the reversal of certain prior period reserves – converted to a 34.7% rate this quarter impacting diluted earnings per share by 9 cents. Operating income for the quarter actually increased 3.1% to $22.7 million from $22.0 million during the year-ago period.

Looking ahead, the company reaffirmed expectations of 5% to 8% sales growth for the year with earnings per share of $1.10 to $1.15, excluding any merger and integration costs.