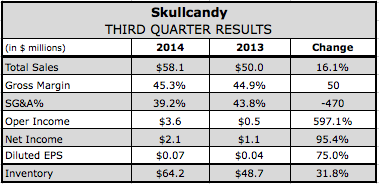

Skullcandy Inc. reported a strong profit turnaround in the third quarter as its top-line boasted a 16.1 percent gain.

Skullcandy Inc. reported a strong profit turnaround in the third quarter as its top-line boasted a 16.1 percent gain.

The sales gain marked a sharp acceleration from the 6.0 percent gain seen in the second quarter. On a conference call with analysts, Hoby Darling, Skullcandys CEO, said the company was planning for growth between 7 percent and 9 percent. He added, The progress weve made exciting our consumer through innovation, refining our retail distribution pyramid, and strengthening our corporate culture and leadership has positively transformed Skullcandy over the past 20 months and created a solid foundation for the future.

U.S. net sales increased 18.8 percent to $38.5 million while international net sales gained 11.1 percent to $19.5 million, primarily due to increased sales in Canada, China and Mexico.

In earbuds, Skulllcandys Jib and Inkd lines were domestic top-five unit movers, with Jib number one. In headphones, Crusher continues to gain market share, while its Bluetooth Hesh shipped for the first time and added year-over-year growth. Better-than-expected gains were seen in gaming sales, especially in its Astro line, which extended its high-end gaming market share. Also supporting the sales strength was the continued healthy performance of its Halo Bluetooth speaker, the Air Raid.

Gross margins increased to 45.3 percent from 44.9 percent in the same quarter in 2013. SG&A expenses were reduced to 39.2 percent of sales from $43.8 percent on the sales leverage despite a net increase due to personnel expenses, demand creation and third-party sales commissions.

Net income surged 95.4 percent to $2.1 million, or 7 cents per share, surpassing Wall Streets 4-cent consensus estimate.

On the call, Darling said market data continues to show the overall headphone category is growing at a solid pace, with Skullcandy currently the number one headphone brand by unit volume over the last several months. An additional $1.2 million will be invested into its Drop-In Campaign featuring the Houston Rockets James Harden and the band Dorothy to support holiday demand.

The brand is also upgrading its in-store presence at key larger accounts such as Best Buy and Wal-Mart with listening stations and extra point-of-sales materials. For the sporting goods channel, it launched a new sports performance line of earbuds, featuring its proprietary Sticky Gel technology, and now has three distinct styles targeting athletes. Said Darling, Were pleased with the initial sell-through of our sports performance products, and believe we now have an established base to build on as we look to extend our reach in this segment of the market.

For the fourth quarter, the company currently forecasts sales to increase at a growth rate of 12-14 percent over 2013 levels and net income between 23 to 25 cents, up from 13 cents a year ago.

For the full year 2014, the company forecasts sales to increase 10 to 12 percent over 2013 levels. EPS is expected to range between 24 to 26 cents as share, which compares with a loss of 3 cents a year ago.

Looking to 2015, Darling said he expects to again expand sales by 10 to 12 percent, driven by growth in existing doors, its push to expand international to 50 percent of sales, and new category growth such as sports performance, women’s, Bluetooth speakers, and gaming.

In 2014, we edited out brand-dilutive accounts to clean up the marketplace, we amplified our in-store presence with many of our top retailers around the world, enhanced digital, and we added certain key accounts such as Walmart, said Darling. These major action items will continue in the new year to set up good accretive business with the right partners.