The transaction implies an equity valuation for Skillz of $3.5 billion, or 6.3x projected 2022 revenue. Estimated cash proceeds from the transaction are expected to consist of Flying Eagle’s $690 million of cash in trust. In addition, investors led by Wellington Management Company, Fidelity Management & Research Company, LLC, Franklin Templeton, and Neuberger Berman funds have committed to invest $159 million in the form of a PIPE at a price of $10.00 per share of Class A common stock of Flying Eagle immediately prior to the closing of the transaction. Flying Eagle’s stockholders with the right to redeem shares representing in excess of $95 million of cash in trust have agreed not to exercise such rights in connection with the transaction.

It is anticipated that post-transaction Skillz will have approximately $250 million of cash and cash equivalents on its consolidated balance sheet. The company expects to use the proceeds to accelerate Skillz’s growth in both domestic and international markets, support marketing efforts, and provide additional working capital.

Skillz stockholders may elect to receive their consideration in either cash or stock of the combined company (or a combination of both), subject to a maximum cash amount. The maximum cash amount will be an amount equal to the cash remaining in Flying Eagle’s trust account (after taking into account any redemptions by its public stockholders and payment of Skillz’s and Flying Eagle’s outstanding transaction expenses), plus the amount to be received from the PIPE investment, plus the closing cash of Skillz less $250 million (which will remain on the consolidated balance sheet of the combined company). If the aggregate amount of cash elected to be received by the Skillz stockholders exceeds the maximum cash amount, the cash to be received by each Skillz stockholder electing to receive cash will be reduced on a pro-rata basis and the Skillz stockholders will receive additional stock of the combined company. If the aggregate amount of cash elected to be received by the Skillz stockholders is less than the maximum cash amount, the excess cash will be allocated pro-rata among the Skillz stockholders and the number of shares of the combined company to be received by each Skillz stockholder electing to receive stock consideration will be adjusted downwards.

Paradise, Chafkin, substantially all of the existing Skillz stockholders as well as Flying Eagle’s sponsor have agreed to a 24-month lock-up, subject to quarterly releases of 1.5 million shares per holder commencing 180 days following the closing. Upon the closing of the transaction, Paradise, who holds a controlling voting interest in Skillz, will hold a controlling voting interest in the combined company.

The Boards of Directors of each of Flying Eagle and Skillz have unanimously approved the transaction. The transaction will require the approval of the stockholders of both Flying Eagle and Skillz and is subject to other customary closing conditions, including the receipt of certain regulatory approvals. The transaction is expected to close in the Fall of 2020.

LionTree Advisors and Jefferies LLC are acting as financial advisors to Skillz. Winston & Strawn LLP is acting as legal advisor to Skillz. Goldman Sachs & Co. LLC is acting as financial advisor to Flying Eagle as well as the exclusive placement agent for the PIPE. White & Case LLP is acting as legal advisor to Flying Eagle.

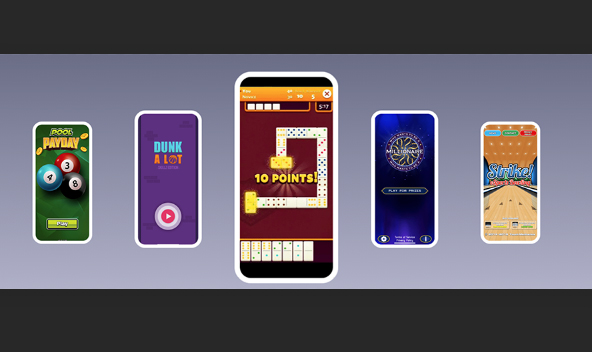

Photo courtesy Skillz