BRP, Inc., the parent company of the Ski-Doo, Sea-Doo, and Lynx power sports brands, reported revenues for the three months ended January 31 were marked by a decrease in the volume of shipments and revenues compared to the three-month period ended January 31, 2023.

The results of the fourth quarter of this fiscal year were mainly driven by a decrease in Seasonal product deliveries as the fourth quarter of the 2024 fiscal year compares unfavorably to a strong fourth quarter in the prior fiscal year, where Seasonal Product shipments were completed after peak retail season due to supply chain issues in the prior year.

Revenues were also negatively impacted by higher sales incentives and unfavorable winter conditions, primarily in North America, where the short riding season reduced the demand for PA&A compared to the fourth quarter of prior fiscal year.

The company’s North American quarterly retail sales were down for all product lines except SSV, resulting in an overall decrease in retail compared to the prior year period. While the company said it continues to demonstrate production efficiencies due to supply chain improvements, the reduction in volume and increase in sales programs led to a decrease in the profit margin percentage for the three-month period ended January 31, 2024, compared to the same period last year.

Total revenues decreased 12.5 percent year-over-year (YoY) to $2.69 billion for the fourth quarter, compared to the $3.08 billion for the corresponding period ended January 31, 2023. The revenue decrease was said to be due to a lower volume across most product lines, explained by late shipments of Seasonal Products for the prior-year period, softening consumer demand, primarily in international markets, higher sales programs across most product lines and unfavorable winter conditions, which impacted the Snowmobile season for PA&A. A favorable product mix in year-round products and favorable pricing across most product lines partially offset the decrease. The decrease includes a favorable foreign exchange rate variation of $4 million.

Year-Round Products (51 percent of Q4-FY24 revenues)

Revenues from year-round products increased 8.7 percent to $1.36 billion for the fourth quarter, compared to $1.25 billion for the corresponding prior-year period. The increase was primarily attributable to a favorable product mix due to the introduction of new models and a higher volume of 3WV due to the timing of shipments between the third and fourth quarters of Fiscal 2024. Higher sales programs and a lower volume of ATV and SSV sold partially offset the revenue increase. BRP said the increase includes an unfavorable foreign exchange rate variation of $1 million.

Seasonal Products (35 percent of Q4-FY24 revenues)

Revenues from Seasonal Products decreased 27.8 percent to $952.6 million for the fourth quarter, compared to $1.32 billion for the corresponding prior-year period. The decrease was primarily attributable to a lower volume of products sold and higher sales programs, mainly on Snowmobile due to unfavorable winter conditions. BRP said the decrease in volume is primarily explained by late shipments in the three-month period ended January 31, 2023, compared to this past fiscal year. The decrease was partially offset by favorable pricing across all product lines and also includes a favorable foreign exchange rate variation of $2 million.

Powersports PA&A and OEM Engines (11 percent of Q4-FY24 revenues)

Revenues from Powersports PA&A and OEM Engines decreased 23.1 percent to $291.0 million for the three-month period ended January 31, compared to $378.3 million for the corresponding prior-year period ended January 31, 2023. The decrease was attributable to a lower volume of PA&A sold, mainly due to lower dealer orders due to higher stock levels remaining in dealer inventory and unfavorable winter conditions in North America, which impacted the Snowmobile riding season and the related PA&A revenues. BRP said the decrease also includes a favorable foreign exchange rate variation of $4 million.

Marine (3 percent of Q4-FY24 revenues)

Revenues from the Marine segment decreased 29.9 percent to $90.1 million for the fourth quarter, compared to $128.5 million for the corresponding prior-year period ended January 31, 2023. The decrease was primarily attributable to a lower volume of products sold, higher sales programs, and an unfavorable product mix. BRP said the decrease in volume is due to softer consumer demand in the industry. The decline was offset by favorable pricing across most product lines. The decrease includes an unfavorable foreign exchange rate variation of $1 million.

North American Retail Sales

The company’s North American retail sales for powersports products decreased 10 percent for the fourth quarter, compared to the prior-year quarter, mainly driven by lower retail sales of snowmobile and PWC for the period, compared to the prior-year period, due to late shipments that occurred after peak retail season during the prior-year fourth quarter. In addition, unfavorable winter conditions impacted the Snowmobile season in the latest fiscal year. BRP said the decrease was partially offset by increased retail sales of SSV for the three-month period.

Year-Round Products retail sales increased on a percentage basis in the low-teens range compared to the prior-year period. The Year-Round Products industry increased on a percentage basis in the mid-single digits over the same period.

Seasonal Products retail sales decreased on a percentage basis in the low-twenties range, even when excluding Sea-Doo pontoon, compared to the three-month period ended January 31, 2023. The Seasonal Products industry decreased on a percentage basis in the high-teens range over the same period.

The company’s North American retail sales for Marine Products decreased 14 percent compared to the prior-year period due to softening consumer demand in the boating industry.

Income Statement

Gross profit decreased by $134.8 million, or 17.1 percent, to $652.8 million for the fourth quarter, compared to $787.6 million for the prior-year period.

Gross profit margin percentage decreased 130 basis points to 24.3 percent of net revenue from 25.6 percent in the prior-year quarter. The decrease in gross profit and gross profit margin percentage results from lower volume sold and higher sales programs. BRP said the decrease was partially offset by favorable pricing and product mix across most product lines and a decrease in material and logistics costs due to more efficiencies in the supply chain. The decrease in gross profit includes an unfavorable foreign exchange rate variation of $12 million.

Operating expenses increased by $123.6 million, or 35.2 percent, to $474.3 million for the fourth quarter, compared to $350.7 million in the prior-year comparable period. The increase in operating expenses was mainly attributable to the impairment charge recorded during the fourth quarter of Fiscal 2024 for the Marine segment. The increase in operating expenses includes an unfavorable foreign exchange rate variation of $6 million.

Normalized EBITDA decreased by $123.5 million, or 23.4 percent, to $404.5 million for the three-month period ended January 31, 2024, compared to $528.0 million for the three-month period ended January 31, 2023. The decrease was primarily due to lower gross profit and higher operating expenses, even when excluding the impairment charge related to the Marine segment.

Net income decreased by $176.9 million, or 48.5 percent, to $188.2 million for the Fiscal 2024 fourth quarter, compared to $365.1 million for the Fiscal 2023 fourth quarter. BRP said the decrease was primarily due to a lower operating income, resulting from the impairment charge related to the Marine segment recorded during the fourth quarter of Fiscal 2024, and an increase in financing costs, partially offset by a favorable foreign exchange rate variation on the U.S. denominated long-term debt, a lower income tax expense and an increase in financing income.

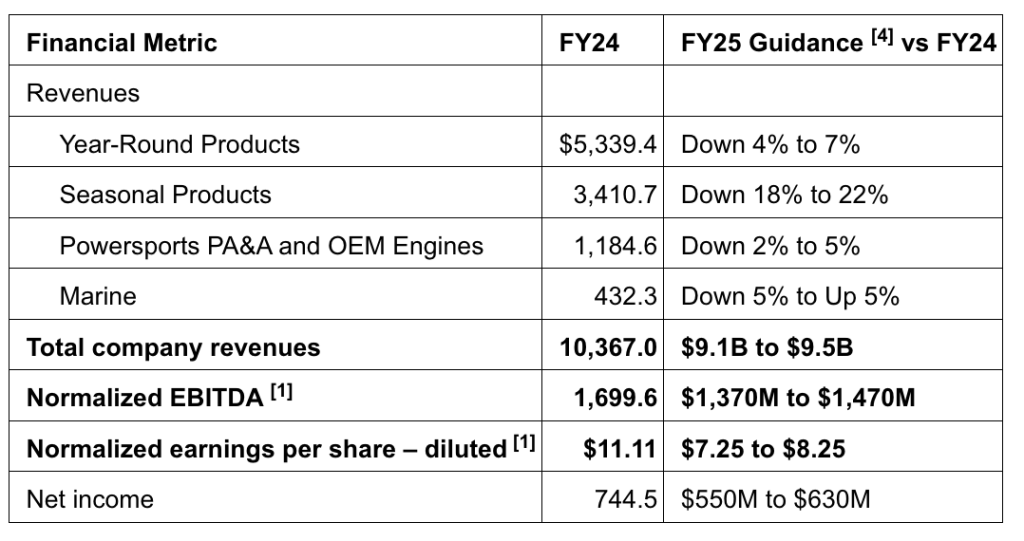

Fiscal 2024 Full-Year Highlights

- Increased revenues by 3.3 percent compared to last year, reaching a record high of $10,367.0 million;

- Net income of $744.5 million, a decrease of $120.9 million or 14.0 percent compared to last fiscal year;

- Reached revised FY24 guidance with Normalized diluted earnings per share of $11.11, a decrease of $0.94 per share or 7.8 percent. Diluted earnings per share of $9.47;

- Continued to gain market share as North American Powersports retail sales increased by 8 percent compared to the same period last year, while the industry increased by 1 percent;

- Delivered record free cash flow of over a billion dollars, allowing for strong returns to shareholders with $501.8 million deployed for share repurchases and dividend payments.

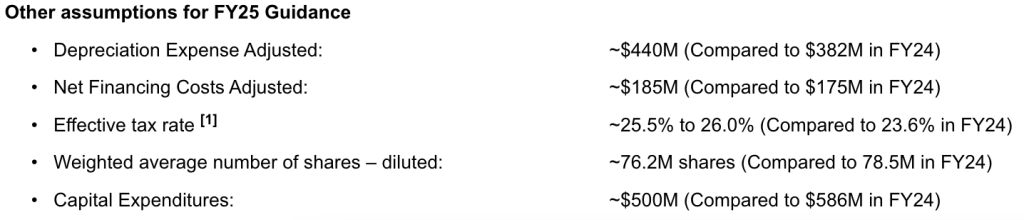

Fiscal 2025 Guidance

BRP, Inc. established its Fiscal 2025 guidance as follows, which supersedes all prior financial guidance statements made by the company, including the long-term financial targets which were previously issued by the company in connection with its strategic five-year plan referred to as Mission 2025:

First Quarter EBITDA

Given its focus on managing network inventory levels, the company expects Q1 Fiscal 2025 Normalized EBITDA to be down approximatively 35 percent versus the same three-month period last fiscal year.

Image courtesy Ski-Doo