The star for Skechers USA Inc. during Q1 was  its international segment, which generated high double-digit growth. But the company was also pleased with the 3.5% growth in domestic wholesale net sales despite the soft retail climate. Skecher's key lines – Active and Sport for men and women – delivered double-digit sales growth domestically, as well as Kids Street Fashion. An aggressive advertising spend up 10% over last year in Q1 – helped drive the gains. Growth also came from Mark Nason. Sales of Mark Ecko and Zoo York were down, but margins improved.

its international segment, which generated high double-digit growth. But the company was also pleased with the 3.5% growth in domestic wholesale net sales despite the soft retail climate. Skecher's key lines – Active and Sport for men and women – delivered double-digit sales growth domestically, as well as Kids Street Fashion. An aggressive advertising spend up 10% over last year in Q1 – helped drive the gains. Growth also came from Mark Nason. Sales of Mark Ecko and Zoo York were down, but margins improved.

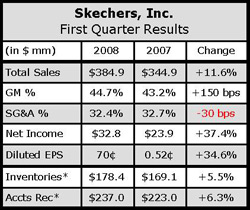

The improvements led Skechers to post its highest quarterly net income in the companys history.

Internationally, wholesale sales improved 39% for Q1, driven by growth at its subsidiaries in Europe, Canada and Brazil. For the quarter, subsidiary sales improved 70%. Five of its seven European subsidiaries had very strong double-digit growth, while the other two, France and Switzerland, had triple-digit growth. Brazil, its newest region, also showed strong potential. Distributor sales, approximately 25% of the Skechers international wholesale business, were down 10%, primarily due to some inventory issues in Central and South America, which are being rectified and bookings are improving. Overall, international represented 27% of total sales for the quarter.

Regarding retail, combined retail sales for company-owned domestic and international stores were up nearly 7% due to a net 35-store increase partially offset by a mid-single digit decrease in net comp sales. Net domestic retail sales increased almost 6%; net international retail sales improved 20%. At the quarter's close, SKX had 179 company-owned stores in the U.S. and 16 internationally. It plans to add 25 to 30 domestic stores this year and also pursue international locations.

Given the difficult retail climate, Skechers now expects Q2 revenues ranging from $350 million to $365 million and earnings per share in the range of 30 cents to 38 cents. In the 2007 second quarter Skechers earned 32 cents on sales of $352 million.

The projections reflect a “solid” international performance and a decrease in domestic wholesale revenues. Overall backlogs are up in March 2007, but the company is booked heavier for the third quarter. As such, management expects to have “a stronger Q3 than Q2.”