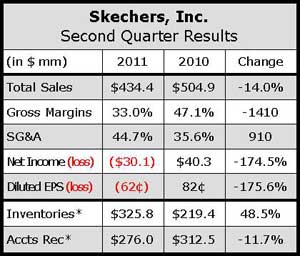

Stung by heavy clearance sales to right-size toning inventories, Skechers USA, Inc. posted a net loss of $29.9 million, or 62 cents a share, in the second quarter. Sales slid 14.0 percent to $434.4 million.

On a conference call with analysts, company COO and CFO David Weinberg said Skechers aggressively reduced its toning inventory by selling two million pairs of its original Shape-Ups for a loss of $21 million.

It also recorded an additional $4.4 million reserve to reflect the net realizable value of its remaining toning product. The two moves reflected a loss of 31 cents per share and a reduction in gross margins from 47.1 percent of sales in Q2 last year to 33 percent this year.

“We feel this was a big step in reaching our goals for the year, which include right sizing our inventory, bringing new product to the market, and getting our overhead in line with anticipated 2012 sales,” said Weinberg.

“We feel this was a big step in reaching our goals for the year, which include right sizing our inventory, bringing new product to the market, and getting our overhead in line with anticipated 2012 sales,” said Weinberg.

Domestic wholesale revenues were down 32 percent due to tough comparisons and clearance efforts. Skechers experienced double-digit growth domestically in its kids footwear, growth in several fitness lines, and solid sales in several of its core lines.

Internationally, wholesale revenues grew 35 percent in the quarter, led by toning performance, casuals, and kids footwear. Italy grew triple-digits in the quarter while its joint ventures drove growth across Asia. Canada was down slightly due to toning weakness. International represented 28 percent of the business in the quarter.

In the company-owned retail business, domestic sales were flat while international retail increased 42 percent for a combined 4 percent increase for the quarter. Comps were down 10.2 percent domestically while inching up 0.3 percent internationally. At quarter-end, SKX had 305 company-owned stores, including five Skechers fitness stores.

Besides margin pressures, the bottom-line was hurt by an increase in SG&A expenses to 32.2 percent of sales from 25.2 percent due to a combination of increased rent from a retail expansion of 43 stores, increased warehouse and distribution costs, and R&D expenses for some new product initiatives.

To help revive domestic sales, Skechers restructured its sales force to create a fitness team and a team to handle its lifestyle and core product. It also leveraged its toning experience to develop new lightweight running and walking lines. Weinberg said initial sell-through of the fitness product in Skechers own stores in the quarter have been strong. Said Weinberg,

“We are now delivering these lines to our wholesale accounts across the country, as well as to our international subsidiaries and distributors, and believe that they will sell well based on early feedback.”