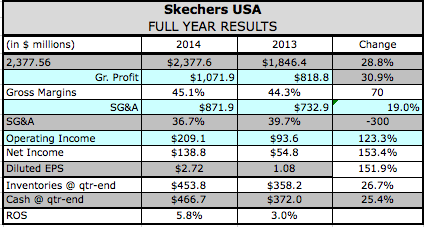

Capping off a strong bounce-back year, Skechers USA reported earnings rose 54.7 percent the fourth quarter, to $21.9 million, or 43 cents a share. Revenues jumped 26.4 percent to $569.7 million.

Capping off a strong bounce-back year, Skechers USA reported earnings rose 54.7 percent the fourth quarter, to $21.9 million, or 43 cents a share. Revenues jumped 26.4 percent to $569.7 million.

HIGHLIGHTS

Double-digit improvements in the quarter in its domestic and international wholesale and Skechers company-owned retail businesses;

Ended the year as the leading walking footwear brand in the U.S. and the No. 2 footwear brand;

International, representing 34.5 percent of total sales, is expected to reach half of revenues in the next three to four years;

Worldwide backlogs are up 60 percent at Dec. 31.

Earnings were in line with Wall Street’s consensus estimates. The period was negatively impacted by approximately $7.0 million, or 14 cents a share, in charges, of which $4.7 million, or 9 cents, was the result of negative foreign currency translations and transactions and $2.3 million, or 5 cents, was the result of foreign and domestic bad debt write-offs.

Gross margins in the quarter improved to 45.2 percent compared to 44.5 percent while SG&A expenses were trimmed to 39.8 percent of sales from 41.4 percent.

In its domestic wholesale segment, Q4 sales jumped 24.3 percent, or $46.9 million, David Weinberg, COO and CFO, said on a conference call with analysts. Pairs grew 15.7 percent and average price per pair gained 7.4 percent. For the year, domestic sales increased 24.4 percent on an increase of 19.1 percent in pairs shipped and 4.4 percent in average price per pair.

Double-digit increases in the quarter in the domestic wholesale business were seen in women's and men's footwear. Double-digit increases came ins men's and women's' Skechers Sport, Skechers U.S.A. and Skechers Work line and its women’s Sport Active, GO and women's winter boots. A single digit gain was seen in its women’s On The Go line.

Its Relaxed Fit business was aided by commercials featuring Pete Rose, Joe Namath, Joe Montana and Brooke Burke. A Ringo Starr Relaxed Fit commercial will start running this spring and one starring Mariano Riviera will run later this year.

Key drivers in its performance area were updates to its GOWalk platform, including a “successful” Super Sock introduction and the GOWalk 3 launch. GOWalk was also expanded to teen girls. GORun was aided by the GORun 4 launch at the New York City Marathon and marketing campaigns featuring Meb Keflezighi and Kara Goucher.

Said Weinberg about the domestic wholesale outlook, “Based on a domestic wholesale backlog and our continued focus on delivering innovative product and relative marketing, we believe we will again achieve strong gains in 2015.”

Its total international subsidiary joint venture and distributor sales climbed 37.9 percent in the quarter. Subsidiary and joint venture sales improved 41 percent and distributor sales grew 31.3 percent.

Europe grew 38.3 percent for the quarter and 50 percent for the year. The U.K. led the way and surpassed $100 million in sales for the year. Several distributors in Central Eastern Europe are being converted to a wholly owned subsidiary to spur Europe’s growth by 2016. Chile had double-digit sales increases in the quarter despite currency losses.

Its Southeast Asia joint ventures business saw combined growth of 59.9 percent for the quarter, which includes increases in China of 129 percent. China is expected to become well over a $100 million business in 2015.

The international distributor gain was led by triple-digit growth in the Middle East as well as double-digit growth for inn Australia, New Zealand, Mexico, the Panama region, Philippines, Scandinavia, South Korea and Taiwan. Concluded Weinberg on international, “With double-digit backlog increases, the strong growth planned in many countries including the UK, China and the UAE, we believe this momentum will continue through 2015.”

Worldwide sales in its company-owned retail stores increased 22 percent for the quarter with domestic sales growing by 15.5 percent and international sales by 56 percent. This included positive comp store sales of 6.7 percent domestically and 19.1 percent in its international stores for a total of 8.6 percent comp store sales increase worldwide.

It expects to have 500 company-owned store milestone by year-end, up from 449 company-owned Skechers at the end of the quarter. Skechers expects to reach 700 international stores in the first quarter. Including distributors and licensees, it expect to have approximately 1,250 Skechers stores around the world at year-end 2015.

Skechers expects sales in the first quarter to range between $690 and $710 million and EPS to range between 95 cents to $1.05. That compares with sales of $546.5 million on EPS of 61 cents a share in the same period a year ago.