Skechers USA, Inc. said sales for the fourth quarter of 2008 ended Dec. 31 were

$298.1 million compared with $302.0 million a year ago, a decline of 1.3%. The loss was $20.4 million, or 44 cents a share, versus

net earnings of $12.1 million, or 26 cents a year ago.

On Feb. 9, Skechers had warned that net sales for its fourth quarter would be in the range of $290 million to

$300 million and a net loss per diluted share of 45 cents to 50 cents. Prior to that, SKX had

previously forecast Q4 sales in the range of $305 million to $320 million, and

EPS in a range of 15 cents to 23 cents a share.

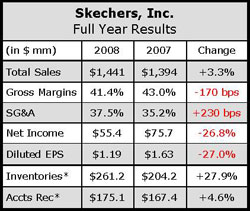

Fiscal year 2008 net sales for the period ended Dec. 31, 2008 increased 3% to $1.44 billion as compared to net sales of $1.39 billion in 2007. Net earnings for 2008 were $55.4 million versus net earnings of $75.7 million in 2007. For fiscal year 2008, diluted earnings per share were $1.19 based on 46,708,000 weighted average shares outstanding versus diluted earnings per share of $1.63 based on 46,741,000 weighted average shares outstanding in the prior year.

“Skechers 2008 net sales of over $1.4 billion represent a new record, a significant achievement in a year marked by a rapidly weakening global economic environment,” stated CFO Fred Schneider. “Despite the record yearly sales, we saw a shortfall in earnings in the fourth quarter primarily due to a decrease in gross margin of approximately 1,000 basis points from the same period last year. The decrease in gross margin is a direct result of the extremely weak retail climate, which caused a significant decline in U.S. retailers comps as well as a number of both retail bankruptcies and going out of business sales. Due to these declining economic conditions, we began to manage our inventory levels down at reduced prices and increased our reserves by over $15 million. As we complete this process, we expect to see our gross margin percentage return to its historic levels of over 40% later in 2009.”

Gross profit for 2008 was $595.9 million compared to $600.0 million in 2007. Gross margin for 2008 was 41.4%versus 43.0 percent for 2007. Gross profit for the fourth quarter of 2008 was $95.0 million compared to $127.3 million in the fourth quarter of 2007. Gross margin in the fourth quarter 2008 was 31.9% versus 42.1% for the fourth quarter of 2007.

CEO Robert Greenberg commented, “For Skechers, 2008 was a year of achievements with several new brands added to our fold, record sales, and meaningful growth in our international business. We continue to see the international arena as an opportunity to further grow our business, and are pleased with the continued solid performance of many of our Skechers and fashion brands in both the domestic and international markets. We are continuing to develop fresh styles in our more well-established lines and look forward to our first full year of footwear from Bebe Sport, Punkrose, and the emergence of TapouT footwear in sport retailers and with specialty chains, and other key accounts. Our product remains affordable, fashionable and relevant, offering a great value in the current marketplace. While the macro-economic environment remains challenging, we believe we will continue to be an increasingly important brand around the world given our on-target product, diversified distribution and team of talented people and dedicated partners.”

“In 2008, the economic downturn adversely affected our domestic and, to a lesser degree, our international business,” said COO David Weinberg. “We believe the economy will continue to have a negative impact on the retail industry for the foreseeable future, and the demand for consumer goods will be reduced. In the first half of 2009, we are focusing on reducing our inventory levels and expenses while maintaining our strong domestic and international presence in this difficult economic environment, which will result in us breaking even in the first half of 2009. As our inventory levels come more in line with our current expected sales and backlog, we believe we will return to profitability in the second half of 2009, and achieve annual revenues between $1.2 billion and $1.3 billion. With a strong balance sheet and portfolio of brands, we remain confident that Skechers is well-positioned for sustainable long-term profitability.”

|

SKECHERS U.S.A., INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

|

| |

|

|

|

December 31,

2008

|

|

December 31,

2007

|

| ASSETS |

| Current Assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

114,941 |

|

$ |

199,516 |

| Short-term investments |

|

|

– |

|

|

104,500 |

| Trade accounts receivable, net |

|

|

175,064 |

|

|

167,406 |

| Other receivables |

|

|

7,816 |

|

|

10,520 |

| Total receivables |

|

|

182,880 |

|

|

177,926 |

| Inventories |

|

|

261,209 |

|

|

204,211 |

| Prepaid expenses and other current assets |

|

|

31,022 |

|

|

13,993 |

| Deferred tax assets |

|

|

11,955 |

|

|

8,594 |

| Total current assets |

|

|

602,007 |

|

|

708,740 |

| Property and equipment, at cost less accumulated depreciation and amortization |

|

|

157,757 |

|

|

98,400 |

| Intangible assets, less applicable amortization |

|

|

5,407 |

|

|

78 |

| Deferred tax assets |

|

|

18,158 |

|

|

13,983 |

| Long-term investments |

|

|

81,925 |

|

|

– |

| Other assets, at cost |

|

|

11,062 |

|

|

6,776 |

| TOTAL ASSETS |

|

$ |

876,316 |

|

$ |

827,977 |

| LIABILITIES AND STOCKHOLDERS EQUITY |

| Current Liabilities: |

|

|

|

|

| Current installments of long-term borrowings |

|

$ |

572 |

|

$ |

437 |

| Accounts payable |

|

|

164,643 |

|

|

164,466 |

| Accrued expenses |

|

|

23,021 |

|

|

19,949 |

| Total current liabilities |

|

|

188,236 |

|

|

184,852 |

| Long-term borrowings, excluding current installments |

|

|

16,188 |

|

|

16,462 |

| Minority interest |

|

|

3,199 |

|

|

– |

| Stockholders equity |

|

|

668,693 |

|

|

626,663 |

| TOTAL LIABILITIES AND STOCKHOLDERS EQUITY |

|

$ |

876,316 |

|

$ |

827,977 |