Just as snow sports reps began hitting the road to show lines and take orders for next winter, Snowsports Industries America reported industry retail sales rose 9% to $506.8 million in the August to October period.

However, reps would be well served to break that number down before making any promises to their brands.

Growth was concentrated in carryover equipment, gear for juniors and accessories and most of it came online, according to the SIAs preseason top-line report.

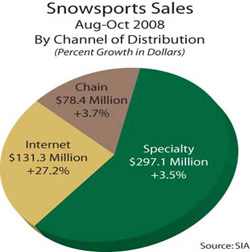

Online sales rose an astounding 35.7% in units and 27.2% in sales, two to three times the overall rate of growth for e-commerce in recent months. By comparison, sales at specialty stores rose a very respectable 2.3% in units and 4.0% in sales. Chains stores managed a 3.5% increase in sales on a 5.9% increase in units mainly on the strength of apparel sales, where YOY growth approached the teens. Alpine skis sales rose 2%, while snowboard equipment sales rose 11%. Apparel sales were up 14% in units and 9% in dollars, again indicating strong sales on discounted prices. Accessories, including helmets and goggles, were particularly strong while auto racks and snowshoe sales declined.

The numbers reflect that while many remain committed to their snow sport, they are behaving more frugally and getting much more comfortable buying fitted product online. Sales of carryover alpine boots, for example, rose nearly four-fold over the same period a year ago. In the chain channel, where alpine ski and snowboard sales tanked, sales of Nordic ski gear rose in the mid- to high-double digits. How much of that is due to chain stores carrying less alpine gear and how much is due to Americans favoring the trails over a $50 to $80 lift ticket is unclear. Growth in dollar sales of accessories, which retailers wisely loaded up on in anticipation of the recession, approached the teens. The most dramatic growth, however, occurred in carryover product, where dollar sales rose in the high double digits.

“Snow sports shoppers went out looking for bargains and they were willing to buy when they found them,” said Kelly Davis, director of research for SnowSports Industries America, the not-for-profit industry trade group that represents manufacturers and distributors of snow sports products.

Kelly said that observation was backed up in survey panels in which consumers said they were not planning to cut back on trips, but were watching their spending on gear and apparel closely.

The data, which is based on POS data from 1,200 snow sports dealers, did not break out growth by month, so it was unclear how much sales have slowed since mid-September when the financial crisis worsened. The most recent government data estimate sales by sporting goods and leisure stores rose 2.2% in October, compared to 1.6% overall.

The SIA does not expect to release November sales estimates until the first week of January, but Kelly said she expects they will slow considerably.

Nor do the data include results from resort retail shops, which dont begin selling snow sport gear in significant numbers until December. Vail Resorts Inc. last week reported its retail/rental sales declined 4.7% in the first quarter ended Oct. 31 to $22.4 million, due mainly to lower sales along Colorados Front Range. Those sales reflect Vail Resorts 69.3% interest in SSI Venture, LLC. The companys 140 stores are concentrated in western mountain resorts where tourists dont begin arriving until around Christmas.

More foreboding was the news that advance bookings at its mountain resorts were off 23%. The company said that if they did not improve it would have to lower its guidance for the current fiscal year. “Great recent snowfall” in Colorado the last two weeks has spurred booking activity, but last week executives said it is still too early to see how much ground they can make up.

In a conference call with analysts, CEO Rob Katz said that while it appears bookings for the whole season will decline more than the 5% experienced during the 2001 recession, people are also booking their trips much closer to their arrival dates, making it hard to estimate what will happen. Vail Resorts disclosed early last week that it is cutting 50 year-round positions and leaving another 92 positions unfilled in an effort to cut costs. In late November, rival Intrawest confirmed it was making an undisclosed number of layoffs at its ski resorts, which span from New England to British Columbia.

The good news is that Vail Resorts season pass sales rose 29%, boosted by its new Epic Season Pass, which offers unrestricted and unlimited access to the companys five ski resorts. While aimed primarily at more profitable destination guests, Katz said the passes sold well in Colorado and that he expects drive-in business to increase as a percentage of overall business there this season.

The SIAs data shows much of the sales growth in the first half of the season was driven by sales of carryover product, which they defined as any item that sells for less than the average retail cost for that item.

Carryover accounted for 28% of skis, 23% of snowboards, 24% of ski boots, and 26% of snowboard boots sold August to October 2008. By comparison, it accounted for just 16% of skis and 19% of snowboards sold and millions fewer dollars spent during the same period a year earlier.

The numbers back up reports of steady attendance and brisk sales at consumer ski shows across the country, where local dealers offer gear for discounts of 40% to 70% on the prior years gear.

Retailers that dont carry older product may not have fared so well.

At New Canaan Ski and Sport, which has stores in Fairfield and Ridgefield, CT, business has been “considerably slower” than last year, according to owner Susan Alberino. Traffic at the stores was very light in October and customers merely looked in November. Only this month did they start buying, she said. The store specializes in upscale brands including ArcTeryx, Bogner and M. Miller apparel and the latest skis and snowboards. If things dont improve soon, she said she will hold back pre-season orders for next year except on top-selling brands.

“We are at ground zero,” she said of her markets proximity to the loss of thousands of jobs on Wall Street. “To go out now, when you have a store full of merchandise and look at a new line, that is not going to be much of an option.”

SIA also reported strength in childrens gear and apparel, indicating that while parents may be foregoing a new pair of skis this year, they are still spending on their kids, which may outgrow last years equipment and apparel. Junior ski sales were up 34% in dollars, junior snowboard sales increased 17% in dollars, junior parka sales were up 16% in dollars and sales of junior snow suits increased more than 40% in units and in dollars.

In Hinsdale, IL, King Keyser Ski and Snowboard sold out the 400 spots in its Kids program in the month of October, the quickest in 44 years of running the program. “In this area parents are willing to spend money on kids to keep them involved throughout course of winter time,” said owner Rick Johnson. “If they are not involved in school sports there is not a whole lot of extra activities.”

Still, Johnson described sales as flat with last year and said he canceled orders that did not show up by Oct. 1 as well as some fill-in orders for fleece and other basics that were due for delivery in mid November. “A lot of vendors will continue to push merchandise out door past cancellation date,” Johnson said. “We stuck to our guns this year.”

By contrast, Alberino said he has been unable to reorder some apparel items. “We are finding Bogner and M. Miller the high-end companies – are very lean as far as reordering. These companies just did not produce as much as in the past.”

In Lansing, MI, meanwhile, the Midwest Reps Associations first ever December show drew buyers fro 65 stores despite some icy weather, said Bonnie Rathbun. She said 40 reps took 72 booth spaces at the event to show lines for winter 2009-10.

“The fax was busy all day and people were around the computers,” she said. “It was great.”