Shoe Carnival, Inc. reported a sharp increased in fourth-quarter earnings exceeded its guidance. Comparable-store sales jumped 9.5 percent driven by broad based gains across all footwear categories and helped by favorable weather.

Shoe Carnival, Inc. reported a sharp increased in fourth-quarter earnings exceeded its guidance. Comparable-store sales jumped 9.5 percent driven by broad based gains across all footwear categories and helped by favorable weather.

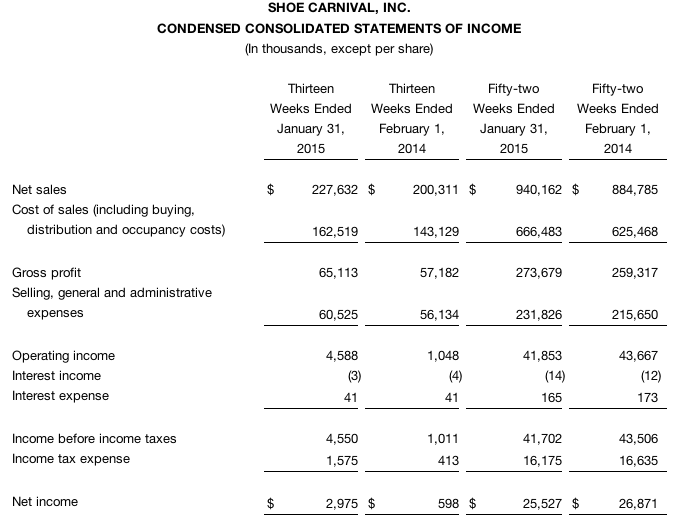

Fourth Quarter Highlights

- Net sales increased $27.3 million to $227.6 million, compared to the fourth quarter of fiscal 2013

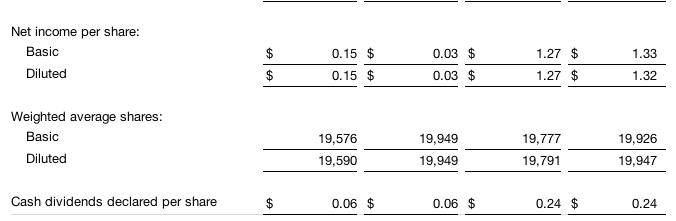

- Comparable store sales increased 9.5 percent in the fourth quarter of fiscal 2014, exceeded the company’s guidance for the quarter

- Earnings per diluted share were 15 cents a share, exceeded the company’s guidance for the quarter

- Per-store inventories were down 5.0 percent at the end of the quarter, compared to the fourth quarter of fiscal 2013

“We were pleased with our strong comparable store sales performance in the fourth quarter driven by broad based gains across all of our footwear categories. Although favorable weather played an important role in our strong performance, we believe our key initiatives of national advertising, better brands in our women’s department and aggressive multi-channel initiatives continued to bring new customers to our stores, e-commerce site, and mobile touchpoints,” commented Cliff Sifford, President and CEO.

Fourth Quarter Financial Results

The company reported net sales increased 13.6 percent to $227.6 million for the fourth quarter of fiscal 2014, compared to net sales of $200.3 million for the fourth quarter of fiscal 2013. Comparable store sales increased 9.5 percent in the fourth quarter of fiscal 2014.

The gross profit margin for the fourth quarter of fiscal 2014 increased to 28.6 percent compared to 28.5 percent for the fourth quarter of fiscal 2013. The merchandise margin decreased 0.4 percent while buying, distribution and occupancy expenses decreased 0.5 percent, as a percentage of sales.

Selling, general and administrative expenses for the fourth quarter increased $4.4 million to $60.5 million. As a percentage of sales, these expenses decreased to 26.6 percent compared to 28.0 percent in the fourth quarter of fiscal 2013.

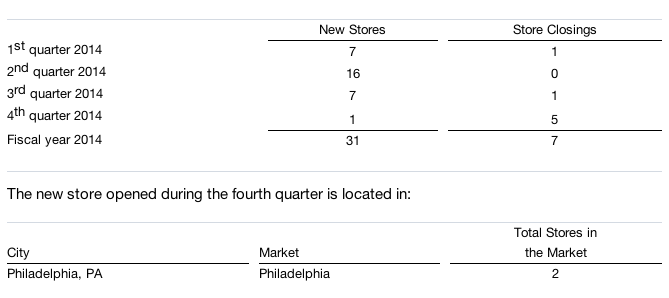

The company opened one new store during the fourth quarter of fiscal 2014 compared to three stores in the fourth quarter of fiscal 2013.

Net earnings for the fourth quarter of fiscal 2014 were $3.0 million, or 15 cents per diluted share. For the fourth quarter of fiscal 2013, the company reported net earnings of $0.6 million, or 3 cents per diluted share. Fourth quarter earnings for fiscal 2014 includes approximately 3 cents of additional expense within cost of sales attributable to the west coast port congestion.

Fiscal Year 2014 Financial Results

Net sales increased 6.3 percent to $940.2 million for fiscal 2014, as compared to net sales of $884.8 million for fiscal 2013. Comparable store sales for the 52-week period ended January 31, 2015 increased 1.8 percent. Net earnings for fiscal 2014 were $25.5 million, or $1.27 per diluted share, compared to net earnings of $26.9 million, or $1.32 per diluted share, in the last fiscal year.

Gross profit increased to $273.7 million in fiscal 2014. The gross profit margin in fiscal 2014 decreased to 29.1 percent from 29.3 percent in the prior fiscal year. Merchandise margin remained flat between years while buying, distribution and occupancy costs, as a percentage of sales, increased 0.2 percent.

Selling, general and administrative expenses, as a percentage of sales, were 24.6 percent for fiscal 2014 compared to 24.4 percent last year. The company opened 31 stores during fiscal 2014 as compared to 32 stores in the prior year.

Speaking on the results, Cliff Sifford, company president and CEO, said, “I am proud of our entire Shoe Carnival team who worked hard to deliver great product and excellent customer service helping us to exceed our fourth quarter guidance and achieve record annual sales. I am also excited with our customers’ willingness to increasingly embrace our multi-channel shopping experience with increased traffic on-line and in our stores.”

Store Growth

During fiscal 2014, the company opened 31 new stores and closed seven to end the year at 400 stores. One store was opened and five were closed in the fourth quarter of fiscal 2014. Total retail selling space increased to 4.4 million square feet at the end of fiscal 2014 from 4.1 million square feet at the end of fiscal 2013.

Store openings and closings by quarter for the fiscal year were as follows:

In fiscal 2015, Shoe Carnival expects to open 18 to 22 new stores, relocate two stores and close 11 stores. During the first quarter of fiscal 2015, the Company expects to open seven stores, relocate one store and close six stores. In the first quarter of fiscal 2014, the Company opened seven stores, relocated two stores and one store was closed.

Share Repurchase Program

For the fiscal year ended January 31, 2015, approximately 405,000 shares were repurchased at an aggregate cost of $7.5 million under the company’s share repurchase program. On December 11, 2014, the company’s Board of Directors authorized a new share repurchase program for up to $25 million of its outstanding common stock, effective January 1, 2015. The new share repurchase program replaced the existing $25 million share repurchase program that was authorized in August 2010, which expired in accordance with its terms on December 31, 2014.

Fiscal 2015 Earnings Outlook

Shoe Carnival expects fiscal 2015 net sales to be in the range of $977 million to $991 million, with a comparable store sales increase in the range of 1.5 to 3.0 percent. Earnings per diluted share for the fiscal year are expected to be in the range of $1.40 to $1.48. This represents an increase of 10 to 17 percent over fiscal 2014 earnings per diluted share of $1.27.