Shoe Carnival’s first-quarter fell short of expectations due to chilly weather and the family shoe chain also issued a poor outlook for the second quarter.

Shoe Carnival’s first-quarter fell short of expectations due to chilly weather and the family shoe chain also issued a poor outlook for the second quarter.

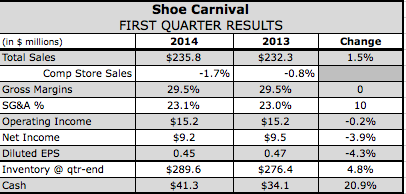

Earnings in the quarter slid 3.2 percent to $9.2 million, or 45 cents a share, on the low end of its guidance calling for earnings of 45 cents to 52 cents a share. Sales inched up 1.5 percent to $235.8 million. Guidance called for revenues between $232 million to $241 million.

On a conference call with analysts, Cliff Sifford, president, CEO and chief merchandising officer, said sales during the first five weeks of the quarter were disrupted with winter storms that negatively affected traffic across the chain. However, more seasonal weather conditions and a later Easter during the second half of the quarter helped limit the comp decline to a decrease of 1.7 percent.

Traffic for the quarter was down low double-digits, but a strategy of bringing in better department store brands led to an increase in average unit retail and average transaction by mid single-digit. Conversion and units per transaction were up low single-digits.

Merchandise margins increased 50 basis points despite increased promotional activity around Easter to liquidate certain slow sellers. Gross margin was basically flat at 29.5 percent.

Sifford said Shoe Carnival was still unable to leverage its expense structure under its lower comparable store sales to come in at the low end of guidance.

Among categories, women's non-athletic comps were down low single-digits. Dress shoes continued to decline due to strength in canvas casuals, flat sandals, and, thanks to the weather, boots. Men’s non-athletic comps were down mid-single digits department, impacted by high single-digit comp growth in boots. Children's non-athletic comps increased low single-digits, driven primarily by sandals and canvas. In athletics, comps for both adults and kids combined were slightly negative for the quarter. Strong categories were boy's basketball, kid's canvas, running for men and women, along with men's skate.

Sifford said the off-pricer saw “immediate results” from the launch of its first ever national cable television ad campaign, which started running in the first week of April. It led to a “strong peak in both on-line's traffic and sales.” Major cities across the US, where Shoe Carnival doesn’t currently operate brick and mortar stores, are now top 10 traffic producers through its e-commerce site. Overall, e-commerce increased during the quarter.

Shoe Carnival added almost 800,000 new members to its Shoe Perks customer loyalty program in the quarter, and are on track to double its membership from 2013 to over 6 million members. For the first quarter Shoe Perks customers accounted for more than 40 percent of its total sales.

Seven new stores opened in the quarter, ending with 382. It plans to add 30 to 35 for the full year.

Looking at the second quarter, Sifford said Shoe Carnival’s customer “continues to be effected by the microeconomic issues of higher fuel and utility costs, leftover from the harsh winter we all experienced. In addition, underemployment and unemployment continues to effect our middle to lower income customer base.”

Also, as part of its national advertising initiative, dollars were shifted from its traditional insert programs to a more aggressive television strategy, tied to drive sales around back-to-school and second half of the year.

As a result, sales, month-to-date, are currently running down mid single-digits. Said Sifford, “It is our belief, that with this trend and the current uncertain economic environment, we will need to be more promotional as we navigate through this quarter.”

The company forecasts net sales of $223 million to $228 million and earnings of 12 to 16 cents per share in the second quarter. Included in the earnings estimate is an increase in store pre-opening costs of about 5 cents due to the expectation of opening 16 stores in the quarter this year compared with opening eight stores in the second quarter of last year. Analysts had expected the company to earn 27 cents per share on revenue of $232.85 million for the quarter.