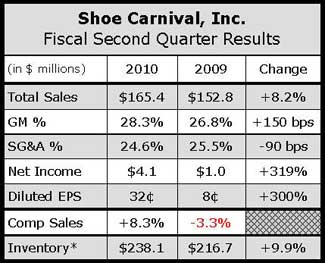

Shoe Carnival, Inc. reported a more than four-fold increase in its second quarter profit as comps climbed 8.3% for the period. The shoe store chain also outlined third quarter profit and sales forecasts that would meet or exceed analysts' expectations.

For the three months ended July 31, earnings reached $4.1 million, or 32 cents per share, up from a profit of $982,000, or 8 cents, in the comp quarter a year ago. The latest quarter included a gain of 4 cents per share from a favorable outcome on a state tax issue.

Traffic was up 4.7% helping comps and total unit sold increases in each merchandise category. Although the toning trend helped drive sales, comps would have still been up low-single-digits excluding the category.

In women's non-athletic, comps were up high-single-digits. Similar to the first quarter, this increase was driven primarily from summer sandals, with most of the sandal category selling at much higher rates than last year. The boot category recorded high-double-digit-comp growth despite record-breaking heat in most of Shoe Carnival's markets during June and July.

Men's non-athletic reported double-digit comp sales increases. driven primarily by sandals, vulcanized canvas, hiking, and work shoes. Children's comps were up in the low-single-digits as strength in girls fashion canvas, girls’ and boys’ sandals, and girls’ and boys’ running offset an underperformance in skate, fashion classic, and boys’ and girls’ athletic slip-ons.

In adult athletics, comps were up in mid-single-digits. Women's climbed high-single-digits, and men's grew low-single-digits. On a conference call with analysts, Cliff Sifford, company EVP & GMM said toning “continues to be an important category in our overall business,” and is expected to boost comps for the rest of 2010.

“Customers continue to respond positively to new technologies and younger silhouettes,” said Sifford. “In addition, new categories and technologies are being added to the mix as we move through fall. Shoe Carnival's key brands continue to market this product aggressively, which we expect to help keep the category in high demand.”

Inventories ended the quarter up 10.2% on a per-door basis, including toning, and up mid-single-digits on a per-door basis excluding toning. Said Sifford, “Aged inventory remains at an all-time low, and we were well-positioned with fresh new product in our stores in time for the all important back-to-school sales period.”

Through the first three weeks of August, comp sales increased about 6%, on top of an 11% rise in the same period last year. Non-athletic categories as a whole reported double-digit increases while athletic as a whole was up mid-single-digits. Sifford said Shoe Carnival is “very encouraged” by the early performance of boots in early BTS selling and the family shoe chain expects the category to again sit as the number one fashion trend of the season for men, women and children. Beyond new technologies and silhouettes, the toning/fitness trend is expected to be bolstered by Nike's entry into the mid-tier channel with its Free technology.

“We are referring to the combination of toning and Free as active to match the growing active lifestyle being promoted by all the key vendors, and embraced by the consumer,” said Sifford. “We remain optimistic that the active category will continue to show comparable store sales growth for the foreseeable future.”