Shoe Carnival, as expected, reported a sharp decline in second-quarter earnings due to a high-single digit decline of traffic in its stores. Although traffic picked up slightly with back-to-school season arriving, the family shoe chain disappointed investors by warning that it expects third-quarter earnings to decline on flattish comps.

Shoe Carnival, as expected, reported a sharp decline in second-quarter earnings due to a high-single digit decline of traffic in its stores. Although traffic picked up slightly with back-to-school season arriving, the family shoe chain disappointed investors by warning that it expects third-quarter earnings to decline on flattish comps.

Shares of Shoe Carnival, well off its 52-week high of $29.75 with past shortfalls, gave back $2.12, or 9.8 percent, to close at $19.41 for the four-day trading week.

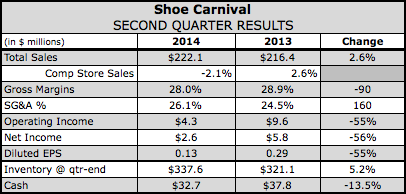

Revenues in the second quarter were up 2.6 percent to $222.1 million but comps dipped 2.1 percent. The traffic decline was partly blamed on the industry wide lack of fashion drivers in the non-athletic footwear side and consumer concerns amid an uncertain economic environment. A change in its circular advertising strategy also accounted for approximately half of its comp loss in the quarter.

Conversion, average units per transaction, average unit retail, and average transaction were all positive for the quarter. Merchandise margins were down 20 basis points as slower selling styles were marked down.

Gross profit decreased by 90 basis points as a percent of sales, while SG&A was deleveraged by 160 basis points as a percent of sales. Earnings slumped 55.7 percent, to $2.58 million, or 13 cents a share, within the companys guidance of 12 to 16 cents a share.

By category, women’s non-athletic for the quarter was down mid-single digits on a comp basis, driven by below-plan sales of sandals as well as declines in dress and boat shoes. The underperformance of sandals was addressed with liquidations and inventories in the category are down double-digits on a per store basis. Robust sales were seen in comfort casual, molded footwear, and canvas casuals.

Comparable store sales in our 108 brand stores, which are located in the higher income localities performed much better not only in women’s non-athletic department but also in the overall store sales results, said Cliff Sifford, president, CEO and chief merchandising officer, on a conference call with analysts. This initiative is working and we are continuing to roll it out to additional stores.

Men’s non-athletic saw a high-single digit comp decrease as gains in canvas casual classification was offset by declines in boat shoes and men’s sandals.

On the positive side, children’s delivered a low-single digit comp increase. Said Sifford, For girls, the quarter was all about canvas casuals and sandals. For boys, basketball, running, and canvas were the key categories.

In adult athletics, comps were up low-single digit for the quarter, led by a nice quarter in women’s running, men’s and women’s canvas and men’s cross-training.

Its Shoe Perks customers, again, accounted for more than 40 percent of its total sales, and the program remains on pace to reach 6 million members by the end of the year.

The shift in calendar was designed to support more aggressive national television push to pick-up traffic for the back-to-school season. Sifford said Shoe Carnival experienced an immediate improvement in traffic and sales once we began the back-to-school television campaign. As a result, after mid-single digit comparable sales declines for May and June, our July comp store sales were up 1 percent.

E-commerce sales increased in the period and the company continues to transition away from a third-party fulfillment arrangement to direct shipping from its own stores. The move will help vastly improve the selection of styles and ensure a depth of sizes available online, which should significantly improve conversion. The transition is running ahead of plan and expected to be completed by the end of the third quarter.

Shoe Carnivals first-ever mobile app will be launched in a few weeks tied to its Shoe Perks loyalty program to help the chain reach increasingly digital consumers. Said Sifford, I cant stress enough how important this initiative is as we navigate through the changing trends in marketing.

It opened a record 16 stores in the quarter-including reaching new markets in Buffalo, New York and Miami, FL-and expects to add another nine over the rest of the year to close with 405. A new real estate analytical software being implemented that will help Shoe Carnival identify best possible markets. For 2015, it expects 20 to 25 stores.

Inventory at the quarters close was down approximately 2.2 percent on a per store basis, in line with expectations. The chain is continuing to put pressure on our per store inventories in support of our strategic initiative to increase inventory turns.

Regarding back-to-school selling, August saw a comp increase of 0.8 percent while comps over the last seven weeks, which comprises BTS activity, were up 1.2 percent.

Canvas product was the category of the back-to-school season, with sales up 38 percent versus the same time period last year, said Sifford. This business accelerated at the expense of boat shoes and soccer slides.

Low single-digit comp store increases for the time period were realized in children’s, non-athletic shoes, and athletic footwear for the entire family. Canvas casuals along with skate and basketball performed well. Increases were also seen in women’s running, men’s cross-training, and men’s running.

For the third quarter, EPS is expected to come in the range of 45 to 51 cents a share, down from 54 cents a year ago and short of Wall Streets consensus estimate of 59 cents a share.

A comeback is expected for the fourth quarter. For the second half, EPS is expected to be in the range of 53 cents to 64 cents, compared to 57 cents in second half of last year.

Sifford said the conservative outlook reflects Shoe Carnivals finding that shoppers increasing have become event-driven.

Our back-to-school results show that when presented with an event like back-to-school, she shops, said Sifford. When the need is not as present, she is less active. We believe this is a result of the current economic environment our customer is facing today.

He added that the company was encouraged by the double-digit gains seen so far in boots during the BTS season but will still take the cautious approach with its guidance due to the lack of event sales driver in the current quarter. Said Sifford, We are looking at fourth quarter with more enthusiasm due to weather fueling boot sales and holiday sales.