Revolve Group, Inc.’s profits declined 55 percent in the second quarter ended June 30 as sales decreased 6 percent. The decline was attributed to a weakening in discretionary spending among its targeted Millennial and Gen Z customer base.

“Aspirational consumer discretionary spending remains challenging, particularly on goods in the U.S. for our younger customer demographic, which is evident in our second quarter financial results,” said Co-Founder and Co-CEO Mike Karanikolas. “Regardless of macroeconomic challenges, we remain on offense and our team continues to deliver great progress on several important growth and efficiency initiatives that we believe will further strengthen our foundation for market share gains and profitable growth over the long term.”

“I’m excited and energized by the momentum in our growth initiatives, and my confidence in the long-term is underscored by our $100 million stock repurchase program announced today,” said co-founder and co-CEO Michael Mente. “As REVOLVE’s largest stockholders holding nearly 45 percent of the outstanding common stock, Mike and I continue to see a significant runway for growth in the years to come.”

Additional Second Quarter 2023 Metrics and Results Commentary

- Trailing 12-month Active customers increased by 34,000 during the second quarter of 2023, growing to 2,458,000 as of June 30, 2023, an increase of 14 percent year-over-year.

- Net sales were $273.7 million, a year-over-year decrease of 6 percent.

- Gross profit was $147.7 million, a year-over-year decrease of 9 percent.

- Gross margin was 54.0 percent, a year-over-year decrease of 198 basis points, primarily reflecting a lower mix of net sales at full price in the second quarter of 2023 as compared to the second quarter of 2022.

- Net income was $7.3 million, a year-over-year decrease of 55 percent, primarily due to the decline in net sales, reduction in gross profit year-over-year and continued pressure on certain operating expenses.

- Adjusted EBITDA was $10.4 million, a year-over-year decrease of 61 percent.

- Diluted earnings per share (EPS) was $0.10, a year-over-year decrease of 55 percent.

Additional Net Sales Commentary

- Revolve segment net sales were $235.1 million, a year-over-year decrease of 4 percent.

- Fwrd segment net sales were $38.6 million, a year-over-year decrease of 15 percent.

- Domestic net sales were $222.9 million, a year-over-year decrease of 7 percent.

- International net sales were $50.9 million, a year-over-year increase of 4 percent.

Cash Flow and Balance Sheet

- Net cash provided by, used in, operating activities improved year-over-year to $(14.1) million in the second quarter and $34.7 million in the six-month year-to-date period, while free cash flow was $(15.1) million in the second quarter and $32.6 million in the six-month year-to-date period.

- Cash and cash equivalents as of June 30, 2023, were $269.3 million, an increase of $31.5 million, or 13 percent, from June 30, 2022, and a decrease of $14.0 million, or 5 percent, from $283.3 million as of March 31, 2023. Our balance sheet as of June 30, 2023, remains debt free.

- Inventory as of June 30, 2023, was $205.3 million, a decrease of $3.2 million, or 2 percent, from $208.5 million as of June 30, 2022.

Results Since the End of the Second Quarter of 2023

Net sales in July 2023 decreased by a mid-single-digit percentage year-over-year amidst continued soft trends in the U.S., where spending on consumer discretionary products remains relatively suppressed, particularly among our customer demographic.

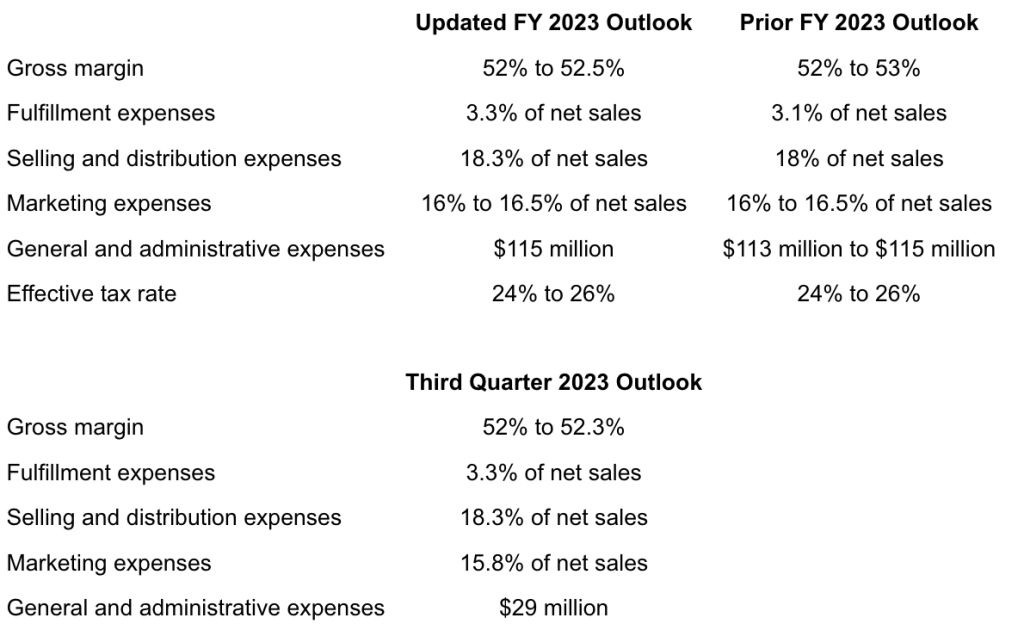

2023 Business Outlook

Photo/Chart courtesy Revolve Group