Global shipments for wearable devices returned to growth in the second quarter of 2023, reversing two quarters of decline, according to new data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker.

According to the IDC, the market grew 8.5 percent year-over-year, with shipments totaling 116.3 million devices. This growth came at the expense of overall market value as average selling prices (ASPs) fell due to increased competition and discounting by retailers looking to reduce excess inventory.

Competition outside the Top 5 companies has risen, allowing smaller companies to gain share in the past year. It has also given way to lesser-known form factors such as connected rings.

“While fitness tracking, such as steps taken and distances run, has been helpful in capturing the mainstream audience, many consumers are now clamoring for a more holistic approach to health tracking, paving the way for features such as sleep monitoring, recovery metrics, readiness scores, and stress level tracking,” said Jitesh Ubrani, research manager, Mobility and Consumer Device Trackers at the IDC. “This is where smaller brands, such as Oura, Whoop and Withings, have been able to carve out a niche, though many big-name brands and some local companies are closely eyeing this space and are expected to launch products in the coming months.”

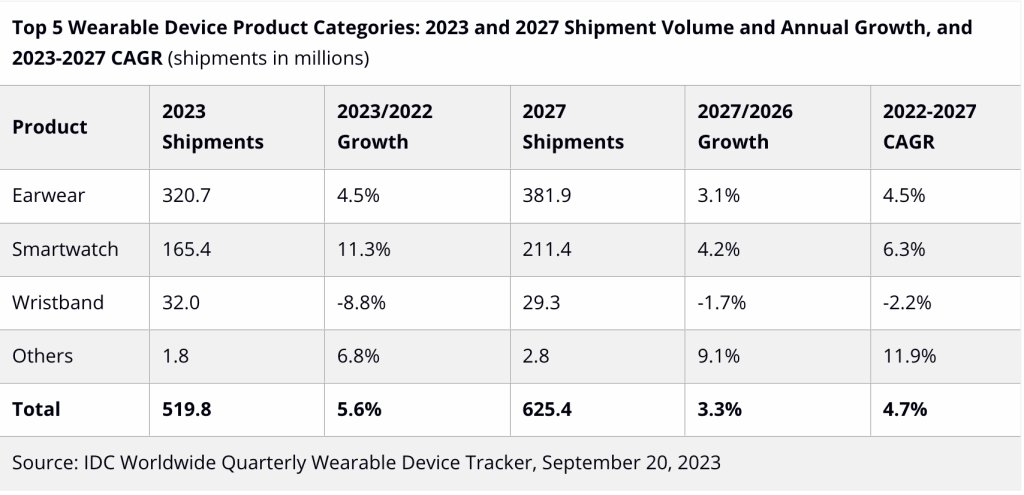

With growth returning this quarter, the IDC forecasted 520 million wearables would ship in 2023, up 5.6 percent from 2022. Hearables will be the top category, with nearly 62 percent shipping this year, followed by smartwatches with almost 32 percent of shipments. The IDC forecasted market share to grow to 625.4 million by the end of 2027, representing a 4.7 percent compound annual growth rate (CAGR).

“Most consumers think of popular brands like Apple, Samsung and Fitbit when it comes to wearables, and they would be correct,” said Ramon T. Llamas, research director with the IDC’s Wearables team. “But driving growth are numerous smaller companies that may not have the global aspirations as the market leaders, but instead focus on specific geographies such as China and India with fully featured devices that meet price expectations. Looking ahead, it isn’t too hard to imagine some of these brands being mentioned in the same breath as the world’s most popular ones or to imagine moving into adjacent markets where pent-up demand has yet to be fully satisfied.”

Photo courtesy of Apple, Inc.