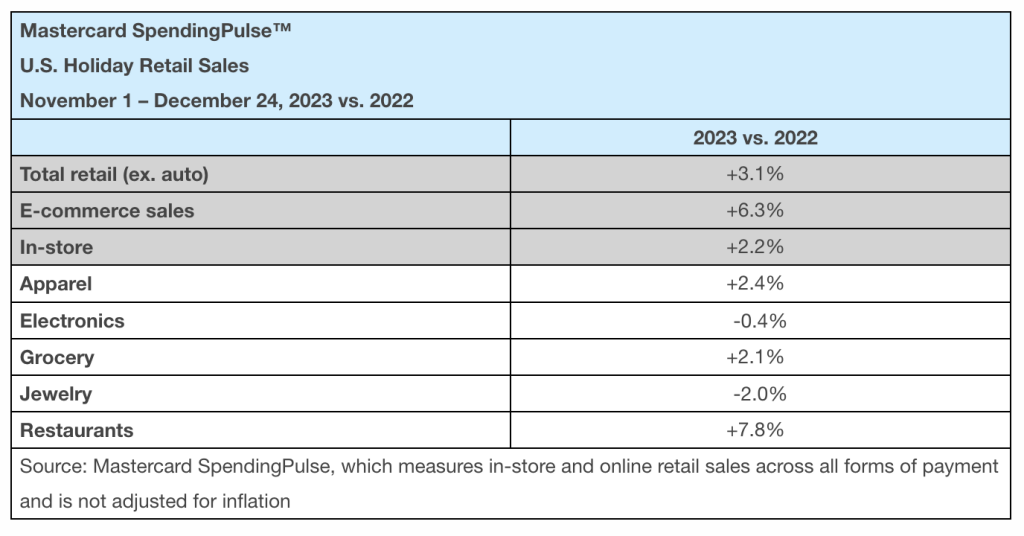

U.S. retail sales, excluding automotive, increased 3.1 percent year-over-year (YoY) this holiday season, according to a report from Mastercard SpendingPulse* measuring the period from November 1 through December 24. The results came at the low end of the National Retail Federation’s forecast growth in the 3 percent to 4 percent range and fell a bit short of Mastercard’s forecast calling for a 3.4 percent increase.

The results fell short of last year’s 7.6 percent gain and were roughly in line with inflation this year, suggesting flattish unit sales. Key retail trends this holiday season included:

Shopping Extravaganzas In-Store & Online

Online retail sales increased 6.3 percent YoY while in-store sales were up a more modest 2.2 percent YoY. Spending online is reportedly increased at a faster pace than in-store, taking a growing slice of the retail pie. ut shopping in-store continued to make up a larger portion of total retail spending, according to the Mastercard report.

Winter Wardrobe Wonderland

Apparel was one of the top categories for consumers this season as they shopped for new clothing for the holidays. The sector was up 2.4 percent YoY.

Season’s Eatings

Culinary celebrations continued as friends and families gathered in restaurants to ring in the holidays. The Restaurant sector was up 7.8 percent YoY, while Grocery was up 2.1 percent for the season.

“Retailers started promotions early this season, giving consumers time to hunt for the best deals and promotions,” said Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks, Inc. “Ultimately it was about getting the most bang for your buck as consumers spent on a variety of goods and services, resurfacing spending trends from before the pandemic.”

*Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment and is not adjusted for inflation.

Chart courtesy Mastercard SpendingPulse