Following a lull in April and May, the 2023 back-to-school (BTS) season is giving retail, and especially the wider apparel segment, a major boost, according to new data from Placer.ai.

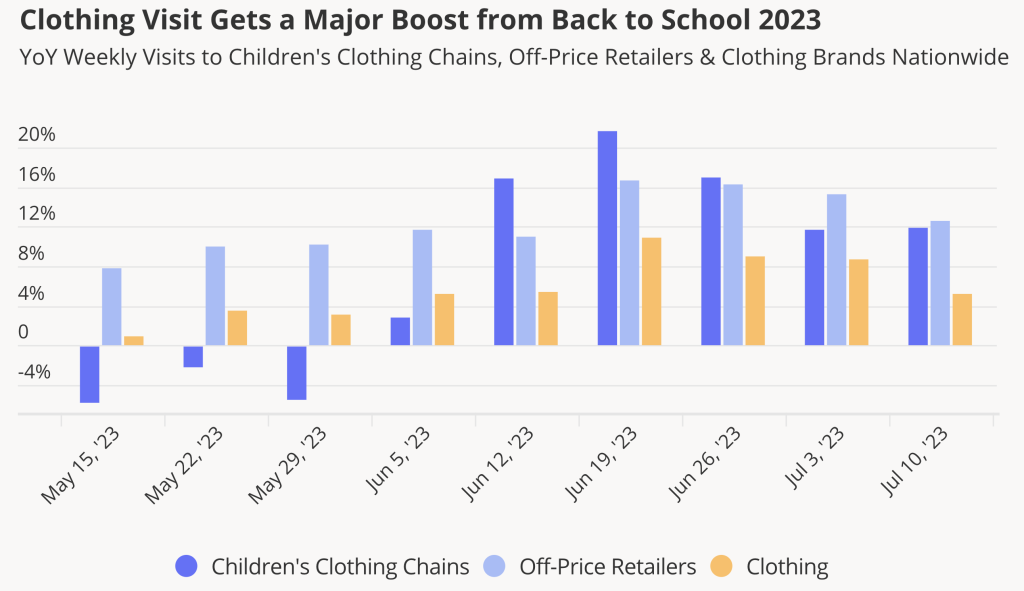

Placer.ai reported that nationwide visits to clothing chains have consistently exceeded 2022 levels since mid-May, with the visit increase growing larger in recent weeks. Students upgrading their style, parents preparing their kids for the year ahead and general consumers looking for new summer wear are driving visits to clothing chains nationwide.

Within this already strong category, foot traffic data from Placer.ai indicates that off-price retailers and children’s clothing are well-positioned to benefit from the surge. Year-over-year (YoY) visits to off-price retailers continue to rise, while YoY visits to kid’s clothing chains remained elevated through June and the first two weeks of July. If these patterns continue to hold, the brick-and-mortar clothing category seems favorably positioned for a strong second half.

Value-Priced Apparel Continues to Grow

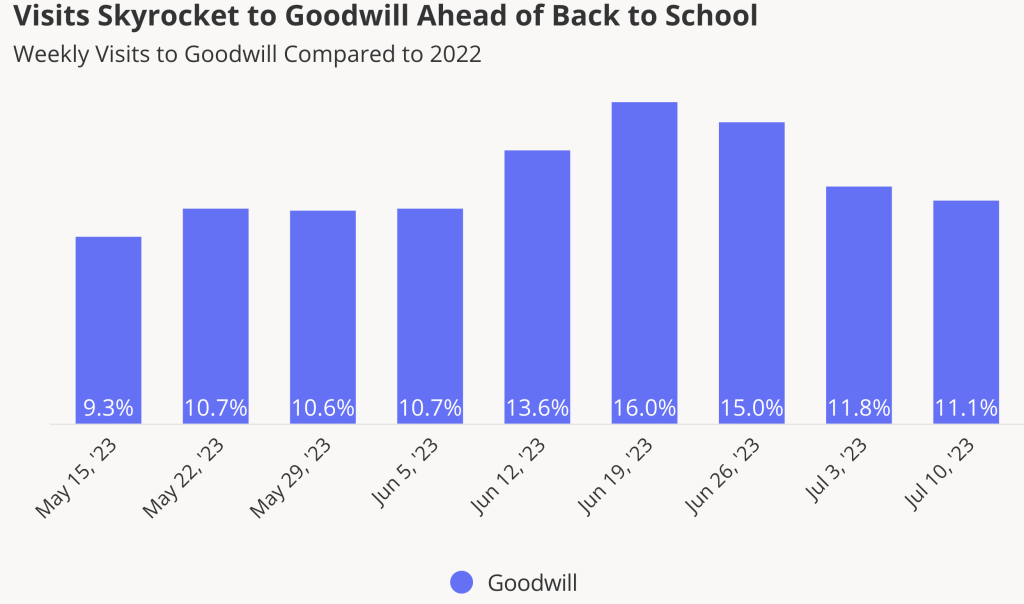

Year-over-year visits to thrift stores has been elevated for some time, but the BTS season is giving thrift store leader Goodwill a more significant boost, with YoY weekly visits in double-digits through June and early July. Placer.ai said in its report that Goodwill’s performance and the strength of the off-price segment suggested that, although consumers may be ready for a wardrobe refresh, budgets remain tight, and consumer spending decisions are not made lightly.

Another analysis conducted by SGB Media research partner SSI Data suggests that Goodwill has also benefitted from the move by the consumer to circularity in the apparel space, with resale programs taking hold across the U.S. retail landscape.

BTS Lifts Superstore Visits

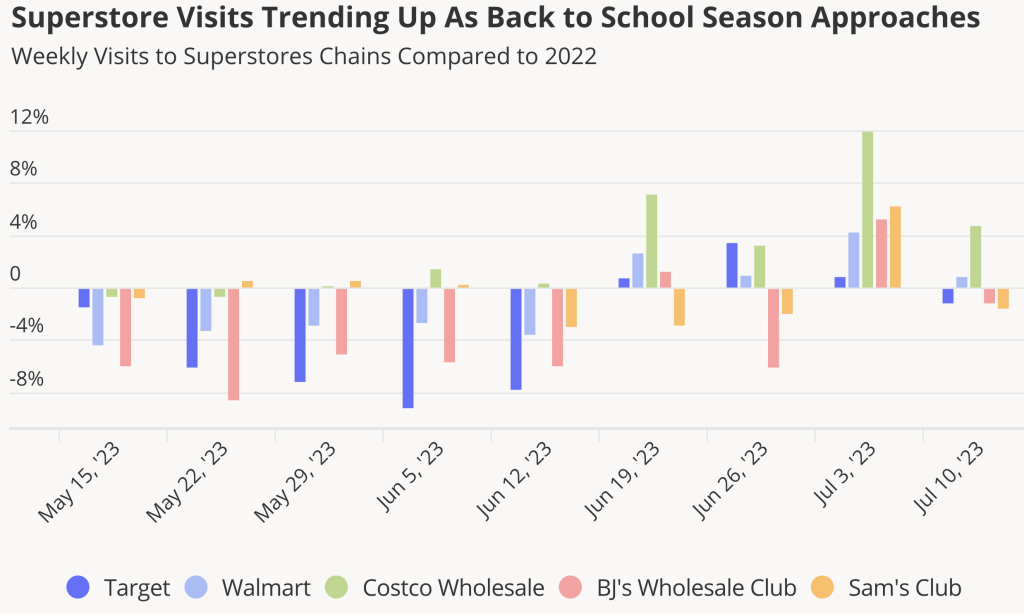

The BTS 2023 season is also pulling up categories that have felt the impact of tighter consumer budgets in recent months. Placer.ai said major superstores and wholesale clubs have seen YoY visit gaps shrink significantly or turn positive in recent weeks as consumers stock up on supplies, clothes and shoes for the 2023 school year.

At the same time, Placer.ai said various sales events scheduled around Prime Day 2023 did not move the needle significantly, with the week of July 10th seeing the worst YoY results than the week prior. And weekly data indicated that Memorial Day also failed to drive a significant visit spike—it was the week of July 3rd that received the biggest superstore visit boost of the past two months, likely driven by the long July 4th holiday weekend.

The weak YoY numbers for recent sales events could stem from the success of these events in 2022, but the performances could also indicate that some consumers remain cautious with their spending, according to Placer.ai analysis. Shoppers coming to superstores to purchase food for their July 4th cookouts may not be ready to spend money on large ticket items, and some consumers may likely delay unnecessary purchases that could wait until the U.S. economy stabilizes.

BTS Drives Traffic to Specialty Retailers

Beyond its impact on the larger retail categories, BTS 2023 also reminds consumers of specialty retailers’ value. Brands, including Staples and Best Buy, are not necessarily a part of most consumers’ regular shopping routine, but shoppers appreciate walking into a store to get guidance on which laptop or printer to purchase when needed.

Consumer year-over-year weekly visits to Staples were elevated most weeks since mid-May 2023, while Best Buy narrowed its visit gap significantly in recent weeks.

BTS Boosts Retail Visits, But Consumer Behavior Remains Cautious

Placer.ai said comparing 2023 and 2022 foot traffic to major retailers highlights the retail impact of BTS 2023. Visits to the clothing category, and its value-priced and children-oriented segments, are up relative to last year at this time. Leading superstores, wholesale chains, specialty electronics, and office supply retailers have also seen promising visit trends.

But the Placer.ai data also indicates that consumers remain cautious, with large sales events failing to provide the significant bump of previous years.

As the BTS season wraps up and with the holidays around the corner, retailers may need to get creative to draw consumers back to in-store shopping amidst a still uncertain economic climate.

For more data-driven retail insights from Placer.ai, go here.

Illustration and graphics courtesy Placer.ai