Kering has appointed Rothschild & Co to handle the potential spinoff of Puma, according to a report in the French business magazine Challenges.

Kering has declined to comment on the report, according to Business of Fashion.

The Paris-based firm’s primary business is its luxury brands, including Gucci, Bottega Veneta and Balenciaga. Kering acquired its controlling stake in Puma in 2007 as part of a strategy to complement its luxury portfolio with sports brands.

Kering last year sold Electric, the snow-goggles manufacturer, which it acquired via its 2011 purchase of skategear brand Volcom. The sale fueled speculation that the group was looking to dismantle its Sports & Lifestyle division.

Kering said last year it planned to hold onto its majority stake in Puma until at least 2018 while referring to it as a non-core asset.

“I think that it has been very clear and I won’t change what has been said directly by the CEO of the group, that Puma is a noncore asset, that the group is focusing more on luxury,” Jean-Marc Duplaix, Kering’s CFO, told analysts after third-quarter results on October 24, according to Business of Fashion.

“I think that Puma is on a very nice trajectory, and we will have the occasion to consider and to contemplate some options, but later and probably not short-term. So let’s work, first of all, still on the turnaround and let’s deliver a very nice set of figures for 2017. That’s the priority for us.”

The sales rumors had also come while Puma was struggling for a few years but its performance has turned around in the last year. Sales on a currency-neutral basis rose 17.4 percent in the third quarter, led by a 22.7 percent gain the EMEA region and a 15.6 percent jump in the Americas region.

Earlier this month, BoF reported that Kering is expected to pursue a dual track IPO-auction to spin off Puma, according to bankers in Paris and London.

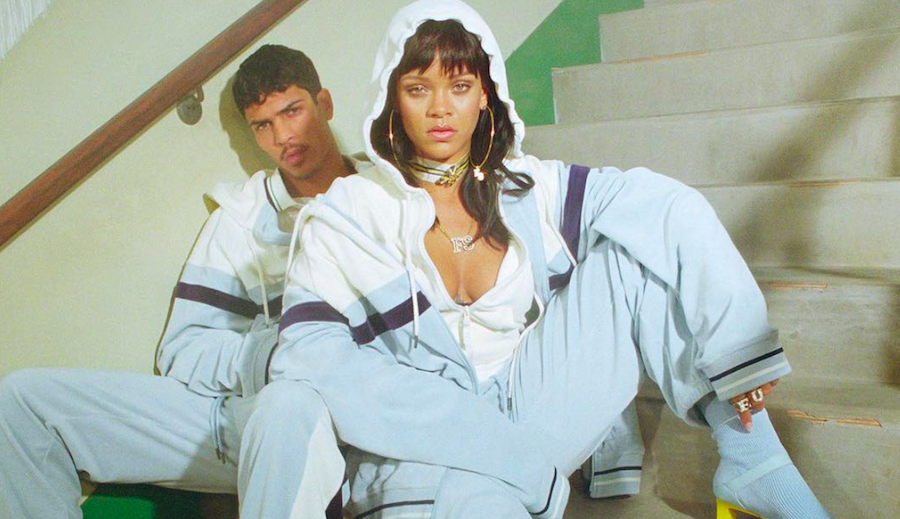

Photo courtesy Puma