Quiksilver Inc. reported its losses narrowed on a 13.7 percent decline in sales for the first quarter ended Jan. 31, but not because of the “revenue cut-off issue” the company cited two weeks ago as the reason for postponing the release of the results.

The company announced March 5 that it was postponing the release of the results pending an investigation by its audit committee of revenue cut-off issues discovered by its management team. On Wednesday (March 18), however, Quiksilver revealed that the investigation found no material impact on the quarter. Instead it revised revenue it reported for the first quarter of 2014 upward by $2 million.

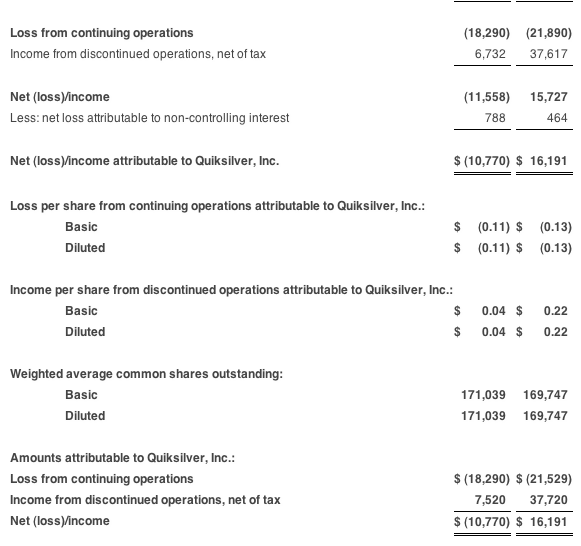

In the more recent first quarter, sales from continuing operations were $341 million, down 13.7 percent, or 4 percent on a currency-neutral (c-n) basis from the first quarter of 2014. Net loss, on a pro-forma basis, declined to $18 million, or 11 cents per share, from $22 million, or 13 cents, a year ago.

“We are encouraged by our first quarter performance,” said Andy Mooney, chairman and chief executive officer of Quiksilver, Inc. “Revenues adjusted for currencies and licensed categories essentially stabilized in Q1, and operating expenses decreased by $20 million versus the prior year in constant currencies.

“Customer feedback on our Spring ‘15 product offering, across all brands, has been positive. Our order book for the Fall ‘15 product line continues to develop, and we are confident in our ability to generate increases going forward.”

Gross margin decreased to 49.7 percent from 50.8 percent. The 110 basis point decline in gross margin reflects higher discounting, the unfavorable impact of currency exchange rates, and higher freight and distribution costs related to the West coast ports labor dispute, partially offset by the favorable impact of higher sales mix in direct-to-consumer channels.

SG&A expense decreased $33 million to $171 million from $204 million. The decrease was primarily driven by currency exchange rates, reduced employee compensation, rent, distribution and legal expenses.

Pro-forma Adjusted EBITDA was $10 million compared with $16 million.

Net loss from continuing operations attributable to Quiksilver, Inc. was $18 million, or $0.11 per share, compared with $22 million, or $0.13 per share.

Cash and availability on credit facilities at the end of the quarter was $141 million.

Net revenues from continuing operations by region, brand, sales channel and product group for the first quarter of fiscal 2015 compared with the first quarter of fiscal 2014 were as follows.

Region:

- Americas net revenues, as reported, were $148 million compared with $175

million. Americas net revenues were down 8 percent, or $13 million, on

constant currency continuing category basis. - EMEA net revenues,

as reported, were $126 million compared with $149 million. EMEA net

revenues were down 3 percent, or $3 million, on constant currency

continuing category basis. - APAC net revenues, as reported, were

$67 million compared with $70 million. APAC net revenues were up 4

percent, or $2 million, on constant currency continuing category basis. - Emerging markets net revenues were $54 million

compared with $53 million. Net revenues from emerging markets were up 20

percent, or $9 million, on a constant currency continuing category

basis.

Brands:

- Quiksilver net revenues, as reported, were $141 million compared with $164 million. Quiksilver net revenues were down 3 percent, or $5 million, on a constant currency continuing category basis;

- Roxy net revenues, as reported, were $100 million compared with $118 million. Roxy net revenues were down 6 percent, or $7 million, on a constant currency continuing category basis; and

- DC net revenues, as reported, were $89 million compared with $103 million. DC net revenues were down 4 percent, or $4 million, on a constant currency continuing category basis.

Distribution channels:

- Wholesale net revenues, as reported, were $192 million compared with $239 million. Wholesale net revenues were down 9 percent, or $19 million, on a constant currency continuing category basis;

- Retail net revenues, as reported, were $119 million compared with $131 million. Retail net revenues were flat on a constant currency continuing category basis. Same-store sales in company-owned retail stores decreased 3 percent. company-owned retail stores totaled 713 at the end of the fiscal 2015 first quarter compared with 645 at the end of fiscal 2014 first quarter; and,

- E-commerce net revenues, as reported, were $27 million compared with $23 million. E-commerce net revenues were up 20 percent, or $4 million, on a constant currency continuing category basis.

Product groups:

- Apparel and accessories net revenues, as reported, were $251 million compared with $306 million. Apparel and accessories net revenues were down 7 percent, or $20 million, on a constant currency continuing category basis; and

- Footwear net revenues were $89 million compared with $88 million. Footwear net revenues were up 8 percent, or $6 million, on a constant currency continuing category basis.

Updated outlook for Fiscal 2015

The company updated its fiscal 2015 guidance for continuing operations to incorporate February 2015 currency exchange rates and provided guidance for its fiscal 2015 second quarter, as follows:

Fiscal 2015 second quarter net revenues are expected to be approximately $340 million, which is flat to last year’s second quarter on a constant currency continuing category basis. Gross margins are expected to be approximately 48.0 percent. SG&A, excluding any restructuring and special charges, is expected to be approximately $175 million. Pro-forma Adjusted EBITDA is expected to be approximately $8 million.

Fiscal year 2015 net revenues are expected to be approximately $1.38 billion to $1.45 billion, which is an increase of approximately 1 percent to 6 percent on a constant currency continuing category basis versus the prior year. Gross margins are expected to be between 48.5 percent and 50 percent. SG&A, excluding any restructuring and special charges, is expected to be between $685 million and $700 million. Pro-forma Adjusted EBITDA is expected to be between $70 million and $80 million. This revision of 2015 fiscal year guidance is driven by changes in currency exchange rates since October 2014, as well as additional cost reduction initiatives.