Quiksilver Inc. reported a loss of $37.6 million, or 22 cents a share, in its fiscal second quarter ended April 30. Revenues slumped 16.1 percent to $333 million. Quiksilver said it no longer expects a profit turnaround in North America in its second half due to poor deliveries and a changes in its distribution channel strategy.

Pierre Agnes, Chief Executive Officer, stated, “Our second quarter performance came in largely as expected with revenues adjusted for currencies and licensed categories essentially stabilized. We also reduced operating expenses, which allowed the company to meet its EBITDA goal for the quarter on a constant currency basis. We are encouraged by customer feedback on our Spring ‘15 product offering across all brands. In addition, as our order book for the Fall ‘15 product line continues to develop, we are confident in our ability to drive revenue growth in the medium term. Overall, we are quite happy with our product lines.”

Agnes continued, “Currency exchange fluctuations are a major headwind this year, with a negative impact of roughly thirty million dollars to the initial EBITDA guidance for fiscal 2015. Also, we are still working on execution issues that are going to impact our business in the second half of this year, particularly in North America where sales and margins are affected by poor deliveries and an evolving distribution channel strategy. The company had expected significant profit improvement in North America in the back half of the year when it provided guidance for fiscal 2015. We are still confident this improvement can be achieved, but not in that time period. We have a number of important steps underway that we believe will take our company forward, including recommitting to our roots while at the same time enabling us to execute our business more effectively. We have reorganized the company and have a tremendously talented team in place that is focused on delivering significant and sustainable EBITDA growth in 2016 and the following years.”

Second Quarter Review:

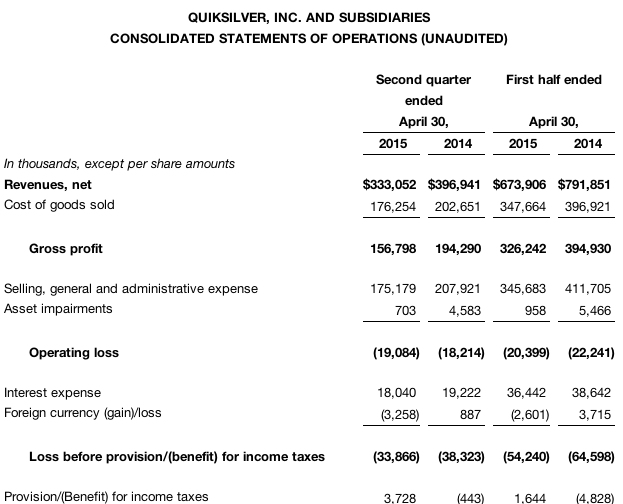

The following comparisons refer to results of continuing operations for the second quarter of fiscal 2015 versus the second quarter of fiscal 2014.

Net revenues, as reported, were $333 million compared with $397 million. Net revenues were down 2 percent, or $5 million, on a constant currency continuing category basis.

Americas net revenues, as reported, were $160 million compared with $186 million. Americas net revenues were down 4 percent, or $6 million, on a constant currency continuing category basis.

EMEA net revenues, as reported, were $116 million compared with $151 million. EMEA net revenues were down 3 percent, or $4 million, on a constant currency continuing category basis.

APAC net revenues, as reported, were $56 million compared with $60 million. APAC net revenues were up 7 percent, or $4 million, on a constant currency continuing category basis.

Net revenues from emerging markets, as reported, were $45 million compared with $51 million. Net revenues from emerging markets were up 10 percent, or $4 million, on a constant currency continuing category basis.

Gross margin decreased to 47.1 percent from 48.9 percent. The 180 basis point decline in gross margin reflects higher discounting and freight expenses due to late deliveries, and unfavorable currency exchange rates, mainly in Europe, partially offset by the favorable impact of a higher percentage of sales mix in direct to consumer channels.

SG&A expense decreased $33 million to $175 million from $208 million. The decrease was primarily driven by currency exchange rates, reduced bad debt and employee compensation expenses.

Pro-forma Adjusted EBITDA was $7 million compared with $13 million.

Net loss from continuing operations attributable to Quiksilver, Inc. was $38 million, or $0.22 per share, in the second quarter of each of fiscal 2015 and 2014.

Cash and availability on credit facilities at the end of the quarter was $118 million.

Q2 Net Revenue Highlights:

Net revenues from continuing operations by brand, sales channel and product group for the second quarter of fiscal 2015 compared with the second quarter of fiscal 2014 were as follows.

Brands:

- Quiksilver net revenues, as reported, were $139 million compared with $167 million. Quiksilver net revenues were down 1 percent, or $1 million, on a constant currency continuing category basis;

- Roxy net revenues, as reported, were $105 million compared with $120 million. Roxy net revenues were up 1 percent, or $1 million, on a constant currency continuing category basis;

- DC net revenues, as reported, were $81 million compared with $103 million. DC net revenues were down 9 percent, or $8 million, on a constant currency continuing category basis.

Distribution channels:

- Wholesale net revenues, as reported, were $230 million compared with $286 million. Wholesale net revenues were down 4 percent, or $9 million, on a constant currency continuing category basis;

- Retail net revenues, as reported, were $84 million compared with $90 million. Retail net revenues were up 6 percent on a constant currency continuing category basis. Same-store sales in company-owned retail stores decreased 3 percent. company-owned retail stores totaled 719 at the end of the fiscal 2015 second quarter compared with 658 at the end of the fiscal 2014 second quarter;

- E-commerce net revenues, as reported, were $16 million compared with $19 million. E-commerce net revenues were down 6 percent, or $1 million, on a constant currency continuing category basis.

Product groups:

- Apparel and accessories net revenues, as reported, were $232 million compared with $283 million. Apparel and accessories net revenues were down 2 percent, or $5 million, on a constant currency continuing category basis;

- Footwear net revenues were $101 million compared with $114 million. Footwear net revenues were flat on a constant currency continuing category basis.

Outlook:

Based on management’s current assessment of the business, the company is rescinding its previously stated financial guidance for the fiscal year 2015. The company may choose to reinstate the policy of providing forward guidance in the future, but will not be providing an outlook for fiscal 2015 at this time.