Quiksilver Inc. has slowed store openings and curtailed online promotions in the United States in a bid to rebuild trust with retailers here, the company 's CEO said last week.

Quiksilver Inc. has slowed store openings and curtailed online promotions in the United States in a bid to rebuild trust with retailers here, the company 's CEO said last week.

Chairman and CEO Andrew Mooney said the company began pulling back some direct-to-consumer initiatives after a series of meetings with key retailers last year that also included President Pierre Agnes and Americas GM Alan Vickers.

“We listened to the issues that were important to our long-time core surf partners, and based on their feedback made several changes to better support their business,” Mooney said during a March 17 earnings call focused on results for the company's fiscal first quarter. “First, we are holding back on opening additional owned and operated retail stores in areas that could negatively affect their businesses. Second, we are substantially altering the form, and substantially reducing the frequency of promotions on our branded websites. Going forward, we will conduct limited promotions solely on past season merchandise, and entirely exclude technical products like wetsuits from any price promotion in our direct-to-consumer channels.”

With the restructuring of the company essentially complete, Mooney said he is looking forward to spending more time with core surf and skate specialty accounts around the globe and said the company would be devoting more resources to promoting those partners.

Whiles revenues off 9 percent in fiscal first quarter

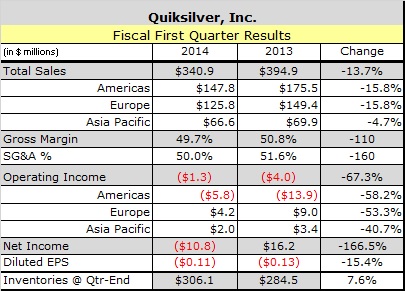

ZQK reported net revenues from continuing operations reached $341 million during the fiscal first quarter ended Jan. 31, down 13.7 percent, or 4 percent on a currency-neutral (c-n) basis from the first quarter of 2014.

Wholesale revenues declined about 9 percent on a c-n, continuing category (adjusted), while sales through the company's e-commerce channel rose about 20 percent. ZQK's owned retail stores generated flat revenues on a 3 percent decline in same-store sales. The decline reflected the company's less promotional posture online as well as its decision to redirect merchandise set aside for owned U.S. stores to replenish fulfill wholesale orders that could not be met because merchandise was stranded on boats or in port terminals along the West Coast.

ZQK ended the quarter with 713 company owned stores, compared with 645 a year earlier, but Mooney said most of the new stores were opened by licensees in emerging markets.

Adjusted net revenues declined 8 percent in the Americas and 3 percent in EMEA and increased 4 percent in the Asia Pacific and 20 percent in Emerging Markets. The entire $13 million decline in the Americas was attributed to lower apparel sales to the wholesale channel with DC and Roxy reporting the biggest declines. Net revenues increased by a combined 12 percent in Brazil and Mexico on an as reported basis, or 23 percent c-n. Net revenues gains in the retail and e-commerce channels offset some of the decline in the wholesale channel.

Roxy slips as footwear gains traction

From the brand perspective, adjusted net revenues declined 3.3 percent to $140.7 million at Quiksilver, 6.5 percent to $100.0 million at Roxy and 4.0 percent to $89.1 million at DC.

Apparel and accessories net revenues were down 7 percent, or $20 million on a c-n continuing category basis. Mooney said a push by Roxy into Dick's Sporting Goods and other the full-line sporting goods stores fell short.

“The retailers there have really struggled with where to put Roxy fitness,” Mooney said. “They don't really want to put it on the main fitness floor alongside Nike, Reebok, Adidas, Under Armour. So it tends it end up being in the action sports floor, sometimes next to swim. So I think the consumer is having a hard time finding it to be honest. Sellthrough have not been good, and we have definitely slipped back a little bit in the fitness category primarily in the sporting goods.”

Mooney added that Roxy's overall apparel bookings for fall are still up in the mid-single digits in the United States.

Net Footwear revenues, on the other hand, grew 8 percent, or $6 million, on an adjusted basis due to strong sell-in of canvas shoes. Much of the growth continues to come from Europe, but the fall 2014 launch of the DC Trase also propelled growth.

“The Trase has been a swing factor, with us having now booked in close to 2 million pairs,” said Mooney. “I would characterize the sellthrough to date as either being on track or beating expectations.”

Mooney said it's too early to gauge the success of Quiksilver's first accessibly-priced canvas shoe – the Shorebreak – which is being launched primarily in surf shops.

At Roxy, where Footwear has become the top selling category, footwear sales grew in the mid-single digits.

Late deliveries, exchange rates squeeze margins

Higher discounting, currency exchange rates and – to a lesser extent higher freight and distribution costs related to West coast ports labor dispute – pushed down gross margin 110 basis points (bps) to 49.7 percent, as a 280 bps drop in Europe offset a 30 bps gain in the America The decline was partially offset by a higher mix of direct-to-consumer sales.

“In Q1, we did see some additional discounting that was really because of the delivery situation, largely in the US,” CFO Richard Shields, referring to delays at West Coast ports.

SG&A expense decreased by $33 million to $171 million, as exchange rates reduced employee compensation, rent, distribution and legal expenses in U.S. dollar terms. The decline reduced SG&A expense to 50.0 percent of revenues, down 160 bps from a year earlier.

As people leave the company, their work is being divided among those who remain, Mooney told analysts.

“Whenever we see any slippage on the margin side or the top line side,” he said, “we want to step up immediately and make sure we can take up the slack on the SG&A side.”

Adjusted EBITDA reached $10 million, down 37.5 percent from $16 million reported in the fiscal quarter ended Jan. 31, 2014. Net loss from continuing operations attributable to ZQK was $18.3 million, or 11 cents per share, compared with $21.9 million, or 13 cents per share. The company ended the quarter with 30 percent more cash and 7.6 percent more inventory.

Lowering expectations for Fiscal 2015

Based on February 2015 currency exchange rates, ZQK expects second quarter net revenues of approximately $340 million, which is flat with last year’s second quarter on an adjusted, or c-n, continuing category basis. Gross margins are expected to be approximately 48.0 percent.

The estimate anticipates an increase in discounting compared with a year earlier for two reasons. First, ZQK anticipates a higher proportion of sales to larger retailers who command higher upfront discounts. Secondly it expects continued delays at West Coast ports will force it to continue offering discounts on goods that miss delivery dates.

“Deliveries are still running on average one week late in the US,” Mooney said.”As a result, we continue to miss some reorder opportunities in our U.S. wholesale, and more so in our U.S. direct-to-consumer business, as we have elected to ship our wholesale customers prior to our direct-to-consumer businesses, whenever we run tight on inventory of spring styles.”

“In North America, reorders are down single-digits in apparel, again partly due to late delivery of product and partly due to the extreme weather on the east coast of the US,” he continued. “Footwear reorders in the Americas are flat to slightly up.”

SG&A, excluding any restructuring and special charges, is expected to be approximately $175 million. Pro-forma Adjusted EBITDA is expected to be approximately $8 million.

The company also revised its Fiscal 2015 guidance to reflect changes in exchange rates and hard data for its fall order book as of Feb. 28. It now expects net revenues to increase 1-to-6 percent on a constant currency continuing category basis to $1.38-to-$1.45 billion compared with the prior year. Gross margins are expected to be 48.5-to-50 percent. SG&A, excluding any restructuring and special charges, is expected to be between $685-to-$700 million. Pro-forma Adjusted EBITDA is expected to be between $70-to-$80 million, down from the $80-to-90 million forecast at the end of the fourth quarter. Mooney attributed the decline entirely to the negative impact of exchange rates.

The biggest currency risk lies in the Russian ruble, Brazilian real and South African rand, where the cost of buying futures contracts to hedge against further depreciation is prohibitive.

“We feel very good about the range that we have given in the guidance, and we continue to make a lot of headway in managing our SG&A down to a level that would generate the EBITDA that we have in our guidance,” said Mooney. “We'll attack SG&A if we need to further down the line, but we are very focused on the gross margin line, to really work at moving that up as a function of just managing our backend operations increasingly more efficiently and effectively.”

The assurance did not prevent investor Ryan Drexler, who controls more than 2 million shares of ZQK through Consac LLC, from again urging ZQK's board to explore strategic options.

“I cannot see a reason to place faith in the current management’s turnaround plan,” Drexler wrote in a letter to Mooney that urged ZQK's board to explore strategic options for the company. “In my opinion, the promise of better times being just around the corner is nothing more than wishful thinking.”