Puma AG reported sales in the fourth quarter increased 16.1% currency-adjusted and 28.2% in euro terms, reaching €623.4 million ($848 mm). All regions contributed positively to the performance, led by the Americas region. But the German footwear giant warned that both sales and profits gains would lessen in 2011 due in part to price rises for its products.

Puma, which also owns Cobra Golf and the Tretorn rubber boot brand, forecast a mid-single-digit rate of growth for profit in both 2011 and 2012 and a mid- to-highsingle digit rate of growth in sales in both years.

In the quarter, the sales gain was led by the Americas, where sales surged 27.8% on a currency-neutral basis, aided in no small part to the inclusion of Cobra Golf in the numbers for 2010. In euro terms, revenues in the region vaulted 41.4% to €216.3 million ($294 mm). Sales in the EMEA (Europe, Middle East and Africa) region rose 15.3% to €223.1 million ($303 mm) and gained 8.8% on a currency-adjusted basis. In the Asia/Pacific region, sales grew 31.7% to €184.0 million ($250 mm) with currency-adjusted sales ahead 13.1% for the period.

By product category, footwear sales in the quarter increased grew 15.7% on a currency-adjusted basis and apparel sales increased 16.9%. Sales in accessories increased 15.1%. In euro terms, footwear sales grew 27.9% to €307.5 million ($418 mm); apparel grew 29.5% to €242 million ($329 mm) and accessory sales, which now includes Cobra Golf, climbed 25.5% to €73.9 million ($101 mm) in the quarter.

Overall gross profit margin in the quarter softened to 45.4% of sales from 50.4% in the prior-year quarter. This decline is partially attributable to the change in the regional sales mix and traditionally higher close-out sales as well as an unfavorable hedging position and higher input costs. Operating expenses decreased from 43.2% of sales to 39.6% in the most recent quarter.

Net earnings were €14.0 million ($19 mm) in the latest quarter versus a loss of €7.2 million in the year-ago quarter.

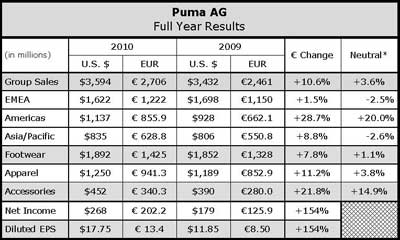

For the full year, consolidated sales increased currency-adjusted by 3.6% to €2.71 billion ($3.59 bn) in 2010. On a currency-adjusted basis, footwear sales increased 1.1% to €1.42 billion ($1.89 bn) and apparel rose 3.8% to €941.3 million ($1.25 bn).

Puma’s full-year currency-adjusted accessories sales grew 14.9% to €340.3 million ($452 mm), mainly attributable to the acquisition of Cobra Golf, which contributed €32.6 million in sales for a portion of the year.

By region, full-year sales in the Americas increased 20.0% on a currency-adjusted basis to €855.9 million ($1.14 bn). The Latin America region contributed significantly to the performance. On a currency-adjusted basis, footwear sales were up 16.8% while apparel jumped 21.8%. Accessories sales rose by 53.5%, again due to the Cobra Golf acquisition. Gross margins in the region eroded to 46.6% from 48.2% in 2009. Adjusted EBIT climbed 64.2% to €85.2 million ($113 mm) for the year.

Sales in the EMEA region decreased 2.5% currency-adjusted to €1.22 billion ($1.62 bn). In euro terms, sales increased 1.5%. Currency-adjusted footwear sales decreased 9.1% but apparel sales increased 2.1% and accessories rose 9.9%. Gross margins shrunk to 50.6% of sales compared to 52.2% in 2009. Adjusted EBIT improved 13.9% to €67.8 million ($90 mm) in 2010.

In the Asia/Pacific region, sales decreased 2.6% currency-adjusted to €628.8 million ($836 mm). A/P footwear sales decreased 6.1% currency-adjusted while apparel grew 1.9% and accessories increased 5.4%. Gross margins improved from 50.8% of sales in 2009 to 52.0% in 2010. Adjusted EBIT decreased 4.0% to €45.4 million ($60 mm) for the year.

Sales from Puma's owned-retail operations increased 2.6% currency-adjusted to €470.1 million ($625 mm) in 2010 despite operating fewer stores versus 2009.

Gross margins eroded 110 basis points to 49.7% of sales due to changes in the regional sales mix, a slight increase in sourcing costs and unfavorable hedging positions in 2010 compared with 2009.

Gross margins in footwear decreased to 48.9% of sales in 2010 from 49.8% of sales in 2009. The apparel margin decreased from 51.3% in 2009 to 50.6% and accessories decreased from 54.1% in 2009 to 50.6% due to the Cobra Golf acquisition.

The discovery of irregularities at Puma's joint venture in Greece resulted in one-off expenses of €31.0 million ($41 mm) in financial year 2010. Prior-year earnings also had to be restated with retained earnings as of Dec. 31, 2009 decreasing by €106.5 million. Puma said it does not expect further expenses related to this matter and is continuing to pursue criminal charges.

Including special items, the operating profit (EBIT) generated in 2010 more than doubled to €306.8 million ($408 mm) from €146.4 in the previous year.

Consolidated net earnings increased to €202.2 million ($269 mm) versus €79.6 million in 2009.

Regarding outlook, the mid- to high-single-digit percentage increased expected in sales in the next two years reflects expectations of moderately weaker global economic growth in 2011 before a pick up in 2012.

Puma's sales are expected to benefit from investments in product and brand stemming from its five-year “Back on the Attack 2011-2015” program launched at last year's investor conference. As a result of the growth investments, Puma's expense ratio is expected to increase in 2011, while gradually decreasing in the subsequent years. Earnings are expected to increase in the mid-single-digit percentage range for 2011 and 2012 on the basis of modest increases in procurement prices.